Is Goldline International a Scam?

In this Goldline International review, we cover the company's history, business set-up, and past scandals. Hopefully, by the time you've finished reading this, you'll be able to find out if they're worth considering.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Important to mention before going further into this interview!

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Check out our top 5 precious metal investment companies list here (for IRAs and Non-IRAs)<<<

Check if Goldline International made our top 5 list!

Or Take a Look at this Limited Time Promotion From Our #2 Recommended Company...

For a short time, they are matching dollar for dollar up to 10% of your order in free silver! That means $10,000 in FREE silver on a $100,000 order.

>>>Learn More About How to Get Your Free Silver HERE<<<

Stats about this company offering free silver:

- Over 1,000 5-star ratings from past clients

- Protects over $1 billion dollars in retirement asset savings

- AAA rating with the BCA

- A+ Rating with the BBB

- 5x Inc 500 winner

- 2021 company of the year

Or move onto the Goldline International review....

History of the Company

Goldline International has had a spotty past. While the company is not accredited by the Better Business Bureau (BBB), consumer complaints have been persistent. Two investigations into the company were published in 2006 and 2010 and multiple after, with many negative online reviews. These factors should be taken into account before deciding whether to deal with the company.

In 2009, the company generated more than eight million in sales, arguably all generated through scammy behavior. It marketed through traditional media channels and the internet; Goldline hired a former US Mint director to be a spokesperson, and sponsored various conservative television shows. Glenn Beck was also often mentioned as a Goldline customer and acted as a radio sponsor.

The company offered a variety of precious metals including rare gold and silver coins. Goldline bars and coins ranged in size from one ounce to a kilogram. Some are eligible for IRAS that allow for precious metals to be an investment.

Goldline International had been around for a long time before having to shut down due to the scandals they couldn't get away from. Goldline has a checkered history and has been the subject of multiple government probes in the past.

Business Setup

Goldline International was a company with a committed team of employees at all levels. GI offered a wide range of precious metal products and services before it shut down.

Scandals

Numerous Goldline International Review Scandals have exposed a company that preys on precious metal investors. The company uses misleading sales tactics, stokes fears about the president, and overcharges for its gold coins. But what exactly are the consequences of Goldline's alleged misdeeds?

In January 2011, the City Attorney for Santa Monica filed official accusations against Goldline, alleging that the company committed 19 counts of fraud and theft while using bait and switch tactics. In a settlement with the city, Goldline agreed to change their methods of selling. They also agreed to have a third party check all commissions and markups.

The lawsuit was filed after Consumer Reports investigated Goldline's practices and complaints. Consumer Reports found that a sales representative was in violation of California's securities laws by providing investment advice by someone who was an unregistered financial advisor. As a result, employees of Goldline were not allowed to offer legal investment advice and was forced to pay a former federal prosecutor to oversee its operation. The former prosecutor is required to access company records and perform undercover test calls.

As a result of the scandal, the company agreed to change its sales practices and pay refunds to 43 consumers as well as have their sales practices audited by an independent third party. The third party also verified that they disclosed commissions and markups to customers. In addition, they agreed to give back $4.5 million dollars to the 43 consumers who had lost money because of their dealings with Goldline. However, the company's reputation was damaged irreparably by the scandal and they were unable to regain their former clout, causing them to have to shutdown.

is Goldline International a scam?

There is a lot of controversy surrounding Goldline. Consumer Reports recently conducted a review of its products, and found that the company had a high markup compared to bullion, not to mention their numerous lost lawsuits. Goldline, however, cited several reasons for the price difference, including the rarity of the item, shipping costs, and payment to salespeople and a compliance department. The company also says that it offers its customers full disclosure about its business practices before they commit to a purchase. GI states that it investigates complaints and tries to resolve them.

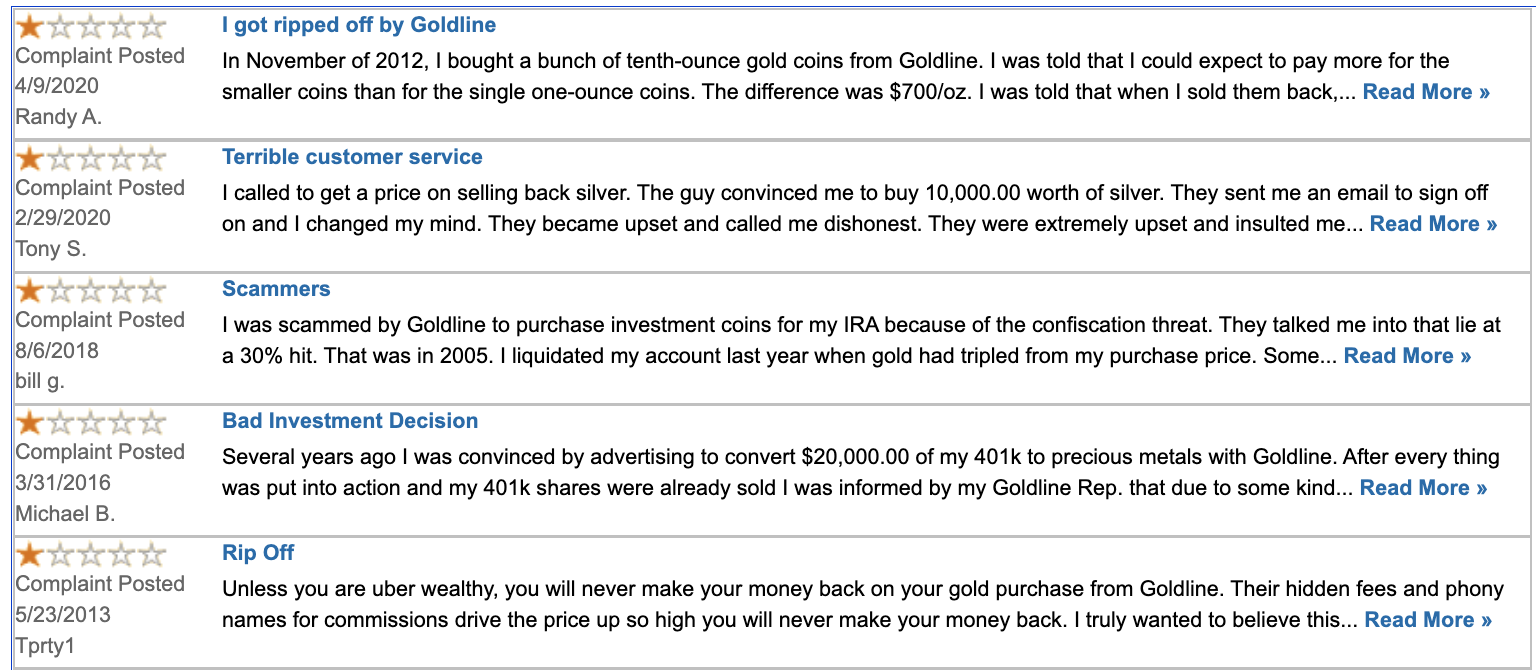

Goldline International has become the subject of several investigations and scandals, including fraud and deception practices which forced them to make payouts to former clients. Some of its executives have even been charged with fraud, and the company even had to shut down because of the allegations. They are no longer in business. Look below for the tone of most of their client reviews...

Pros and Cons of Goldline International

Although Goldline is no longer in business, below we discuss its former pros and cons.

Pros: One of the sole pros for GI is the fact that they allow people to invest in gold and silver, some of the safest assets on the planet.

Cons: Goldline as a company has lost numerous lawsuits, has terrible client reviews, and the executives have been charged with fraud. The company's sales methods have drawn criticism from consumer groups and the FTC. In 2011, Goldline's representatives were charged with fraud after their deception and malpractices were brought to the attention of the federal agencies.

Final Thoughts

The company's reputation has been plagued by negative reviews since 2012. In 2012, a lawsuit against Goldline was settled and then criminal charges against the company were brought up again. Along with that, a recent investigation by Consumer Reports revealed that Goldline employees were giving investment advice while also not being certified financial advisors. In an effort to expose the company's practices, Congressman Anthony Weiner led a campaign against it. Some other companies you can look at for gold investing is Monetary Gold, Augusta, Goldco Precious Metals, Birch GG, and American Hartford Gold.