The Beverly Hills Precious Metals Exchange provides an opportunity for individuals and businesses to buy, sell, and trade physical precious metals. With a wide variety of gold, silver, platinum, and palladium products available, the exchange is designed to offer investors access to the latest market data while providing services that are secure, transparent, and reliable.

In this review we will take a closer look at what makes the Beverly Hills Precious Metals Exchange stand out from other exchanges in the industry.

The first aspect worth noting about the Beverly Hills Precious Metals Exchange is its comprehensive selection of products. From coins and ingots to jewelry and bullion bars, customers can select from various forms of precious metal investments with ease.

All prices on the website are up-to-date and accurate so customers never have to worry about being overcharged or underpaid for their purchases.

In addition to offering a vast array of investment options, the Beverly Hills Precious Metals Exchange also stands out due to its commitment to security and transparency. All transactions made through the site use encrypted technology which ensures customer information remains safe throughout every step of the process.

Customers who choose to open accounts receive real-time updates on market trends so they can stay informed as they invest in precious metals.

When orders are placed online they are processed quickly so items arrive promptly after purchase – meaning customers get their hands on their new investments right away!

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Beverly Hills Precious Metal Exchange made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

Beverly Hills Precious Metals Exchange Company Background

Beverly Hills Precious Metals Exchange (BHPME) is a company that specializes in precious metals investments.

The company has quickly grown to become one of the leading providers of gold and silver investment products. The management team at BHPME consists of experienced professionals with extensive knowledge in the field of investing and trading precious metals.

They offer customers an array of services including self-directed IRAs, precious metal storage options, and a full range of exchange services.

In addition to their core business offerings, BHPME also provides customers with access to market research, portfolio analysis, and other helpful tools designed to maximize their return on investment when it comes to investing in precious metals.

With such reliable business practices in place, there is no doubt that this company is well equipped to meet all your needs when it comes to managing your assets involving precious metals.

Moving forward into the next section about Precious Metals IRA’s we will explore how Beverly Hills Precious Metals Exchange offers these unique retirement accounts and what benefits come along with them.

Precious Metals IRA

Precious metals investments, such as gold and silver IRAs, are becoming increasingly popular. Many investors are looking for a secure way to store their wealth outside of the stock market.

As an alternative to traditional retirement savings accounts, precious metal IRAs provide more stability and better returns in the long run.

For those interested in investing in gold coins or other types of metals, Beverly Hills Precious Metals Exchange has some of the best customer reviews on the market. They offer a wide variety of products at competitive prices and have knowledgeable staff who can answer any questions about the process.

Beverly Hills Precious Metals Exchange also provides resources that make it easier to understand how to invest in precious metals. Their website offers comprehensive information on all aspects of investing, from understanding different investment options like ETFs or mutual funds to learning about taxation policies related to these assets.

They offer IRA rollover services so customers can easily convert existing retirement accounts into physical metals without incurring added tax penalties. This allows them to diversify their portfolios with greater ease while maintaining safety and security throughout the entire process.

Gold IRA Roll Over

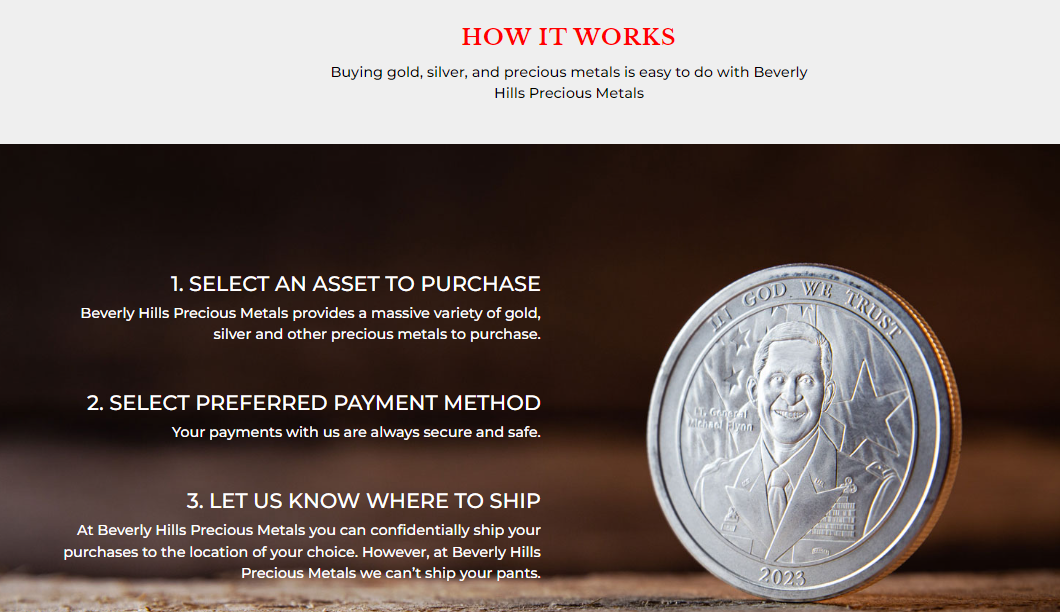

The process of conducting a Gold IRA rollover is increasingly popular as investors look for ways to diversify their retirement portfolios. With the help of companies like Michael Flynn’s Oxford Gold Group, Patriot Gold Group and Regal Assets, individuals can now move their funds from an existing 401(k) or traditional IRA into physical gold held in storage with a custodian.

Here are some key points to consider before taking this step:

- Tax Implications - It’s important to understand the tax implications associated with moving your pre-tax dollars into gold. As long as you follow Internal Revenue Service (IRS) rules, transferring money from one account type to another does not trigger taxes or penalties; however, if done incorrectly you may be subject to these fees.

- Storage Location – Before making any transactions, it’s essential to know where your precious metals will be stored and how they will be protected against theft or natural disasters. Most reputable dealers store customers’ items in secure vaults located within the United States while also offering insurance coverage through third parties.

- Fees & Costs – Customers should inquire about all additional costs involved in setting up a Gold IRA including setup fees, annual maintenance charges, delivery expenses and administrative costs that could impact overall returns on investments.

When deciding whether or not to invest part of your IRA portfolio in gold bullion coins or bars, understanding the steps required to do so is critical.

You must consult qualified professionals who have experience helping individuals complete successful transfers without incurring hefty taxes and fines. Researching each company’s track record when it comes to customer service and reputation is paramount when selecting which one meets your needs for achieving financial goals through investing in gold products.

Knowing what percentage of your assets should be invested in precious metals requires careful consideration but by following the proper protocols outlined above you can rest assured knowing that your hard earned savings are safe and soundly allocated throughout various types of investment accounts.

What Percentage of Your IRA Should You Invest Precious Metals?

Investing in precious metals can be a great way to diversify your retirement portfolio and protect yourself against inflation. However, it is important to understand how much of your IRA should go towards investing in these physical assets.

The amount you decide to invest will depend on several factors such as the size of your portfolio, any management fees associated with investments, and the risk tolerance you have for long-term investments.

When deciding what percentage of your IRA should be invested in precious metals, it’s best to start small. Start by allocating 10 percent of your total portfolio into gold or silver coins or bullion bars stored either at home or an approved third party.

This helps minimize potential losses due to market volatility while giving you the opportunity to reap rewards from the ongoing appreciation of certain types of precious metals over time. As markets change, you may want to adjust this percentage accordingly in order to take advantage of different trends that could make investing more lucrative.

Understanding how much money should be allocated towards investing in precious metals requires careful consideration and research into current market conditions as well as understanding which specific products are likely to experience increases in value over time.

Knowing where and when to allocate capital can help ensure that your retirement savings remain secure even during turbulent economic times.

The Differences Between a Gold IRA Rollover and a Transfer

The differences between a gold IRA rollover and a transfer are significant.

When it comes to investing in precious metals, understanding the various types of account transfers is essential for making an informed decision about your retirement savings. A gold IRA rollover allows you to move funds from one self-directed IRA account into another without incurring any taxes or penalties.

On the other hand, a transfer involves liquidating assets from one account and transferring them into another, which can incur storage fees as well as trading costs depending on the type of asset being transferred.

To better understand the difference between these two options when investing in precious metals:

- Gold IRA Rollovers involve moving funds from one self-directed IRA account to another free of tax or penalty charges.

- Transfers occur when assets are moved out of an existing account and into a new one; this may result in storage fees or trading costs depending on the type of asset being sold or purchased.

It's important to keep in mind that while both methods allow investors to access their retirement funds more easily and quickly, only certain types of accounts are eligible for each option.

As such, investors should carefully research all available investments before deciding whether a gold IRA rollover or transfer is right for their individual needs and objectives.

Investors need to be aware that there can be risks involved with investing in the precious metal market - including but not limited to fluctuations in prices - so they should seek professional advice prior to making any decisions regarding their retirement fund transfers.

Why Invest in Precious Metals?

The allure of investing in precious metals has long been established. They are seen as a safe haven asset, providing protection against inflation and economic downturns.

With the world economy in turmoil, more investors have turned to physical gold and other investment grade metals for both short-term gains and long-term wealth preservation.

Precious metals investments offer many advantages over traditional stocks and bonds – they are an alternative asset class with no counterparty risk, low correlation to equities markets, tangible value that can’t be devalued or manipulated by governments or financial institutions, and high liquidity.

Beverly Hills Precious Metals Exchange (BHPX) is a full service precious metals investment firm offering clients access to a wide range of nonferrous metal products including coins, bars, rounds, bullion vaults and storage facilities - ideal for individuals looking to diversify their portfolios with hard assets such as silver and gold.

BHPX also provides expert advice on portfolio allocation strategies so that you get the most out of your precious metal investments.

Whether it’s buying rare coins from around the globe or taking advantage of current market conditions; BHPX offers its customers both safety and peace of mind when making purchases via its secure online platform.

Is Beverly Hills Precious Metals Exchange a Scam?

Beverly Hills Precious Metals Exchange is a company that buys and sells precious metals in the form of coins, bars, and jewelry. While this type of investment has its risks, it also provides an opportunity for those who are willing to take a chance.

The Beverly Hill’s website claims that their team consists of knowledgeable professionals with over 50 years combined experience in the industry. Their services include sales advice from Financial Advisors, as well as secure storage options for your investments.

The Beverly Hills Precious Metals Exchange is affiliated with Andrews Sorchini, Orion Metal Exchange, and Augusta Precious Metals. They have been accredited by the Better Business Bureau since 2019 which speaks volumes about their commitment to customer service.

Customers can contact them directly via phone or email if they have any questions or concerns regarding their transactions or products offered by the exchange. Customers can access online resources such as reviews and ratings from other customers on the BBB website before making a purchase decision.

While there may be some legitimate complaints lodged against Beverly Hills Precious Metals Exchange due to misunderstandings or even potential scams, overall their feedback rating remains relatively positive across multiple websites including Yelp and Google Reviews.

Investing in precious metals comes down to personal choice but considering all factors involved; Beverly Hills Precious Metals appears to offer reliable services backed up by professional experts in the field along with being accredited by the BBB.

Conclusion

The Beverly Hills Precious Metals Exchange company is a trusted source of investment in the precious metals market. It offers investors an opportunity to diversify their portfolio with gold and other precious metals, providing stability during economic downturns and protecting against inflation.

Investing in precious metals through an IRA rollover can be extremely beneficial for those looking to secure their retirement savings.

When deciding how much of one’s IRA should be invested in precious metals, there are several factors to consider such as budget constraints, desired return on investments, and risk tolerance.

For individuals who are willing to take a greater level of risk, investing up to 20% of the total IRA balance into precious metal assets may prove fruitful over time. Transferring funds from existing IRAs into a Gold IRA Rollover allows for more tax-efficient growth potential than traditional investments like stocks or bonds.

Investors have begun using precious metals as part of their portfolios because they offer various benefits that other types of investments do not provide. Precious metal prices tend to remain stable even during times of financial uncertainty while also preserving purchasing power over long periods of time due to its intrinsic value.

These tangible assets increase in value when compared with paper currency which tends to lose value over extended periods due to inflationary pressures.

Despite being a legitimate business offering valuable services, many still question whether the Beverly Hills Precious Metals Exchange is truly reliable or if it just another scam trying to take advantage of unsuspecting consumers.

After thorough research however, it is clear that this company has been well established for years and provides excellent customer service coupled with competitive pricing structures making them one of the top players in the industry today.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Beverly Hills Precious Metal Exchange below: