BEST 401k & IRA Rollovers/Transfers

4.9/5 Rating

$25,000 minimum IRA investment

BEST CUSTOMER FEEDBACK

4.8/5 Rating

$50,000 minimum IRA investment

Get immediate access to the most qualified silver IRA companies so you can safely secure your retirement.

These companies have:

- Lifetime customer support

- Highest level of Global Accreditations

- Flexibility to meet every concern

- Stellar customer feedback

- The most secure depository storage

My lengthy review process first rounded up 20 silver IRA companies. Then, I picked those with the highest consumer ratings from the Business Consumer Alliance (BCA) & the Better Business Bureau (BBB), which narrowed it down to 10 contenders.

I moved on to screen these companies for the best ratings in these categories: Customer support, compliance assistance, transparency, education, and fees & prices to gather the top 5 gold IRA accounts.

Or, keep reading below to protect your wealth with the most reliable silver IRA accounts on the market.

Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

The Best Silver IRA Companies

Automatic protection from increasing inflation and market risks is granted with these providers.

- Best Pricing: Goldco

- Best Customer Feedback: Augusta Precious Metals

- Best Buyback Program: American Hartford Gold

- Best Customer Education: Birch Gold Group

- Lowest Minimum: Noble Gold Investments

#1 Goldco - Best Pricing

- Fully trusted by Sean Hannity

- Educational opportunities tailored to you

- Up to $10,000 in free silver

- Near perfect ratings from BCA, TrustPilot, & other sources

- Well-known "white glove" customer service

#2 Augusta Precious Metals - Best Customer Feedback

- Up to 10 years of fees waived

- Thousands of 5-star ratings from clients

- Endorsement by high-income customers like Joe Montana

- No-pressure sales strategy

- Account lifetime support

- Unique one-on-one web conference with Harvard economist

#3 American Hartford Gold- Best Buyback Program

- Ranked #1 Gold Company on INC 500 List

- Bill O’Reilly & Rick Harrison's trusted and recommended precious metals dealer

- Buyback commitment with price-match guarantee and no back end fees

- Over $1 billion of precious metals delivered

- A+ Rating from the BBB and a 5-Star Rating on Trustpilot

#4 Birch Gold Group - Best Customer Education

- Low barrier to entry - $10,000 minimum investment

- Great customer education opportunities for every stage investor

- Transparent pricing and fees

- Have been in business since 2003

- Trusted by Ron Paul & Ben Shapiro

#5 Noble Gold Investments - Lowest minimum

- No questions asked buyback program

- Free delivery straight to your door at any point

- Lowest minimum investment of $2,000

- Diverse precious metal investment options (gold, silver, platinum, & palladium)

Let's Get into the Comparison of These Silver IRA Companies....

#1. Goldco - Best Pricing - WINNER

Our Rating: 4.9/5 stars

Goldco gets high marks from me because it is an excellent choice for first-timers as well as veteran investors. Goldco is known as one of the most transparent and straightforward companies in the industry. They are industry veterans, too, having been founded in 2006.

Goldco provides excellent customer service combined with accessible barriers of entry, making them a very well-rounded choice.

Goldco’s agents meet you where you are and ensure that you are comfortable with every step of the investment process. At no point will their agents pressure you into making an investment that you are uncomfortable with.

Especially as a first-time investor in a Silver IRA, you may not be ready to invest a big chunk of money. Goldco’s minimum investment of $25,000 is a low barrier to entry. They are one of the most accessible silver IRA companies.

"Goldco is the company I recommendation to my audience, friends, & family. "

-Sean Hannity

Goldco's ratings as of 2022:

Business Consumer Alliance: AAA

Better Business Bureau (BBB): A+

Scam Report: N/R

Trustlink: ★★★★★

Consumer Affairs: ★★★★★

Trustpilot: ★★★★★

Goldco Fees & Minimum Investment:

Annual custodial fee | $80 |

Annual depository storage fee | $100 |

Minimum investment | $25,000 |

Goldco Pros & Cons

Pros

Cons

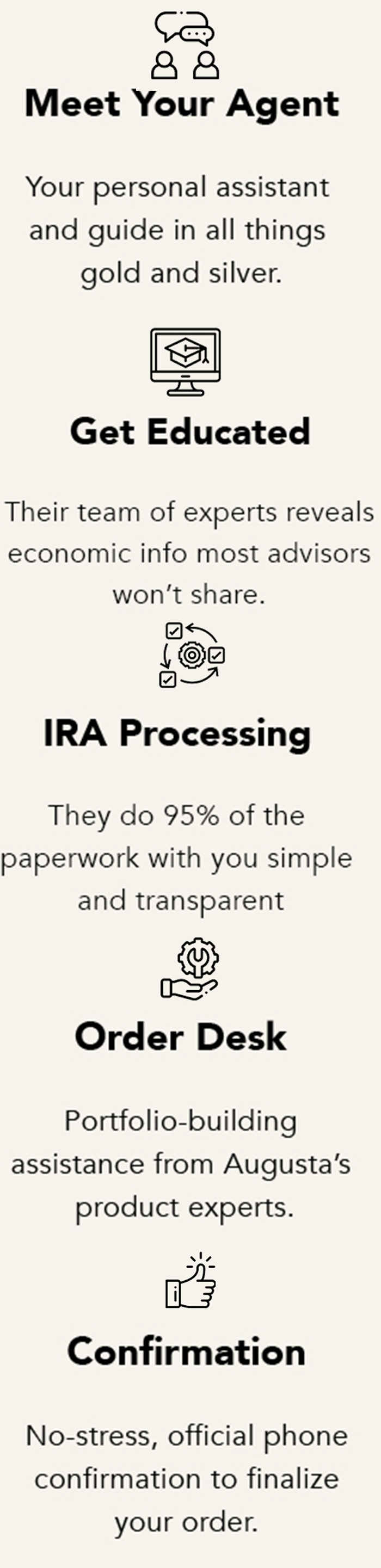

#2. Augusta Precious Metals

**Best Client Feedback - No Complaints since they began in 2012**

Our Rating: 4.8/5 stars

Quick Summary of Augusta:

- Up to 10 years of fees waived

- Thousands of 5-star ratings from clients

- No-pressure sales strategy

- Account lifetime support

- Unique one-on-one web conference with Harvard economist

Augusta Precious Metals is one of the best silver IRA companies, and has a stellar reputation in the industry.

They have exceptional customer support from day one and that support continues for the entire lifetime of your Silver IRA account.

They also offer some of the most comprehensive educational resources of any silver or gold IRA company, including books, pamphlets, blog posts, and web conferences. They have a reputation as one of the most transparent companies in the industry.

Augusta Precious Metals openly publish their fees and prices with no surprises and has a no commission sales floor which naturally makes the buying process easier, with less pressure to make a decision or buy after a certain amount of time than with other companies.

Augusta Precious Metals is our top choice because they treat you with the respect and support that you would expect from your own family.

Augusta's 2022 ratings:

Business Consumer Alliance: AAA

Better Business Bureau (BBB): A+

Scam Report: N/R

Trustlink: ★★★★★

Consumer Affairs: ★★★★★

Trustpilot: ★★★★★

Augusta Precious Metals Fees & Minimum Investment:

- Annual custodial fee: $80

- Annual depository storage: $100

- Minimum investment: $50,000

Annual custodial fee | $80 |

Annual depository storage fee | $100 |

Minimum investment | $50,000 |

Augusta Precious Metals Promotions:

- Up to 10 years of fees waived on certain investments

- First year of fees waived for investments over $50,000

Augusta has 4 different client-devoted departments that you’ll work with when you invest with them. They will all work together for the lifetime of your account to deliver you the best service and make sure you understand every step, with easily digestible information.

What to Expect if You Choose Augusta:

Augusta Pros & Cons

Pros

Cons

- Annual custodial fee: $80

- Annual depository storage: $100

- Minimum investment: $25,000

#3. American Hartford Gold - Best Buyback Program

Our Rating: 4.6/5 stars

American Hartford Gold is a family-owned precious metals investment company. They offer some of the best lifetime account support features of any silver IRA company.

If you have concerns about setting up a silver IRA or questions about how the process works, American Hartford Gold is a great place to start. They have representatives readily available to help you with the entire process. They also offer comprehensive resources on their website.

American Hartford Gold offers direct purchase of precious metals as well as precious metal IRAs.

One of the best things about American Hartford Gold is its guaranteed buy-back policy. Most silver IRA companies do not guarantee that they will buy back your silver when you are ready to cash out your account.

American Hartford Gold's ratings as of 2022:

Business Consumer Alliance: AAA

Better Business Bureau (BBB): A+

Scam Report: N/R

Trustlink: ★★★★★

Consumer Affairs: ★★★★★

Trustpilot: ★★★★★

American Hartford gold Fees & Minimum Investment:

Annual custodial fee | $75 |

Annual depository storage fee | Varies |

Minimum investment | Not specified |

American Hartford Gold Pros & Cons

Pros

Cons

#4. Birch Gold Group - Best Customer Education

Our Rating: 4.4/5 stars

Birch Gold is one of the oldest silver IRA companies in the industry, having been founded in 2003. Their focus in one-on-one customer interactions ensures that every client can feel comfortable with every step of the process.

When you purchase through Birch Gold, you are assured that you will receive directed, individualized attention from their representatives. They keep you informed at every step of the process and go the extra mile to make it as painless as possible.

They have industry experts readily available to discuss stock market trends and how that could impact your silver IRA account. These agents are available to you at any point during the lifetime of your account.

Birch Gold’s mission is to empower their clients to make informed decisions that are the best for them. They are specialists in helping customers to rollover IRA, 401(k), and other tax-advantaged retirement accounts into Silver IRAs. For that reason, they rank high on my list.

Birch Gold Group's ratings as of 2022:

Business Consumer Alliance: AAA

Better Business Bureau (BBB): A+

Scam Report: N/R

Trustlink: ★★★★★

Consumer Affairs: ★★★★★

Trustpilot: ★★★★★

Birch Gold Group Fees & Minimum Investment:

Annual custodial fee | $75 |

Annual depository storage fee | Varies |

Minimum investment | Not specified |

Birch Gold Pros & Cons

Pros

Cons

#5. Noble Gold Investments - Lowest Minimum

Our Rating: 4.3/5 stars

Noble Gold Investments has a decade of experience in the precious metals investment industry and in that time they have earned a reputation of excellence. They make my list because of their unique approach to account management.

They shine among their competitors for offering cost-saving benefits to their clients. One benefit they offer is free delivery to your door anywhere in the world.

Another benefit is segregated storage for your precious metals at no additional cost, meaning that your investment will not be stored with other clients’ in one storage unit.

Noble Gold Investments is one of the up-and-coming silver companies. They have been reported on in Smart Money, Forbes, Yahoo! Finance, and Market Watch. They ranked #20 in Inc. Magazine’s top 500 list.

Noble's ratings as of 2022:

Business Consumer Alliance: AA

Better Business Bureau (BBB): A-

Scam Report: N/R

Trustlink: ★★★★★

Consumer Affairs: ★★★★★

Trustpilot: N/R

Noble's Fees & Minimum Investment:

Annual custodial fee | $80 |

Annual depository storage fee | $100 |

Minimum investment | $2,000 |

Noble Gold Investments Pros & Cons

Pros

Cons

Silver IRA FAQ

What is a Silver IRA?

IRA means Individual Retirement Account and is a type of IRS-approved investment account.

An IRA allows pre-taxed income to be invested in your retirement. This means that the account avoids any capital gains or dividends. Income tax is not taken out of this money until you withdraw from the account.

There are several types of IRAs. A traditional IRA is an investment in money, stocks, or bonds. A Roth IRA is similar to the traditional one except it only allows investment in stocks and bonds.

Following this logic, a silver IRA then is a silver-backed retirement account. Silver IRAs have certain regulations as to what types of coins, bars, and bouillon are IRS-approved.

This means that rather than money or stocks and bonds, a silver IRA is backed by a physical asset: silver! This is important because, unlike other investments, physical assets will always retain some value. For more information on gold IRAs, click the link.

| $50,000 Minimum Investment Free portfolio reviews for all clients | *Most Professional *Most Transparent |

Silver IRA Accounts: Tax Rules & Regulations FAQ

Silver IRAs have many rules and regulations put in place by the IRS. It’s important to understand them before making any investments.

What Can Be Held in a Silver IRA?

Silver IRAs are limited to silver bullion, bars, and coins. The IRS does not allow for collectible items, such as coins, to be included as they rarely meet the purity requirements. The IRS requires that all precious metals in a Silver IRA be of a minimum of 0.995 purity.

The silver must be purchased from an approved precious metal IRA company that will ensure that everything meets all of these standards.

Silver IRAs may also include certain non-phyical assets. These include precious metal mutual funds, stocks in gold mining companies, precious metal commodity futures, and gold commodity exchange-traded funds.

How is a Silver IRA Taxed?

A Silver IRA is tax deductible like other types of IRAs; they are not subject to capital gains tax, unlike direct purchases of precious metals.

How Do I Avoid Capital Gains Tax on Silver?

You can avoid this by investing in a silver IRA instead of physical metals outside of an IRA.

Early Withdrawal Exceptions

In most cases, early distribution does earn a 10% levy tax. This penalty does not apply in specific situations:

* the owner dies and the beneficiary makes the withdrawal

* the owner uses the distribution to pay medical bills they would otherwise not be able to afford

* the owner uses the distribution towards a down payment on their first home

* the owner uses the distribution to help fund the education of a family member or themselves

* the owner loses employment

They are not subject to capital gains tax, unlike direct purchases of precious metals.

Contribution Limits

The minimum required investment for a silver IRA will vary from company to company.

The IRS does have annual maximum investments. That amount varies depending on your age. It is $6,000 annually until you are 50 years old when it increases to $7,000.

What Fees Should I Expect for a Silver IRA?

Silver IRA investments have several types of fees that you should expect.

Most silver IRA companies will have their fee structure readily available for you to review. Some companies publish these fees on their websites.

Fees can be divided into two types: one time and annual. One time fees typically include an account setup fee, shipping costs, and purchase fees. The annual fee is a custodial fee for the ongoing storage of your precious metals.

Each company has its own fee structure and its own rates. Some companies have guaranteed rates that will not change over time and others have a variable structure. This is something you should discuss with them when making your decision.

When is a Good Time to Invest in a Silver IRA Account?

Now is a great time to make an investment in a Silver IRA.

The price of precious metals has steadily increased over the last several years, meaning that investing sooner rather than later is to your benefit.

The stability of the stock market and the economy are uncertain. You should be considering what risk this poses to your retirement accounts and what you can do to lessen that risk. Who knows what tomorrow could bring.

Inflation increased by a whopping 5.6 points to 7 in 2021 and predictions are that it will only raise more in 2022. As inflation increases your spending power decreases. This means that your retirement accounts are likely being outpaced and could be decreasing in value.

Silver and other precious metals are inflation resistant because the price usually outpaces the dollar. Historically, the price of precious metals tends to increase when the economy is unstable.

Why Should I Invest with a Silver IRA Custodian?

There are many reasons that you should invest in a silver IRA. While you may be more familiar with traditional IRAs, silver IRAs offer several benefits that they do not.

- Portfolio diversification - Investment in a silver IRA has the benefit of diversifying your investment portfolio. It’s risky to limit yourself to a single investment or asset, especially in such a turbulent economic climate. Silver IRAs are a departure from traditional investments that lend security to your retirement portfolio.

- Economic stability - Silver and other precious metals are historically less impacted by turbulent economic turns than other types of investments. Silver IRAs are considered a low-risk investment because physical assets retain value more reliably than non-physical assets.

- Protection from inflation - Inflation causes the value of the dollar to fall, which negatively impacts your buying power. The same $20 in 1982 has much less value in 2022. Historically, silver and other precious metals have reliably outpaced the value of the US dollar.

- Widely used - Silver has been considered valuable for centuries, but it is useful for more than just jewelry making. Silver is used to make mirrors, dental alloys, solder and brazing alloys, electrical contacts, and batteries. With its use in so many industries, demand is unlikely to decrease much.

- Silver is a low-risk investment option because it is market resistant and the value of precious metals has steadily increased over the last few years. The market trend is that usually when the economy and stock market are unstable, the price of precious metals increases. However, no investment is 100% risk-free.

Conclusion: Is Investing in a Silver IRA a Good Move?

Choosing the right Silver IRA company is important. It’s your future, so you need to make an informed decision to safeguard it. It’s vital to choose a company with integrity, that has your best interests at heart.

You need to feel secure in your future and investment with the right Silver IRA company will help.

Silver IRAs are a great investment option, especially with the economy being unstable and inflation rapidly rising. Whether you decide to roll over existing retirement accounts or as an additional investment to diversify your portfolio, a Silver IRA will offer a greater sense of security.