Boston Bullion Review is a leading source of information on the global bullion market. It provides up-to-date news and analysis, enabling readers to stay informed about industry trends.

With its comprehensive reviews and insights into current topics, Boston Bullion Review offers an invaluable resource for those interested in gold and silver investments.

The review covers a wide range of subjects related to the bullion markets such as prices, regulations, security measures, technological advancements, and more.

Through their detailed research and thorough coverage of the latest developments, they provide crucial knowledge that allows investors to make sound decisions when it comes to buying or selling precious metals.

Their team consists of experienced professionals from all walks of life including financial advisors, researchers, economists and traders who are passionate about what they do.

Their mission is to help people better understand the world of bullion investing by providing reliable data backed by insightful analysis.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Boston Bullion made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

About Boston Bullion

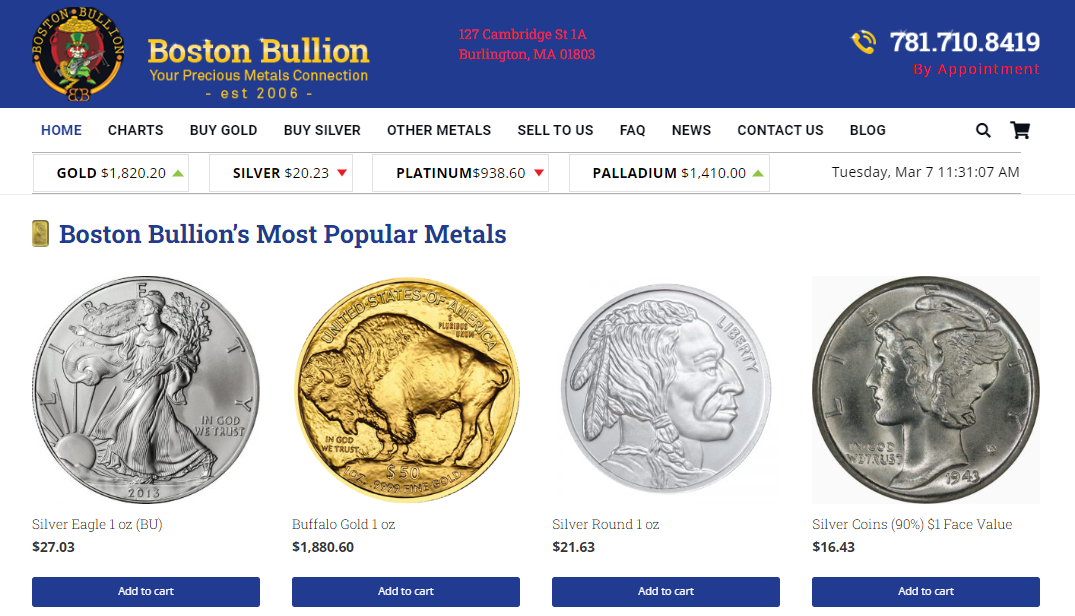

Boston Bullion is a trusted brand for selling and buying precious metals. It provides excellent customer service, offering a wide range of options to customers who are looking to purchase or sell items like gold, silver, platinum and other valuable metals.

They have been in the industry since 2009 and are considered one of the most reliable sources when it comes to making sure your investments yield maximum value over time.

The company has an impressive reputation with their clients because they offer competitive prices on all items purchased and sold through them.

In addition, Boston Bullion also offers free shipping on orders over $100 so that you can get your materials delivered quickly without having to pay extra.

As such, they provide an ideal way to invest in precious metals without breaking the bank.

Moreover, Boston Bullion's staff is knowledgeable about what’s going on in the market and can help you make informed decisions about where you should allocate your finances.

Their experts will walk you through each step of the process from start to finish so that you don't miss any important details along the way.

All in all, Boston Bullion ensures that anyone looking for quality services related to investing in precious metals can find exactly what they need at this premier destination.

Whether its coins or bars, customers know they’re getting top-notch products backed by superior customer service every time they shop here – no matter if it’s online or in store!

With these great benefits available, it's no wonder why people choose Boston Bullion when searching for ways to buy or sell their precious metal investments.

How To Sell Your Precious Metals to Boston Bullion

Selling your precious metals can be a daunting task, but with the help of Boston Bullion it doesn't have to be.

Kenneth Murphy, owner and founder of Boston Bullion, has over 30 years experience in helping people invest in precious metals.

He offers a variety of options for vault storage as well as investment strategies so you can make sure your investments are safe and sound.

When looking to sell your precious metals to Boston Bullion, the process is simple and straightforward.

First, you will need to contact their team directly through email or phone call to discuss what type of metal you would like to sell.

Once they receive your request, they will provide an estimate based on current market values and then arrange payment either via bank transfer or check if requested.

They offer free shipping when selling more than $10K worth of product allowing you easy access without having to pay additional fees.

It's clear that working with Boston Bullion is a great choice for those ready to begin investing in Precious Metals Investment or transitioning from another provider.

With quick response times and secure vault storage options available they provide exceptional customer service while offering competitive rates at the same time!

Boston Bullion Products

Buying precious metals is a form of investing akin to modern-day alchemy, transforming the everyday into something rare and valuable.

Boston Bullion offers its customers a wide variety of products that allow them to make this transformation: gold coins, physical gold bars, silver coins, and more.

No matter what kind of investor you are—from beginner to expert—Boston Bullion has an option for everyone.

They offer both bullion coins like American Eagles as well as collectible coins such as Canadian Maple Leafs.

For those looking to invest in physical gold or silver, they have plenty of options available.

Whether it's rare dates or special releases commemorating anniversaries and holidays, there’s something to fit any budget at Boston Bullion.

The company also carries other forms of bullion besides just gold and silver, including Platinum Eagle Coins and Palladium Bars from world mints like the Royal Canadian Mint.

With so many choices available, anyone can find the perfect way to invest in their future with Boston Bullion.

Precious Metals IRA

A Precious Metals IRA allows individuals to invest in gold and other precious metals. This type of IRA is called a self-directed Individual Retirement Account (IRA).

It gives the investor more control over their retirement funds than traditional IRAs, allowing them to purchase physical assets such as Gold Eagle coins or bars, silver bullion and platinum ingots.

Investing in these types of accounts can also help diversify an individual's portfolio by providing additional protection against inflation.

Many investors choose to open a Precious Metals IRA because it offers tax advantages that are not available with other investments.

For example, when investing in gold or silver, gains on the investment are taxed at a lower rate than many other securities.

Contributions to this account may be tax deductible up to certain limits depending on your income level and filing status.

Distributions from the account are generally exempt from taxes if they meet certain criteria set forth by the IRS.

Investors should take care when setting up a Precious Metals IRA due to its special requirements for custodianship and storage as well as specific rules about how much you can contribute each year.

Taking time to understand all aspects of this investment vehicle before starting can ensure that you make sound decisions while building your portfolio.

What Is a Self-Directed IRA?

A self-directed IRA (Individual Retirement Account) is an investment account that allows investors to make their own investment decisions.

It differs from a traditional or Roth IRA in that it offers more flexibility and access to a wider variety of investments such as precious metals, real estate and private placements.

This type of retirement savings plan can be beneficial for those looking to diversify their portfolios beyond stocks, bonds and mutual funds.

When investing in a self-directed IRA, there are several options available.

Bank wire transfers are the most common way to fund these accounts; however, some custodians offer full service options where they manage the transfer on your behalf.

International storage options may also be available depending on which custodian you choose.

Further research into the various companies offering this option should be done before making any final decisions.

Investing in a Self-Directed IRA can provide individuals with greater control over their retirement assets compared to other types of IRAs.

However, due diligence must be taken when selecting an appropriate custodian to ensure necessary regulations are met.

How To Fund a Precious Metals IRA

Funding a Precious Metals IRA is an investment strategy that allows you to diversify your retirement savings.

It involves purchasing gold, silver and other precious metals from a precious metals dealer.

The price of gold and other metals can fluctuate significantly, so it's important to do research before investing in these assets.

When deciding which type of self-directed IRA to open for a precious metals purchase, it's essential to consult with both your financial advisor and the IRS regulations.

When researching potential dealers, look for one that has competitive prices and top customer service ratings.

A reputable dealer will be able to provide guidance on how much should be invested into each metal based on its current value.

Most importantly, they'll help ensure compliance with all legal requirements associated with this type of investment vehicle.

TIP: Before selecting any precious metals dealer be sure to review their background information thoroughly as well as the fees associated with setting up or transferring an existing IRA account.

Consider seeking advice from a qualified financial professional when making decisions regarding investments in precious metals IRAs.

Reasons To Own Gold

From the days of ancient Pharaohs to modern-day investors, gold has been a symbol of wealth and power.

Why should you join these illustrious ranks? Here are four compelling reasons:

Firstly, gold is an excellent hedge against economic uncertainty and inflation - it is often seen as a safe haven in times of financial turmoil.

Secondly, because gold does not corrode or degrade over time, it can be held for long periods without losing its value.

Thirdly, with business profiles growing more complex each day, precious metal dealers now offer volume discounts that make investing in physical gold easier than ever before.

Last but not least, owning gold offers diversification benefits; having a tangible asset like gold in your portfolio allows you to have exposure to multiple markets at once.

It's clear that there are many advantages associated with owning gold – so why put it in your IRA? Let’s find out next!

Why Put Gold in Your IRA?

Owning gold is a wise decision for many investors. With its history of being used as currency, gold has been seen as a way to secure wealth and ensure financial stability in uncertain times.

Putting gold into an IRA can be especially beneficial, allowing individuals to diversify their retirement portfolio with this precious metal.

So what are the benefits of putting gold in your IRA?

One reason why it may make sense to include gold in your investment strategy is that you have access to physical assets from reputable precious metals companies.

Investing directly in a gold bar or coins allows you to gain exposure without having to worry about stock market volatility or complex derivatives.

This makes it easy for those who want control over their investments and peace of mind when planning for retirement.

There are certain tax advantages associated with using a self-directed IRA, including potential deductions on contributions made throughout the year which could help save more money long-term.

Gold also provides protection against inflation since its price tends to rise during economic downturns due to increased demand.

By adding some of this valuable asset into your retirement plan, you can reduce risk while still taking advantage of profit opportunities if prices go up over time.

Of course, keep in mind that investing comes with some risks but by researching various options available through top gold brokers and understanding the fees involved, you can find an option that fits both your budget and needs best.

As you explore different strategies for protecting your savings, consider how allocating part of your nest egg towards owning physical gold could benefit you now and later down the road.

Brokerage Fees

Talkin' 'bout brokerage fees? Let's start with the basics.

When you're investing in gold, it's important to know what kind of financial advice and services come along with it.

Brokerage fees can vary depending on a variety of factors such as the type of product you’re buying, where you buy from, or even how much is being purchased.

So let’s take a look at some of those costs associated with putting your hard earned cash into gold investments.

When it comes to gold IRA accounts specifically, there are typically two kinds of fees that apply: setup and annual maintenance fees.

Setup fees cover all the administrative paperwork required for setting up an account while annual maintenance covers any custodial services needed throughout the year; these may include asset storage, insurance coverage, and other related expenses like taxes which need to be paid each year.

Of course if you decide to use a broker-dealer then additional commissions will also likely be charged based on the products bought and sold through them - so keep that in mind!

Many brokers offer different types of services and platforms which require various levels of expertise so do your research beforehand to ensure you understand exactly what level of service you'll receive when dealing with them.

All in all, knowing about brokerage fees before making gold investments is essential for ensuring that your money is well spent.

Difference Between Spot Prices and Bullion Premiums

Spot prices and bullion premiums are two different kinds of pricing in the gold market.

Spot prices refer to the current price for buying or selling an ounce of gold at a given moment, while bullion premiums reflect what it costs to buy pure gold coins or bars from a reputable dealer.

Knowing the difference between these two types of pricing can help investors make more informed decisions when purchasing gold products.

Sales tax is one factor that sets spot prices apart from bullion premiums. Gold Alliance and Gold Kangaroo are examples of dealers who may offer lower rates on their goods than those found in spot markets due to taxes not being factored into the premium rate.

It's important to consider this difference when making purchases as it can add up over time if you're investing long-term in physical gold assets.

Most dealers will have additional fees such as shipping costs associated with each purchase which should also be taken into account before any transaction takes place.

Understanding how both spot prices and bullion premiums work together is essential for successful investments in the precious metals market.

Boston Bullion Reviews

Boston Bullion reviews have been highly positive. Customers appreciate the company’s competitive prices, speedy delivery, and variety of payment options.

The spot price of bullion is the current market price for an ounce of gold or other precious metals; whereas premium prices are slightly higher than this.

Orders from Boston Bullion typically take just a few business days to process and arrive at the customer’s door.

As such, many customers feel that they get their money's worth with Boston Bullion.

In addition to offering competitively priced products, Boston Bullion also provides excellent customer service in terms of both pre-sale inquiries and post-sale follow up support.

They offer helpful advice on investments based on individual needs as well as provide a secure checkout system which makes it easy for customers to make purchases without any hassle.

In summary, Boston Bullion has received high ratings due to its great value, fast shipping times, and convenient payment options - all factors which contribute towards an overall satisfying experience when purchasing bullion online.

Economic Conditions

The economic conditions that have been experienced in recent years can impact the way companies do business, and Boston Bullion is no exception.

The international market has seen a downturn in investment as credit cards become more expensive to use.

This could make it harder for customers to purchase products from Boston Bullion, which could lead to lower sales and profits.

Customers may be less likely to leave positive reviews when they are not happy with their purchase due to economic concerns.

Boston Bullion must take these factors into account when considering their current operations.

They need to find ways of making sure their customer service remains high while also keeping prices competitive within the market.

By doing this, they will be able to maintain loyal customers who are satisfied with their purchases despite any financial hardships being experienced by them or the company itself.

Transitioning forward, it is important to understand if Boston Bullion is scam or not.

Is Boston Bullion a Scam?

In this day and age, the question of whether or not Boston Bullion is a scam has become an increasingly pertinent one.

With alternative investments such as monetary gold becoming more popular amongst investors, it is important to ascertain if fair prices are being offered by companies like Boston Bullion.

From examining customer reviews to researching company policies, let's take a look at what can be said about the legitimacy of this investment firm.

To begin with, there have been numerous reports from customers claiming that they were taken advantage of by this particular business.

Many allege that they paid exorbitant fees for products which did not meet their expectations; others complained that staff members had misrepresented facts in order to coerce them into buying specific products.

These issues have certainly caused some people to doubt the credibility of Boston Bullion: 1) fraudulent practices 2) lack of transparency 3) high costs associated with purchases.

However, when looking closer at the company itself - its history, track record and portfolio - it becomes clear that Boston Bullion does indeed offer legitimate services and should not be considered a scam.

They possess all necessary licenses required for trading precious metals and other commodities, employ experienced brokers who provide honest advice regarding various markets, and consistently pay out dividends on time without fail.

This is certainly reassuring evidence for any potential investor considering taking part in transactions involving metal bullions or coins through their platform.

Pros and Cons

Well, here we are - it's time to dive into the pros and cons of Boston Bullion.

Let's get right to the bottom line: is this a scam or not?

With all that said, let's break down what you need to know about BB.

Firstly, they have physical possession options available through their GoldStar Trust Company and Dakota Depository Company locations.

This means customers can take advantage of holding gold coins in safe deposit boxes with one of these two companies.

Both provide excellent security measures for your holdings so there’s no worry about them disappearing overnight!

Boston Bullion has competitive prices on gold bullion bars and coins as well as other precious metals like silver and platinum.

The cons include a lack of transparency when it comes to pricing structures on some items and a few customer service complaints from users who had difficulties getting help when needed.

Buyers should be aware that although there are free shipping offers available on certain orders over $99 USD, international delivery may incur additional charges depending on location – something worth keeping in mind before making an order.

Here are just a few points to consider if you're thinking about purchasing from Boston Bullion:

•Physical Possession Options Available

•Competitive Prices On Precious Metals

•Lack Of Transparency In Pricing Structures

•Customer Service Complaints Reported

•Additional Charges May Apply For International Delivery

In short, whether or not buying from Boston Bullion is a good fit for you depends largely upon your needs and comfort level with taking risks.

Ultimately though, having access to physical possession options via reputable companies such as Goldstar Trust Company or Dakota Depository Company might make using Boston Bullion worthwhile even despite any potential negatives listed above.

Conclusion

In conclusion, it is clear that Boston Bullion is a reliable source for purchasing precious metals.

Through the company's expansive variety of products and services such as their Self-Directed IRA, customers are able to diversify their portfolios with ease.

The numerous positive reviews from satisfied clients attest to the service provided by this organization.

Moreover, despite some fluctuations in economic conditions, investors can rest assured that they will receive quality products at competitive prices.

All things considered, working with Boston Bullion is an excellent way to increase one's wealth through gold and silver investments.

The advantages of doing business with this firm have been established; however, potential buyers should also be aware of any possible risks associated with investing in precious metals.

It is important to do research on all available options before deciding which route to take when investing funds.

Individuals must ensure they are getting the best value for their money and consider if buying physical bullion or other forms of investment might be more suitable for them.

Overall, those looking for a trusted provider of gold and silver investments should seriously consider Boston Bullion as an option.

With its comprehensive range of products and services combined with high customer satisfaction ratings and competitive pricing strategies, the benefits far outweigh any drawbacks.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Boston Bullion below: