As a leading self-directed IRA custodian, NuView Trust offers individuals the opportunity to take control of their retirement funds by investing in a wide range of alternative assets.

This includes real estate, private equity, precious metals, and more.

With its comprehensive services and commitment to providing clients with freedom and flexibility in investment choices, NuView Trust has gained recognition in the industry.

In this article, we will explore the services provided by NuView Trust, including account opening procedures and customer reviews. And, we will discuss the pros and cons associated with choosing NuView Trust as your self-directed IRA custodian.

Whether you are a seasoned investor or new to the world of self-directed IRAs, this review aims to provide you with valuable insights into NuView Trust's offerings and help you make informed decisions about your retirement savings.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if NuView Trust made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

About NuView Trust

NuView Trust, founded by Glenn Mather in 2003, offers a diverse range of IRA options to its clients, empowering them to serve as account fiduciaries and providing access to an array of investment opportunities.

As a self-directed IRA custodian, NuView Trust allows its clients to take control of their retirement funds and make investment decisions on their own.

One significant aspect that potential clients may consider is the fee structure at NuView Trust. While specific fees can vary depending on the type of account and investments chosen, it is essential for investors to thoroughly understand these fees before making any decisions.

NuView Trust provides various investment options such as real estate, precious metals, private equity, loans or notes secured by real estate or other assets.

In terms of account types offered by NuView Trust, individuals have several choices including Traditional IRAs, Roth IRAs, SEP IRAs for small business owners or self-employed individuals who want to save for retirement while maximizing tax savings.

NuView Trust recognizes the importance of retirement planning and aims to provide resources and education about different aspects related to retirement planning.

Through webinars and educational materials available on their website, they strive to empower their clients with knowledge so that they can make informed decisions regarding their financial future.

NuView Trust stands out as a provider of self-directed IRA services offering flexibility in terms of investment options along with educational resources aimed at helping individuals achieve their retirement goals.

NuView Trust Services

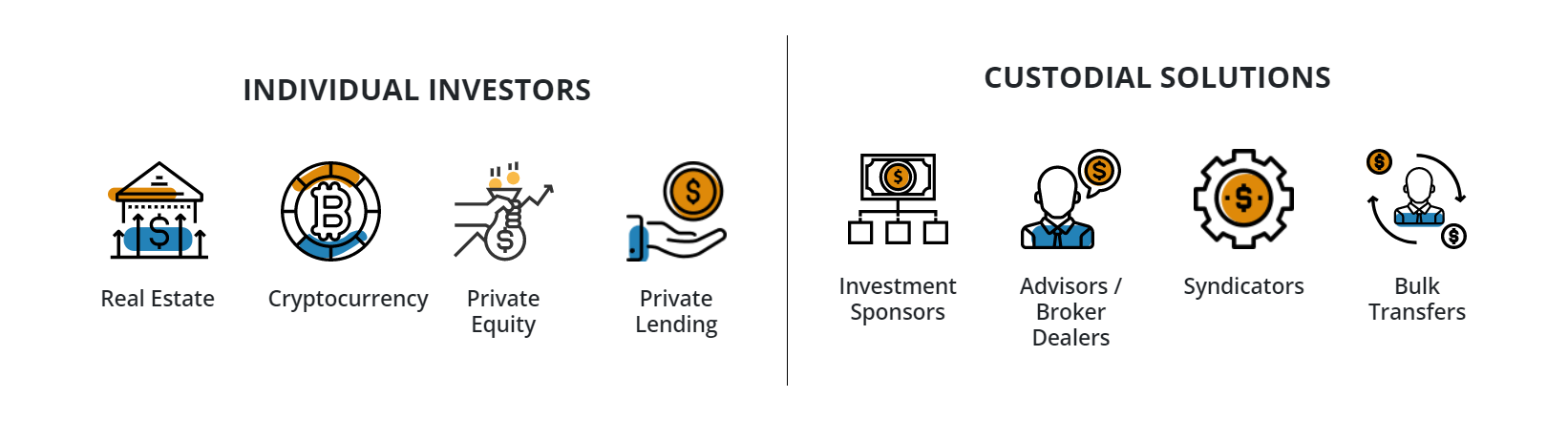

Investors have access to a range of alternative asset options, including real estate, cryptocurrency, and private equity, when utilizing the services provided by NuView Trust. These options allow investors to diversify their portfolios and potentially achieve higher returns in volatile markets.

NuView Trust offers various investment opportunities in real estate assets such as single-family homes, commercial properties, apartment buildings, unimproved lands, condominiums, farms, and timber.

This allows investors to participate in the real estate market without the hassle of direct ownership.

Cryptocurrency is another asset option available through NuView Trust. The company provides opportunities to invest in popular cryptocurrencies like Bitcoin, Dogecoin, Ethereum, Litecoin, and more.

Cryptocurrencies have gained significant attention in recent years due to their potential for high returns and their role as a digital asset.

Private equity investing is also offered by NuView Trust. Private equities involve providing liquidity to private companies in exchange for ownership stakes.

This option allows investors to support promising startups and gain potential profits from their success.

When it comes to fees and account minimums at NuView Trust, it is important for investors to review the specific details based on their chosen investment options. NuView Trust specializes in self-directed IRAs that can be utilized for retirement planning purposes.

NuView Trust's wide range of alternative asset options provides investors with opportunities for portfolio growth and diversification while aligning with their individual investment goals.

Customer Reviews

Based on online feedback, customers have expressed varying opinions about their experiences with NuView Trust's services and highlighted areas of concern regarding transparency, software system efficiency, and customer service.

- User experiences: Customers have shared their experiences with NuView Trust, with some expressing satisfaction and others raising concerns.

- Satisfaction ratings: NuView Trust has received a 4.4 out of 5 rating from 74 clients on GoogleMyBusiness. This indicates that the majority of customers are satisfied with the company's services.

- Feedback and testimonials: Customers have provided feedback and testimonials about their interactions with NuView Trust. Positive comments include praise for the customer service team's professionalism and knowledge about self-directed IRA accounts.

- NuView Trust reputation: The overall reputation of NuView Trust seems to be positive based on the reviews available online. But, there are also negative reviews that highlight certain issues.

- Trustworthiness and credibility: Some customers have raised concerns about transparency regarding annual fees and withdrawal processing times. These issues may impact the trustworthiness and credibility of NuView Trust.

It is important for potential investors to consider these factors when making a decision about choosing a self-directed IRA account provider.

How to Open an Account

To initiate the account opening process, individuals can easily access a user-friendly online platform that streamlines the procedure.

NuView Trust offers a simple and efficient way for individuals to open an account with them. This online platform allows users to conveniently provide all necessary details through a Docusign form, eliminating the need for tedious paperwork.

- One of the key benefits of opening an account with NuView Trust is the wide range of account types available.

They offer various options such as Traditional IRAs, Roth IRAs, Solo 401(k) plans, and Health Savings Accounts (HSAs). This allows individuals to choose the type of account that best suits their financial goals and retirement planning needs.

- In terms of eligibility requirements, anyone who meets the Internal Revenue Service's guidelines for IRA contributions can open an account with NuView Trust.

These guidelines include having earned income and being under the age of 70 ½ for Traditional IRAs.

- When opening an account with NuView Trust, there are certain required documentation that individuals need to provide.

This typically includes valid identification documents such as a driver's license or passport, as well as proof of address. The process itself is straightforward and can be completed entirely online.

The online application guides individuals through each step, ensuring that all necessary information is provided accurately and securely.

Opening an account with NuView Trust offers numerous benefits and flexibility in terms of account types. The streamlined online application process makes it convenient for individuals to begin their journey towards financial independence and retirement planning.

Customer Service

Customer service at NuView Trust is easily accessible through various channels, including a toll-free phone line and email contacts for specific departments.

This level of accessibility provides investors with multiple options to reach out for assistance.

When it comes to service quality, NuView Trust strives to provide efficient and effective communication with their clients. Their staff is trained to handle inquiries promptly and professionally, ensuring that customers receive the support they need in a timely manner.

One important aspect of customer service is problem resolution. NuView Trust understands the importance of addressing any issues or concerns raised by their clients.

They have a supportive staff that is dedicated to resolving problems effectively and efficiently, aiming to exceed customer expectations.

In terms of responsiveness to inquiries, NuView Trust recognizes the significance of providing prompt responses to client queries. Whether it be through phone calls or emails, their customer support team aims to address inquiries in a timely fashion, demonstrating their commitment to excellent service.

NuView Trust's customer service channels enable investors to access assistance conveniently. The company prioritizes communication efficiency, problem resolution, responsiveness to inquiries, and maintaining a supportive staff.

These factors contribute towards enhancing the overall investor experience with NuView Trust's IRA services.

Pros of NuView Trust

One notable advantage of working with NuView Trust is the extensive range of investment options available to clients. NuView Trust stands out among competitors by offering a wide variety of alternative assets, including real estate assets, cryptocurrency, precious metals, and more.

This provides investors with the opportunity to diversify their portfolios and explore different investment avenues.

The benefits of having multiple investment options are numerous.

- It allows investors to spread their risk by investing in different asset classes. This can help protect against market volatility and potential losses in any one particular area.

- It gives investors the opportunity to capitalize on emerging trends or industries that show promising growth potential.

- Having a diverse range of investment options allows individuals to tailor their portfolio to their specific financial goals and risk tolerance.

Offering such a broad spectrum of investment choices, NuView Trust empowers its clients to take control over their investments and make decisions that align with their unique financial objectives.

This level of flexibility sets them apart from other financial institutions that may have limited offerings.

The multitude of investment options provided by NuView Trust is undoubtedly one of its major strengths. It offers clients the ability to explore various alternative assets and build a diversified portfolio that suits their individual needs and preferences.

Cons

The previous subtopic discussed the pros of NuView Trust, highlighting some positive reviews from customers. However, it is important to consider the cons associated with this self-directed IRA provider.

- One major concern is the lack of transparency regarding their account types and fees.

NuView Trust does not provide clear information about the different account options available, making it difficult for investors to make informed decisions about their retirement portfolios.

- There are reports of high fees associated with NuView Trust, which can be a red flag for those looking for a self-directed IRA account.

Without knowing the specific fees upfront, investors may find it challenging to assess whether this platform aligns with their financial goals.

- NuView Trust has a complex account setup process that lacks details on how much funds are required to open an account and other essential information needed to complete the process.

This lack of clarity can be frustrating and time-consuming for potential investors.

- Customers have reported slow response times and difficulties in resolving issues with NuView Trust's customer support team.

This inefficiency in addressing concerns can hinder the smooth functioning of business transactions.

These factors contribute to a lack of transparency, limited investment options due to undisclosed account types, high fees, a complex setup process, and slow response times when dealing with NuView Trust.

Potential investors should carefully consider these drawbacks before deciding if this self-directed IRA provider meets their needs.

Conclusion

NuView Trust is a company that offers self-directed IRA services to individuals looking to have more control over their retirement funds.

They provide a range of services including account management, investment options, and educational resources. Customer reviews of NuView Trust are generally positive, with many praising the company's professionalism and responsiveness.

To open an account with NuView Trust, individuals must complete an application process and meet certain eligibility requirements. The company's customer service is known for being helpful and knowledgeable.

NuView Trust has its pros and cons like any other financial institution.

NuView Trust is a reputable company that provides self-directed IRA services to individuals seeking greater control over their retirement funds.

Their range of services and educational resources make them a popular choice among customers. It is important to consider both the pros and cons before deciding whether NuView Trust is the right fit for one's individual needs and goals in managing their retirement savings.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit NuView Trust below: