Asset Strategies International Reviews is an important topic for any investor or financial advisor. Understanding the reviews of this service can help individuals make informed decisions about their investments, as well as how to best manage their finances.

In this article, we will provide a comprehensive overview of what these reviews are and why they matter for investors. We'll explore the various types of ASI reviews that exist, what information they contain, and how customers use them in practice.

Whether you're considering investing with ASI or looking to get more out of your existing portfolio, understanding how to read and interpret these ratings could prove invaluable.

Let's dive into our deep dive on Asset Strategies International Reviews!

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Asset Strategies International made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

Asset Strategies International Background

Asset Strategies International (ASI) has provided individuals with strategies for investing in precious metals such as gold coins. ASI is dedicated to helping clients create long-term accounts that can be used to build wealth over the course of their lives.

With a commitment to customer service, ASI strives to ensure that each client's financial needs are met with quality products and services designed specifically for them.

The company prides itself on providing personal attention and reliable advice from knowledgeable professionals who have years of experience in the industry.

ASI specializes in buying and selling physical bullion investments including gold bars, silver coins, platinum coins and rare coins. In addition to these services, they also offer portfolio management solutions which provide investment recommendations based on an individual’s risk tolerance level.

Their team of experienced advisors takes into account both short-term market fluctuations and long-term economic trends when crafting personalized portfolios for their customers. They believe that it is important to maintain diversification within an asset allocation strategy so as not to put all eggs in one basket.

For those looking for more hands-on guidance during the investment process, ASI offers comprehensive consulting services ranging from retirement planning through estate planning.

Products Offered by Asset Strategies International

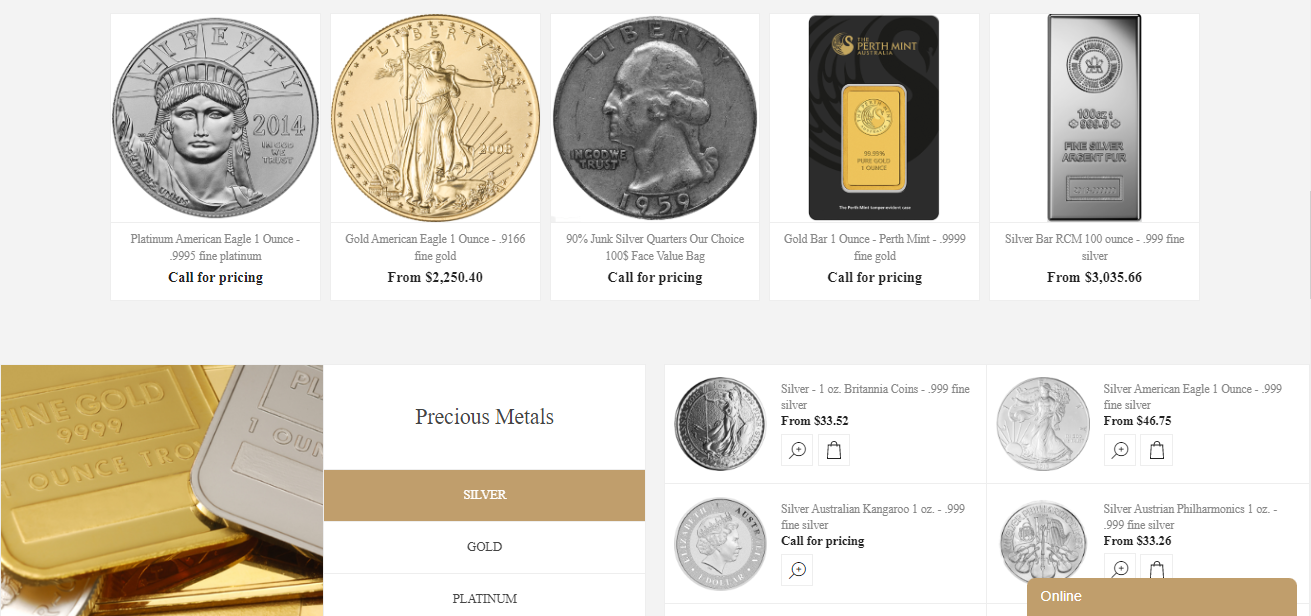

Asset Strategies International offers a wide variety of products for customers seeking to invest in physical metals. The company specializes in gold coins, such as the American Eagle and Canadian Maple Leaf, making them one of the most sought-after wealth strategies accessible today.

They offer silver coins from various mints around the world, offering their clients an array of options when selecting precious metal investments. Asset Strategies also carries palladium and platinum coins for those looking to diversify their portfolios with these two rare metals.

Asset Strategies International provides access to bars and rounds produced by some of the highest quality refineries on the planet. These products come in both gold and silver varieties and range from 1 gram up to 400 ounces or larger sizes depending upon availability.

Regardless of size or type, investors can rest assured that all products sold through Asset Strategies meet industry standards for purity and weight accuracy. This guarantees that each purchase is not only secure but also backed by proven reliability in production methods used by well-established mints worldwide.

For those who are interested in investing in physical metals but do not have the means to buy large amounts outright, there are numerous ways that customers can take advantage of payment plans provided by Asset Strategies International. Through these flexible programs, buyers can spread out payments over several months while still enjoying security afforded by holding physical assets rather than relying solely on paper investments like stocks or bonds.

Whether you’re looking to make a one-time purchase or build your portfolio slowly over time, Asset Strategies has a wealth strategy tailored specifically to your needs!

Why Put Gold in Your IRA?

Investing in gold is a great way to diversify your portfolio and protect it from the volatility of stocks. An IRA backed by physical gold, or a Precious Metals IRA (PMIRA), allows you to store your investments outside of traditional banks and stock exchanges.

Here are three reasons why putting gold into an IRA might be right for you:

- Safety - Gold has stood the test of time as an investment vehicle, with its value rarely fluctuating drastically like other asset classes. It's also highly liquid, meaning that if needed, you can easily access funds stored in your PMIRA without having to sell off any assets quickly in order to pay bills or meet financial obligations.

- Tax Benefits - Storing gold within a retirement account may offer tax advantages over investing directly in bullion coins or bars outside of such accounts; this could mean saving money on capital gains taxes when cashing out later down the road. Additionally, some types of metals are exempt from sales taxes when purchased through an IRA-approved custodian and stored at a depository facility chosen by them.

- Diversification - By adding precious metals to your existing portfolios – equities, fixed income bonds, mutual funds – investors can help reduce risk because gold prices tend to behave differently than most other investments during periods of economic uncertainty or market fluctuations. This type of diversification can ultimately result in greater overall returns while still protecting principal investments against potential losses due to inflationary pressures or currency devaluation.

There are many more advantages associated with choosing a Precious Metal IRA rather than storing gold elsewhere.

Many companies specialize in setting up such accounts including American Buffalo Bullion which offers storage options and advice on selecting the best products for each individual’s needs—from coins certified by government mints and authorized dealers around the world to quality bars manufactured by recognized refiners across North America and Europe.

Whatever form you choose, putting gold into an IRA could be a smart move for those looking for long-term stability and security in their retirement savings plans.

What Is a Precious Metals IRA?

According to the World Gold Council, an estimated $3.2 trillion dollars has been invested in gold worldwide since 2017. With such a large amount of money involved, it's no surprise that individuals are looking for ways to invest in this precious metal and diversify their portfolios.

One popular option is a Precious Metals IRA (Individual Retirement Account). In addition to the more traditional investments like stocks and bonds, these accounts allow investors to store physical gold and silver bullion as part of their retirement savings plan.

The most common types of gold approved by the IRS for use in IRAs include coins such as the American Eagle or Austria Philharmonic, bars from recognized refineries, and certain rounds with high purity levels.

Silver can also be included in a Precious Metals IRA along with other metals such as palladium or platinum; however, they must meet specific requirements set out by the Internal Revenue Service (IRS).

Popular options include coins like the American Eagle or Australia Kangaroo/Nugget as well as select minted bar products.

Asset Strategies International reviews provide useful insight into investing with precious metals through an Individual Retirement Account. They review different IRA-approved gold and silver products, help clients understand current market trends, and give detailed advice about how to make sound decisions when choosing metals for their portfolio.

By carefully researching various options available, investors can confidently choose which product best fits their individual needs and goals while taking advantage of all potential tax benefits associated with these accounts.

How Does It Work?

Asset Strategies International is a bullion dealer that specializes in asset protection and wealth creation. The company's approach to customer service is what sets it apart from its competitors, offering individualized solutions tailored to each client's needs.

The process of working with the firm begins with an initial consultation where clients are asked about their financial goals and objectives. During this time, Asset Strategies International will assess any current investments or assets held by the client as well as provide advice on how best to achieve desired outcomes.

Once the initial consultation has been completed, Asset Strategies International works closely with clients to develop a strategy for asset protection and wealth creation tailored specifically for them.

This includes providing reports detailing market analysis and trends as well as making recommendations regarding which types of gold or silver should be purchased. They can also assist in transferring funds from existing accounts into new ones at approved dealers if necessary.

Once the plan has been established, Asset Strategies International provides ongoing support throughout its duration so that customers have access to knowledgeable advisors when needed.

What Is a Rollover?

Rollovers are an important asset strategy for those looking to invest, save and grow their money. A rollover is the process of transferring funds from one retirement account into another without incurring a tax penalty or other fees.

It can be used by individual investors as well as businesses who want to move liquid assets between different investment strategies.

The most common type of rollover comes in the form of an Individual Retirement Account (IRA). IRA's allow individuals to transfer monies from traditional 401(k)s and 403(b)s accounts to alternative investments with more flexibility and potential returns.

This can include commodities like precious metals and foreign exchange markets.

When researching potential firms that offer these services, it is essential to read customer reviews before making any decisions. Asset Strategies International has consistently received good ratings when it comes to customer satisfaction - regardless of what kind of rollover service you may need.

The firm offers expert advice on creating a customized plan tailored specifically towards your financial goals, allowing customers to make informed investment choices along their path toward retirement security.

They have no hidden fees associated with their services which makes them attractive to many prospective clients.

Here’s a list of 4 reasons why people choose Asset Strategies International:

- Offers flexible options for managing liquid assets

- Experienced advisors provide personalized plans for investing in retirement savings

- Accessible customer support team available 24/7

- No hidden fees or charges associated with their services

Asset Strategies International is dedicated to providing quality assistance when it comes to setting up IRA’s and other types of retirement accounts – giving users peace-of-mind knowing that they are getting the best possible advice at all times while exploring various avenues for increasing wealth through long-term investments.

With so much at stake, this company continues its commitment towards helping people reach financial independence through sound investment decision-making skills backed by years of experience in the business world.

Storage Options for Precious Metals

When it comes to storing your precious metals, there are a few options available. Many gold companies and bullion dealers offer storage services for their customers, allowing them to store actual gold bars in secure vaults or deposit boxes.

This is one of the most popular methods of storing physical gold because it offers peace of mind that your investment is safe and sound. There are also other ways to store physical gold, such as at home or in a bank safety deposit box.

However, these carry some risks due to potential theft and unauthorized access, so it’s important to consider all your options carefully before making a decision on how you want to store your valuable asset.

Another option is to purchase paper assets backed by the demand for gold such as exchange traded funds (ETFs) or certificates of ownership. These are essentially pieces of paper representing an allocated amount of physical metal held in reserve somewhere else - usually a fully insured vault maintained by a third party custodian.

While this can be more convenient than owning the metal itself, investors should understand that if something were to happen with either the issuer or the custodian holding their ETFs or certificates, they may not have any recourse or protection against loss or devaluation – so research into each company's reputation is vital before investing through this route.

What Exactly Is a Numismatic Coin?

A numismatic coin is an ancient or rare coin of significant value as a collectible item. These coins can range from gold to silver and even bronze, but are often considered valuable due to their age, rarity, or unique design features.

Numismatics were first developed during the Middle Ages in Europe as a way for people to save money without having to worry about its stability; it was assumed that these coins would retain some value over time.

Today, numismatic coins are still popular among collectors, with various organizations dedicated to grading and authenticating them for investment purposes. Many companies specialize in buying and selling these coins, such as GoldStar Trust Company and Kingdom Trust Company.

They offer investors the opportunity to buy into different types of collections of numismatic coins, including those made out of junk silver. Junk silver refers to any form of currency that has been previously circulated but remains intact—a common example is pre-1965 US dimes which contain 90% pure silver content by weight.

Numismatic coins have become increasingly sought after investments in recent years because they provide a more secure store of wealth than paper money does; not only do they hold intrinsic value based on their metal content (as opposed to fiat currencies), but also have potential upside if demand increases due to collector interest.

As such, purchasing one or more numismatic coins can be an excellent addition to anyone's portfolio who wants reliable protection against inflationary risk while potentially making a profit from appreciation in market prices over time.

What Makes Gold Such a Strategic Asset?

Transitioning from the previous section, gold has long been viewed as an important asset for individuals and nations alike. This is in part because it serves many purposes which make it a great store of value.

Gold’s reputation as a safe haven asset during times of economic instability also makes it attractive to investors. Its ability to hold its value over time makes it a great hedge against inflation and other financial risks.

Gold offers investors diversification benefits that are not present with other investments such as stocks or bonds. Physical gold can be held directly, allowing investors to add tangible assets to their portfolios without having to invest in paper securities or derivatives.

By owning physical gold, investors can protect themselves against macroeconomic factors including currency fluctuations and geopolitical events that could have negative impacts on markets around the world.

For those looking to invest in gold, there are several options available depending on one's experience level and personal preferences. For example, coins offer a relatively low-risk way for novice investors to get started by purchasing silver Australian Kangaroos or American Eagles issued by the United States Mint.

Coin collectors might find catalogs of rare gold coins more appealing while professional traders may prefer investing through ETFs such as GLD or IAU where they can buy shares instead of actual bullion bars or coins.

Regardless of what route you take when investing in gold, it is essential to always do your research and choose reputable dealers who provide honest pricing and quality products along with excellent customer service experiences.

Smart Reasons to Invest in Gold

Smart investors around the world have been diversifying their portfolios with physical assets for centuries. It’s a time-tested strategy of protecting wealth and ensuring growth in uncertain times. Gold is one of the most sought-after precious metals, offering some unique advantages over other investments like stocks and bonds.

Here are just a few reasons why you should consider investing in gold:

The Asset Strategies International states that gold has historically outperformed all other asset classes when adjusted for inflation – meaning it retains its value even during market downturns.

This makes it an ideal option as part of an overall portfolio diversification strategy. Gold provides protection against currency devaluation since gold prices tend to appreciate when currencies such as the US dollar weaken or depreciate over time.

Charts for silver, another precious metal often used in investment strategies, show similar trends to those seen with gold – suggesting both are appropriate choices if you’re looking to add alternative assets to your portfolio.

Many people view owning physical bullion as a form of “insurance policy” against economic uncertainty or risk; this can be particularly attractive given current conditions across global markets.

As always, though, investors should do their own due diligence before making any decisions about investing in physical assets like gold or silver coins and bars.

Pros & Cons

For more than three decades, Asset Strategies International has offered services to clients all over the world. Due to their outstanding customer service and loyal clientele, they have earned an unrivaled reputation in the industry and a high level of customer preference.

According to customer reviews, Asset Strategies International provides exceptional customer service and support for the duration of each client's portfolio.

Working with Asset Strategies International has a lot of benefits. Customers can count on staff members to respond to questions promptly and to provide thorough justifications for transactions and investments.

Access to specialists in particular areas of finance, such as tax planning, retirement planning, estate planning, or investment management, is also made available by the firm. This allows investors to benefit from a wide range of experience and knowledge all under one roof.

The company makes sure its clients understand every decision they make – whether it be about investing funds or managing assets – so that customers feel informed and empowered throughout the entire process.

On the flip side however, some cons may come into play within this type of business model. Such issues include potential conflicts of interest between advisors/brokers and their clients due to commission payments based on product sales; fee structures which may not always be transparent; or lack of professional advice regarding certain types of investments or securities trading strategies.

While many firms offer online resources for convenience purposes (such as account access), there still remains an inherent risk related to cyber security threats like identity theft or data breaches when using digital platforms for financial activities.

Overall, although there may be potential drawbacks associated with using Asset Strategies International’s services, customers can rest assured knowing that their money is being handled by professionals who possess both extensive experience in various aspects of finance and complete dedication to providing quality service at all times.

Conclusion

It is clear that asset strategies international can provide a great deal of value for those looking to diversify their investments and take advantage of the many benefits afforded by gold.

With an IRA, investors have access to a wide range of options in terms of both coins and bars, including numismatic coins which offer greater potential returns than standard bullion products. Gold has proven itself to be one of the most strategic assets around due to its scarcity, liquidity and longevity as well as its ability to act as a hedge against inflation.

The pros clearly outweigh the cons when it comes to investing in gold through an Asset Strategies International IRA. Investors who are aware of all available options will find themselves better equipped to make sound decisions about how best to protect their financial future.

With smart planning and research into what products best suit individual needs, investors can rest assured knowing they’ve made an informed decision on where their hard-earned money is being invested.

In conclusion, there is no doubt that gold investment through Asset Strategies International presents numerous advantages for those seeking stability and security in uncertain times.

By taking advantage of these opportunities with careful consideration given towards understanding various product types, investors may enjoy peace of mind knowing their money is safe from economic or market uncertainty.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Asset Strategies International below: