Gold Gate Capital is an investment firm that has made a name for itself in the financial world. Founded in 2006, they have been providing investors with high-quality services and solutions to complex problems ever since.

They specialize in venture capital investments, private equity acquisitions, and mergers & acquisitions (M&A).

This article will provide an overview of Gold Gate Capital's services, as well as a review of their performance over the years.

The first thing to note about Gold Gate Capital is that they have made a name for themselves by being highly successful at making profitable investments.

Their team consists of experienced professionals who use their expertise to find opportunities where others may not see them.

Each member brings unique skillsets and insights which help the organization succeed.

The company also takes great care when selecting partners for each transaction – ensuring only those who bring value are selected.

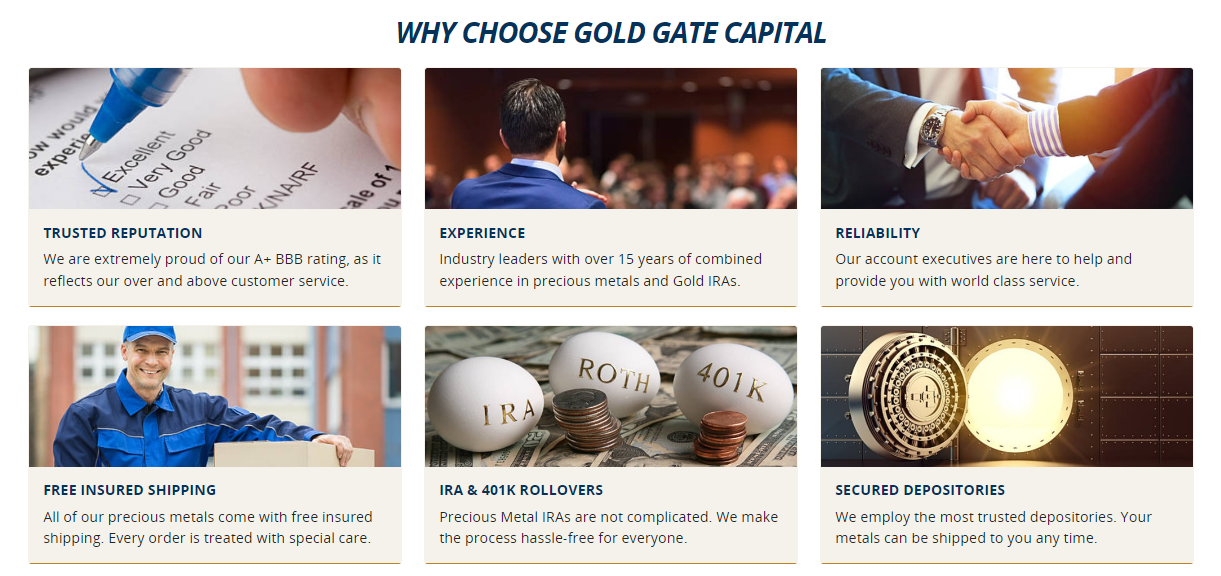

Gold Gate Capital prides itself on its commitment to service excellence. From start to finish, clients receive personalized attention from experts who make sure all questions are answered promptly and accurately.

The firm works hard to build relationships with customers that last long after any deal is finalized.

These traits combined with their track record of success show why so many people choose Gold Gate Capital when it comes time to invest money.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Gold Gate Capital made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

What Is a Self-Directed IRAs?

Self-directed IRAs are a smart savings strategy for savvy savers.

They offer the opportunity to diversify one’s investments beyond traditional stocks and bonds, allowing individuals to invest in alternative assets such as gold and other precious metals.

Gold Gate Capital provides a great option for those looking to explore this type of investment.

With their services, clients can easily set up an IRA with access to physical gold or silver coins, rounds, bars and bullion stored in secure vaults.

Clients have full control over the selection of products they wish to purchase through the company's online interface which is easy to use.

There is no minimum balance requirement so investors need not worry about investing large sums upfront; instead, they can start out small and gradually build their portfolio over time.

Gold Gate Capital also offers custodial services that provide peace of mind by helping customers manage their accounts efficiently and securely while providing ongoing support if needed.

Ultimately, this makes them a perfect choice for anyone wanting to maximize returns from investing in gold IRAs without sacrificing safety or convenience.

A Reliable Track Record Of Steady Performance

Gold Gate Capital Review offers a reliable track record of steady performance, but what does that mean for your retirement portfolio?

Precious metal investments are an important part of any retirement account and Gold Gate Capital provides the expertise to help you find the best option.

With a proven history of providing clients with solid returns, Gold Gate capital is one of the most trusted names in precious metal investments.

The team at Gold Gate Capital understand how important it is to choose the right investment options for their customers.

They have established robust strategies designed to maximize profits from gold, silver, platinum and palladium holdings while minimizing risk.

The company's expert advisors will work closely with each client to ensure they make informed decisions on their retirement funds.

This means that even when markets fluctuate, investors can rest assured they have made sound choices regarding their hard-earned money.

What Are the Benefits of Precious Metals IRAs?

Gold investments have become increasingly popular in recent years. According to a survey by the World Gold Council, over 17 percent of people globally own gold-based assets like coins or jewelry.

Investing in precious metals IRAs offers many advantages for those looking to diversify their portfolios with tangible commodities.

A precious metal IRA is an individual retirement account where investors can store physical gold and other metals such as silver, platinum, and palladium.

The goal of this type of investment is similar to that of any traditional IRA: long-term growth through tax breaks and capital appreciation.

With a precious metal IRA, investors get the added advantage of portfolio diversity when including tangible products — unlike stocks or mutual funds which are not backed by anything concrete.

Because these assets appreciate differently than paper currencies, they provide greater stability against market volatility.

Precious metal investments can be made in various ways: buying bullion coins directly from the government mints, purchasing bars from online dealers, or investing in exchange traded funds (ETFs) linked to gold prices.

It's important to understand each option before making a decision on what’s best for you; often times it helps to speak with a financial advisor who specializes in gold investment strategies.

Gold Gate Capital: How To Get Started

Gold Gate Capital is a financial planning firm that offers its clients the opportunity to invest in gold and other precious metals.

It provides an array of services, including asset management, portfolio guidance, and retirement planning.

To get started with Gold Gate Capital, one must first decide if they want to open up a self-directed IRA or 401K account with them.

Once this decision has been made, individuals can start setting up their account through Gold Gate’s website or by calling the customer service line for assistance.

When opening an account, investors will be asked about their risk tolerance level as well as what assets under management they would like to include in the portfolio such as stocks, bonds, mutual funds, ETFs (Exchange Traded Funds), real estate investments trusts (REITs) and commodities.

Depending on which option is chosen; there may be fees associated with each investment type and Gold Gate Capital's advisors are available to help guide customers through any questions related to these fees.

With how much money is invested into the accounts; customers could have access to tax advantages when filing taxes annually.

After all details have been worked out; individuals can begin investing with confidence knowing that the team at Gold Gate Capital is providing them with sound advice along the way.

Storing Your Precious Metals at a Depository

Storing your precious metals is like putting money in the bank—you want to make sure it’s safe.

When investing with Gold Gate Capital, here are four important things you need to consider when looking for secure storage options:

1) Choosing a depository that offers proper asset protection

2) Investigating insurance coverage for any stored items

3) Doing research on the safety of the facility

4) Making sure there is an audit trail so everything can be tracked.

Finding a reliable provider and knowing what they offer can give you peace of mind while you invest with Gold Gate Capital.

You also have to be aware of any potential fees associated with these services, as well as other regulations or laws pertaining to storing precious metals.

Making sure you know all these details will help ensure your investments remain protected no matter where they're located.

With this knowledge in hand, checking in on your investments becomes even more meaningful!

Checking In on Your Investments

Investing in precious metals through Gold Gate Capital is a great way to diversify and grow your investments.

By taking the time to check in on your investments, you can ensure that they are meeting their goals and providing you with long-term financial security.

At Gold Gate Capital, investors have access to top gold bullion dealers such as Bain Capital or other major companies specializing in gold investing.

You'll be able to keep track of the performance of these businesses and make changes if necessary.

Whether it's because of market volatility or just an overall change in strategy, having up-to-date information about where your money is going can help you make informed decisions when it comes to managing your portfolio.

With Gold Gate Capital's transparent platform, investors will have all the tools at their disposal to stay abreast of current developments within the industry so they can adjust accordingly.

This allows them to maximize returns while minimizing potential risks associated with gold investments.

Transitioning into understanding if Gold Gate Capital is considered a scam?

Is Gold Gate Capital Considered a Scam?

Investing in a financial service company can be like walking into an abyss.

You don't know what you're going to find and if you make the wrong choice, it could cost you dearly.

That's why researching companies such as Gold Gate Capital is essential before signing up for their services.

But is Gold Gate Capital considered a scam?

Let's look at some of the reviews from people who have used Gold Gate Capital to get a better understanding of their financial services.

Most customers report that they had prompt services with no lags or delays when dealing with their account.

They also mention satisfaction with the gold bullion investment options offered by the company.

The customer feedback paints a positive picture about this particular financial service provider, but there are other factors to consider as well such as fees and pricing when using Gold Gate Capital as your broker.

We'll explore these topics further in our next section.

Fees and Pricing With Gold Gate Capital

Investing in private equity can be an attractive option for many people, but it's important to understand the fees and pricing associated with any investment.

Gold Gate Capital is an industry leader in specialty finance and private equity investments, so let's take a closer look at their fee structure.

When investing with Gold Gate Capital, investors are charged a yearly management fee of 1-2%, plus 20% of all profits generated from investments made by GGC.

This percentage varies depending on the amount invested and the type of security being purchased.

The firm also charges transaction costs that range from 0.25%-1%.

These transactions costs cover research and due diligence expenses as well as commission paid to brokers when purchasing securities.

If investors decide to exit their positions early, they may incur additional fees or penalties which will be outlined in the fund documents prior to closing the deal.

Gold Gate Capital offers potential clients access to experienced professionals who provide comprehensive financial services including asset management, capital markets advice and portfolio construction strategies.

Understanding their fees before signing up can help ensure you maximize your returns while minimizing risk.

Conclusion

Gold Gate Capital offers an impressive range of services for those looking to invest in precious metals.

Their self-directed IRAs offer a steady track record of performance, along with the potential benefits that come from investing in gold and other precious metals.

Moreover, customers appreciate their low fees and easy storage options at approved depositories. Gold Gate Capital is also highly reliable when it comes to checking up on investments and getting started with one’s IRA.

Despite its advantages, there has been some speculation as to whether or not Gold Gate Capital could be considered a scam due to stories about hidden fees or bad customer service experiences.

While these instances do exist, they are few and far between; most clients report positive experiences with the company overall.

Gold Gate Capital provides a secure way for investors to get involved in the world of precious metals without having to worry too much about fraud or any sort of financial risk.

With plenty of information available online regarding how to set up an account and store your assets safely, this trusted firm is well worth considering if you want to take advantage of this lucrative opportunity.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Gold Gate Capital below: