Goldmoney is an online financial service that offers customers a secure way to store and manage their wealth. The company provides services such as gold and currency trading, precious metals storage, international payments, and more.

It has been gaining traction among investors looking for an alternative to traditional banking systems.

In this review of Goldmoney, we will explore the features it offers and whether you can trust it with your money.

The idea of using physical gold as a form of payment or investment is not new; however, Goldmoney provides a unique twist on the concept by allowing users to buy, sell and trade gold digitally without having to physically possess it.

This type of digital asset management could revolutionize how people view investing in gold.

Furthermore, its security measures are considered some of the best available today, making it an attractive option for those looking for secure investments.

Finally, Goldmoney also allows users to make cross-border payments quickly and securely through its Global Payment Network (GPN).

By utilizing GPN’s powerful technology infrastructure combined with low transaction fees and fast processing times, customers can easily transfer funds from one country to another without having to worry about foreign exchange rates or other typical issues associated with international payments.

With all these features in place, let's dive into this GoldMoney Review: Can You Trust Them?

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Goldmoney made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

About Gold Money

Gold Money is like a lighthouse in the night for investors looking for an alternative to traditional investments. It provides customers with access to physical metals, such as gold and silver, stored securely within their network of vaults located around the world.

Gold Money, as well as other options such as Strata and iTrust, offers various services, including buying and selling precious metals, transferring funds between wallets, investing in exchange-traded funds (ETFs) backed by physical metal, and managing customer accounts worldwide.

All transactions are secure and protected by advanced authentication protocols. Customer service is available 24/7 via email or telephone with representatives speaking multiple languages in order to assist those who prefer non-English support.

As part of its commitment to providing a safe environment for buyers and sellers alike, Goldmoney also works hard to ensure that all its products meet strict compliance standards set by governing institutions throughout Europe and North America.

Overall, Goldmoney has established itself as a reliable provider of valuable investment opportunities for both experienced traders and novice investors seeking exposure to physical metal markets without having to take on too much risk.

Goldmoney Management

The relationship between the management team and goldmoney is one of precious metal. Firmly rooted in a commitment to providing customers with access to gold-backed accounts denominated in pounds sterling, it's easy to see why so many trust this company.

As a source of physical delivery, they offer an unparalleled level of security:

• A secure online platform

• Top-tier customer service

• Compatible with major payment systems

• Insurance coverage for all assets on their platform

Goldmoney has established itself as a reliable partner when it comes to investing in tangible commodities like gold.

Through its strong relationships with governments, banks and other financial institutions, the company’s management team have worked hard to ensure that customers can purchase and store gold securely.

Meticulous attention is paid to every aspect from storage solutions through to account setup procedures, giving users peace of mind about their investments.

With these measures in place, Goldmoney provides the highest levels of protection available in the market today.

In turn, this allows people to confidently invest with them knowing that they are making smart decisions and getting great value for money.

Products and Services

Goldmoney is an international business that specializes in holding precious metals, such as gold and silver. It provides various products and services to its customers.

For example, a customer can invest their money into one of Goldmoney's metal holdings, or even transfer their own physical metals from storage at home to the secure vaults available through GoldMoney.

In addition to these core offerings, GoldMoney also provides additional services for investors looking for more comprehensive solutions.

They offer tools for measuring market performance, portfolio tracking options, and even investment advice with insight from experienced professionals.

This range of features makes it easy for anyone looking to leverage the potential benefits of investing in precious metals to find what works best for them.

TIP: Depending on your individual needs when it comes to investments, you may want to consider exploring some of the different products and services offered by GoldMoney before making any decisions about where to put your money!

That way you know exactly what’s available so you can make an informed decision that fits your goals perfectly.

Goldmoney Insights

Goldmoney insights provide a unique perspective on the company's trustworthiness and services. Customers can easily research Goldmoney Holding, Schiff Gold, and its Gram of Gold products to get an in-depth understanding of how the company operates.

Through this section customers can gain valuable insight into the benefits that come with trusting their investments to the firm:

• Learn about what sets them apart from other firms in terms of financial security

• Understand why they are widely known for offering low fees

• Get informed about innovative features like gold savings plans

• Discover how trustworthy their customer service is

These topics offer users an excellent starting point when considering whether or not to entrust their money with Goldmoney Holdings.

Additionally, customers can learn more about the background of the firm and any awards it has received which may lend further credibility to its operations.

With this knowledge, investors will have all the information needed to make an educated decision regarding investing with Goldmoney Holdings.

Moving forward, readers can explore even more resources available through 'library'.

Library

Goldmoney is a gold payment technology company, offering customers the chance to purchase, store and transfer precious metals easily.

As such, an understanding of their library is paramount in order to make sure that they are a trustworthy provider.

That being said, let's dive into Goldmoney’s library; like diving into a pool of knowledge.

Firstly, Goldmoney provides users with access to spot prices on all major assets traded through them.

This means you can stay up-to-date with real time data:

* Live market updates throughout the day

* Historical price information for research purposes

* Precious metals dealer insights

* Comprehensive portfolio overviews

* In depth analytics about trends in the market

In addition, Goldmoney has created engaging educational resources that explain how it works and why people use it.

With detailed articles from experts, videos and podcasts – there is plenty of material available for those who want to learn more about investing in precious metals or using Goldmoney as a reliable and secure way to hold wealth outside traditional banking systems.

All these tools provide users with everything needed for informed decision making when choosing a trusted precious metals dealer like Goldmoney.

Safety & Transparency

When it comes to safety and transparency, Goldmoney has taken the necessary steps to ensure customers’ funds are protected.

They have a secure messaging feature that allows for encrypted communication between their staff and clients.

To maintain their high standard of security, they also conduct regular independent audits by their auditing partners.

These outside firms review the financial records on at least an annual basis to make sure everything is in order.

Goldmoney also makes use of advanced technology such as Two-Factor Authentication (2FA) which adds further protection against unauthorized access of user accounts.

All these measures put together help to provide not only peace of mind but also confidence in using Goldmoney services knowing that your money is safe with them.

Moving forward, this section will look into how much do you need to pay when making transactions through Goldmoney.

Goldmoney Fees

When it comes to investing, fees can affect the purchasing power of a customer’s funds. Goldmoney has a fee schedule that investors should be aware of when deciding whether or not they want to use their services.

Goldmoney charges storage fees on all precious metal holdings in account balances and these vary depending on what type of metals are being stored as well as the currency used for payment.

For example, gold accounts hold 0.18% per annum while silver accounts charge 0.48%. Separate transaction fees also apply when buying and selling products through the platform.

The cost is determined by the size of each order, however customers have access to discounts if they trade more frequently.

All details regarding costs associated with trading gold and other metals are clearly outlined on their website so potential clients can review them before making any decisions about using Goldmoney’s services.

In addition to storage and transaction fees, buyers must take into consideration taxes imposed by local governments as this will reduce their purchasing power even further.

Knowing all applicable expenses helps individuals make informed choices about how much money they would like to spend prior to initiating a purchase or sale of precious metals with Goldmoney.

Information for New Clients

For new clients, understanding the basics of investment companies such as Goldmoney can be a bit confusing. It is important to know that they are not like traditional banks but offer an alternative way to invest in precious metals and use them as a form of currency or store of value.

In order to understand how this works, it helps to first familiarize yourself with their metal unit system.

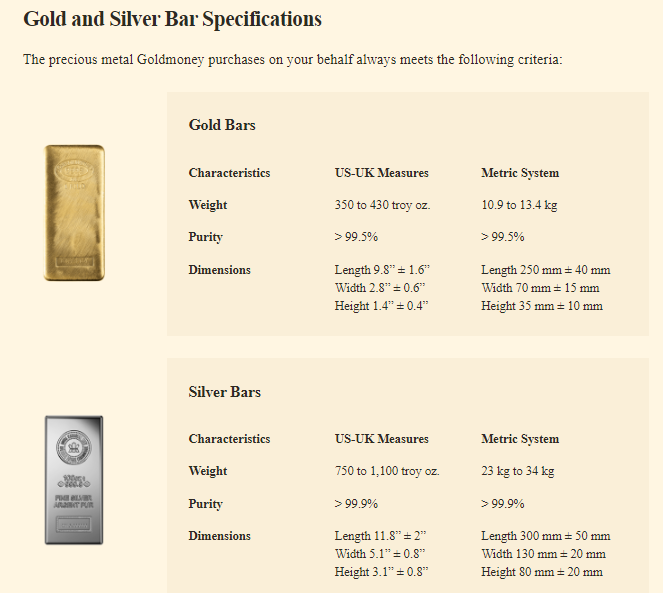

This system allows you to purchase units of gold, silver, platinum and palladium which can then be held securely within your own personal account.

The real benefit here lies in the fact that these metal units come at no additional cost; there are no fees associated with buying or holding them.

Furthermore, Goldmoney provides access to insured storage facilities for those who wish to hold physical bullion coins or bars for added security and peace of mind.

With all these benefits considered, it's easy to see why many investors have turned towards precious metal investments as an alternative source of income and stability amidst market uncertainties.

Goldmoney Reviews

The question of whether goldmoney is a trustworthy source has been in the minds of many. To answer this, a review of customer experiences is necessary to gain an understanding as to how reliable they are.

The reviews for goldmoney seem to be quite mixed with some customers expressing their satisfaction and others citing negative experiences.

Those who have had positive interactions with them laud their quick and efficient services while those on the other end of the spectrum complain about long wait times when trying to access funds or verify accounts through bank statements.

One happy customer noted that they were able to get their money quickly without any issues while another unhappy client reported experiencing difficulties during verification process due to incorrect information appearing on their bank statement.

Despite these reports, it's clear that there are both satisfied and dissatisfied customers which can make it difficult for potential clients to decide if they should trust goldmoney or not.

Pros and Cons

Goldmoney is an online service that allows customers to buy and store gold, silver, platinum, palladium and cryptocurrencies.

According to the company's website, it has over 1 million users worldwide - almost a quarter of whom are in Europe alone.

This makes Goldmoney one of the largest digital gold providers globally. With its mission to "make precious metals accessible," let us take an in-depth look at the pros and cons of using Goldmoney.

The benefits of Goldmoney include founder James Turk's guarantee that customer funds are always backed by physical gold stored in secure vaults around the world.

As well as this, transferring money into your account is easy with bank transfers accepted from countries such as Canada and Germany.

Furthermore, if you choose to withdraw your physical gold or convert it back into fiat currency, you can do so quickly through their platform with no additional fees charged for storage or delivery.

Additionally, customers have access to 24/7 multilingual customer support should they need assistance with any queries about their accounts or transactions.

On the other hand, there may be drawbacks associated with using Goldmoney which potential users should consider before signing up.

For example, while there is insurance coverage on all assets held by Goldmoney, individual investments are limited to just $100,000 per user due to AML regulations imposed by certain governments across various jurisdictions where they operate.

What’s more, frequent withdrawal requests made within a 30 day period may incur charges depending on how much metal needs to be shipped out each time; however these fees can vary depending on location and product type being withdrawn (e.g., physical bullion versus coins).

Lastly, it could also take some time for new users to understand how best use the platform given its multiple options available when purchasing assets like cryptocurrency tokens or storing them securely offline via cold storage wallets – something many beginners struggle with initially but become familiarized after spending some time exploring what features work best for them.

In summing up then: While Goldmoney does provide peace of mind for users who want reliable protection against market volatility thanks largely in part due to its backing by physical gold reserves – not forgetting its low investment minimum thresholds too - possible charges along with having a learning curve associated with understanding terms related asset management might make this less attractive for those wanting quick results without incurring extra costs during their journey towards financial freedom!

Conclusion

Goldmoney is a digital wealth management service that provides customers with access to investment opportunities in gold and other precious metals.

Goldmoney’s services are available globally, offering an alternative to traditional banking and financial services. Its products range from physical gold vaulting options to currency trading accounts.

Goldmoney also offers insights into market trends, as well as a library of educational resources.

The fees associated with the use of Goldmoney can vary according to the type of product or service being used.

On average, however, these fees are quite reasonable compared to those charged by similar services on the market today.

New clients will find it easy to get started with their account; all they need is some basic information and proof of identity.

What sets Goldmoney apart from its competitors is its focus on security and transparency.

Customers have peace of mind knowing that their transactions are secure due to advanced encryption technology, while reviews suggest that customer support has been helpful and responsive when needed.

All things considered, Goldmoney appears to be a reliable provider for online investments in gold and other precious metals – providing users with convenience, security, cost-efficiency and more than enough insight into making informed decisions about their finances.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Goldmoney below: