CamaPlan is an independent IRA administrator that offers various types of IRA accounts and investment opportunities.

Founded in 2003, the company provides clients with educational resources to make informed financial decisions for retirement. CamaPlan offers a range of investment options including gold and precious metals, real estate, mortgage notes, private lending, and tax liens.

The company's fee schedule is transparent and reasonable, offering two fee structures to choose from.

In this article, we will provide an objective review of CamaPlan's services and investment options. We will examine the company's management team and founders as well as discuss the different types of accounts available through CamaPlan.

We will explore alternative investing options offered by CamaPlan such as real estate investments or tax lien certificates.

And, we will evaluate the fees associated with using CamaPlan's services and take a closer look at their educational platform called Cama Academy which aims to educate investors on making sound financial decisions for retirement planning.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if CamaPlan made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

About CamaPlan

Background and services offered by an independent, self-directed IRA administrator provides investors with a diverse range of options for long-term retirement planning and compliance assistance.

CamaPlan is one such company that offers clients the ability to invest in alternative investment opportunities such as real estate, mortgage loans, gold and other precious metals, private placements, tax liens, and more through their Traditional, Roth, SEP, SIMPLE IRAs and Inherited IRAs.

CamaPlan's founders Carl Fischer and Maggie Polisano are both Certified IRA Services Professionals (CISP) and Certified Trust Specialists (CTS), bringing years of experience in real estate development to their business.

Investors looking for options beyond stocks, bonds, and mutual funds can access a wide range of choices when selecting a CamaPlan IRA account.

The company aims to assist clients in making their own financial decisions for retirement while also providing government reporting and regulatory compliance assistance.

Investors have the opportunity to engage in educational opportunities through Cama Academy where they can explore IRS rules and regulations as well as federal and local legislation related to retirement planning.

Reviews of CamaPlan show that investors appreciate the transparency of fee schedules available on its website along with reasonable fees that enable them to keep more money.

Clients also benefit from two fee structure choices: asset-based or value-based.

CamaPlan is an ideal option for investors who want greater control over their investments while still receiving quality service from experienced professionals who understand the intricacies of self-directed IRAs.

CamaPlan Founders and Management Team

An overview of the founders and management team of CamaPlan, a self-directed IRA administrator based in Pennsylvania.

Carl Fischer and Maggie Polisano, both third-generation real estate developers, established CamaPlan in 2003 to provide alternative investment opportunities for retirement planning.

The company offers various investment options such as real estate, mortgage loans, gold and other precious metals, private placements, tax liens, and more.

Carl Fischer is a Certified IRA Services Professional (CISP) and a Certified Trust Specialist (CTS). He has directly overseen real estate transactions totaling more than $20 million.

With his extensive knowledge in business, finance, scheduling, and overall management combined with his experience as a rocket scientist for the Kennedy Space Center in the 1970s, Mr. Fischer is an important voice in his clients' success in directing their financial futures.

Maggie Polisano is also a Certified IRA Services Professional (CISP) and a Certified Trust Specialist (CTS).

She assists clients with real estate planning, tax avoidance strategies, general investing guidance as well as understanding tax minimization strategies when investing in mortgages, notes options or any other form of alternative investments.

Ms. Polisano has strong residential property development experience across New Jersey, Pennsylvania and Florida; she helps individual investors as well as business owners choose suitable financial plans that can help them reach their financial goals through CamaPlan's self-directed IRA services platform.

CamaPlan Accounts

As retirement planning becomes increasingly relevant in today's uncertain economic climate, investors are searching for self-directed IRA administrators like CamaPlan to provide a range of account options that suit their unique needs and investment goals.

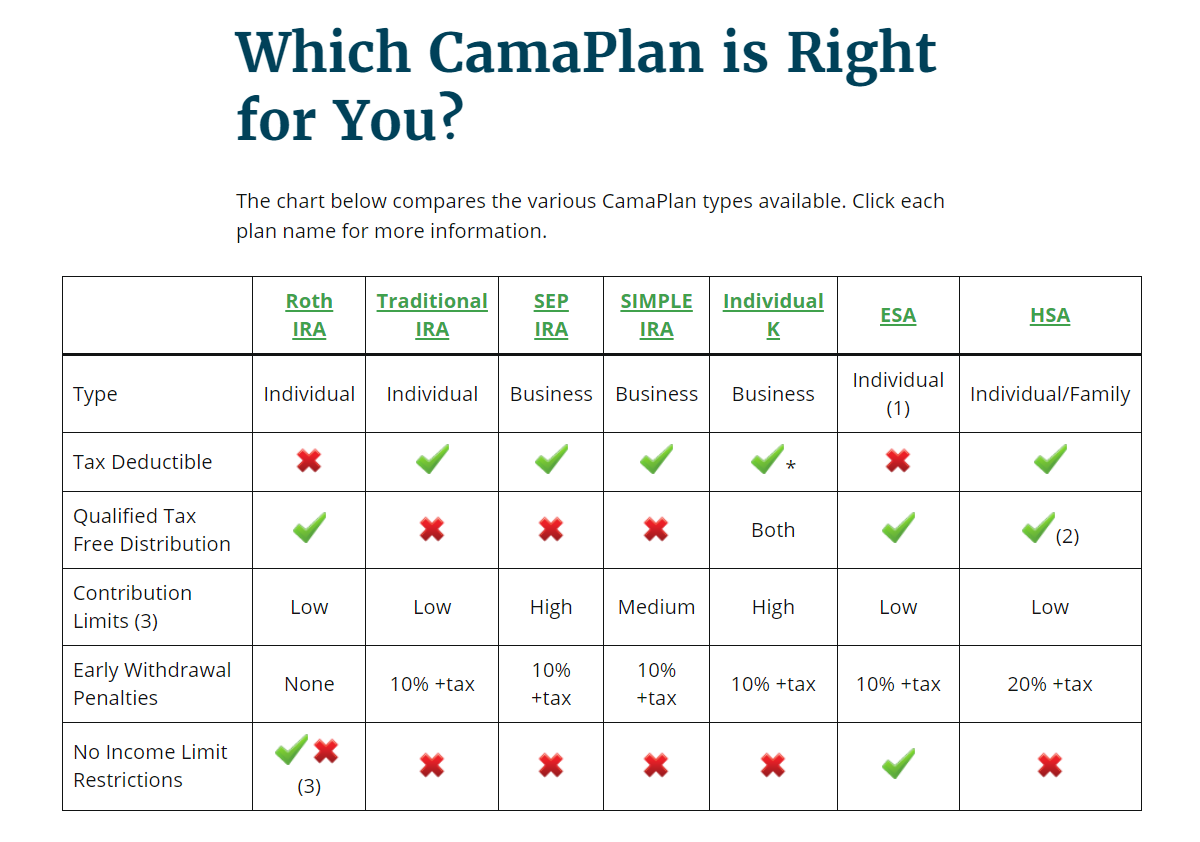

CamaPlan offers four types of IRA accounts: Traditional, Roth, SEP, and SIMPLE IRAs. These accounts provide tax advantages for retirement savings.

CamaPlan provides an Inherited IRA account for individuals who claim an IRA as an inheritance from a loved one.

CamaPlan's self-directed IRAs allow investors to diversify their assets beyond traditional stocks and bonds.

The company provides alternative investment opportunities in real estate, mortgage loans, gold and other precious metals, private placements, tax liens, and more.

Real estate investing is particularly attractive through CamaPlan because it provides the opportunity to invest in various types of properties such as single-family homes, multi-family homes, apartment complexes, co-ops, condos or commercial real estate.

CamaPlan offers a comprehensive suite of self-directed IRA accounts that cater to both individual investors and businesses alike.

With its focus on asset diversification through non-traditional investments like real estate and gold bullion acquisition programs along with transparent fee structures available on its website, it makes it easier for investors to keep track of costs while making informed decisions about their financial future.

Other Investing Options with CamaPlan

Investors with a CamaPlan self-directed IRA have access to alternative investment options such as gold and precious metals, real estate, mortgage notes, private lending, and tax liens.

These investments provide greater asset allocation options for investors seeking to diversify their retirement portfolio.

By investing in alternative assets, investors can reduce their risk exposure while potentially increasing returns.

CamaPlan provides education resources through its academy to help investors make informed decisions about their investments.

Clients and professional advisers can explore IRS rules and regulations as well as federal and local legislation through Cama Academy initiatives.

CamaPlan offers consultation services to assist clients in making the best investment choices based on their unique financial goals.

CamaPlan's alternative investment options provide investors with greater flexibility and control over their retirement portfolios.

The ability to invest in gold and precious metals, real estate, mortgage notes, private lending, and tax liens allows for more diverse asset allocation strategies that can potentially lead to higher returns with lower risk exposure.

The educational resources provided by Cama Academy and consultation services enable clients to make informed decisions about their investments.

CamaPlan Fees

Overview of the fee structure options offered by CamaPlan, including asset-based and value-based choices, as well as the annual maintenance fee for precious metals pricing.

CamaPlan's fee schedule is transparent and available on their website, enabling investors to make informed decisions about their retirement planning services.

The company offers two fee structure choices: asset-based and value-based. With these options, investors can determine how much they will pay in annual maintenance fees based on either the number of assets in their account or the account's total value.

The annual maintenance fee for precious metals pricing is also value-based. Investors are charged a minimum of $160 and a maximum of $280 annually for storage and insurance fees.

These costs are determined by multiplying the value of an investor's precious metals by 0.0015.

Payment occurs in January each year, with additional expenditures for storage and insurance adjusted accordingly throughout the year when necessary.

CamaPlan accepts payment via credit cards, debit cards, or bank accounts; however, all credit card transactions are subject to a 3.5% convenience fee.

Clients can lower their costs by referring new clients to CamaPlan through their referral program.

CamaPlan offers alternative investment opportunities beyond traditional IRA accounts with reasonable fees that enable investors to keep more money while maintaining transparency about charges associated with different investments within their self-directed IRA accounts.

Cama Academy

Cama Academy offers ongoing educational opportunities for individuals and businesses to expand their knowledge base in investing, including traditional and non-traditional markets, and federal and state regulations for tax-advantaged savings accounts.

The program brings together experts in the creation, management, and taxation of retirement and savings plans.

It provides thought leaders from various financial sectors such as debt financing, venture capital, precious metals, real estate, and venture capital.

Through Cama Academy's initiatives such as live lectures, webinars, online seminars, workshops, articles, films, court cases and Q&A sessions investors can learn how to recognize possibilities while assessing their potential.

They are also taught how to carry out transactions per federal and state regulations for tax-advantaged savings accounts. Clients can explore IRS rules and regulations along with federal and local legislation through Cama Academy initiatives.

Cama Academy encourages hiring reputable professionals while being licensed to provide continuing education nationwide.

The key to acquiring knowledge is education which is vital in implementing an investment strategy that meets retirement goals effectively.

Most activities offered by Cama Academy are free of cost with individual phone or in-person sessions available upon request to accommodate busy schedules.

Conclusion

CamaPlan is an IRA administrator that provides clients with a variety of investment options to help them make informed decisions about their retirement.

With transparent fee schedules and reasonable fees, CamaPlan offers two fee structure choices to suit each client's needs.

The company also provides educational opportunities through Cama Academy to help clients understand the different types of investments available to them.

From precious metals to tax liens, CamaPlan offers alternative investment options for clients looking to diversify their portfolios.

The company's founders, Carl Fischer and Maggie Polisano, have created a management team that prioritizes empowering clients with knowledge and resources so they can make sound financial decisions for themselves.

CamaPlan is a reliable IRA administrator that offers flexibility in investment options while providing transparency in fees. The company's commitment to education through Cama Academy demonstrates its dedication to empowering clients with the knowledge necessary for successful investing.

As such, it remains an excellent choice for those looking for alternative investment opportunities within their IRAs.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit CamaPlan below: