OneGold is a fast-growing digital asset trading platform that has been gaining traction in recent years. According to the latest statistics, OneGold boasts over 1 million active users and continues to grow at an impressive rate of 15% on average per month.

This review will explore why this platform stands out among its competitors and what advantages it can offer investors looking to diversify their portfolios.

The first thing that makes OneGold stand out from the competition is the broad range of products available on the platform. From gold and silver coins to stocks, options, exchange traded funds (ETFs), mutual funds and more, there's something for everyone who wants to invest in digital assets.

Furthermore, customers have access to real-time pricing information so they can stay up-to-date with market conditions.

Finally, OneGold also provides educational resources such as tutorials and webinars designed to help educate new investors and keep experienced traders informed about industry trends.

These resources are invaluable when it comes to making wise investment decisions and maximizing returns.

In this article we'll take a closer look at all these features and find out if OneGold really lives up to its hype or not.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if OneGold made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

What Is OneGold?

A foray into the world of precious metals investments can be a daunting and risky prospect. It requires an immense amount of research, understanding, and trust within the industry to make it successful.

Onegold is atttempting to provide customers with that level of expertise in order to navigate their way through this complex market.

Founded as a subsidiary of APMEX Inc., one of the foremost names in the precious metal investment arena, Onegold has quickly become a leader in providing customers with access to physical gold, silver, platinum and palladium.

Their commitment to customer service shines through not only on their website but also in customer reviews from around the web which highlight how easy it is for new investors to use the platform and benefit from its features.

In addition, they offer competitive prices and are constantly striving to optimize their services so that customers have access to quality products at fair prices while ensuring safe delivery of those products when purchased online.

Their exemplary customer service has made them stand out among competitors in the precious metals industry thus far.

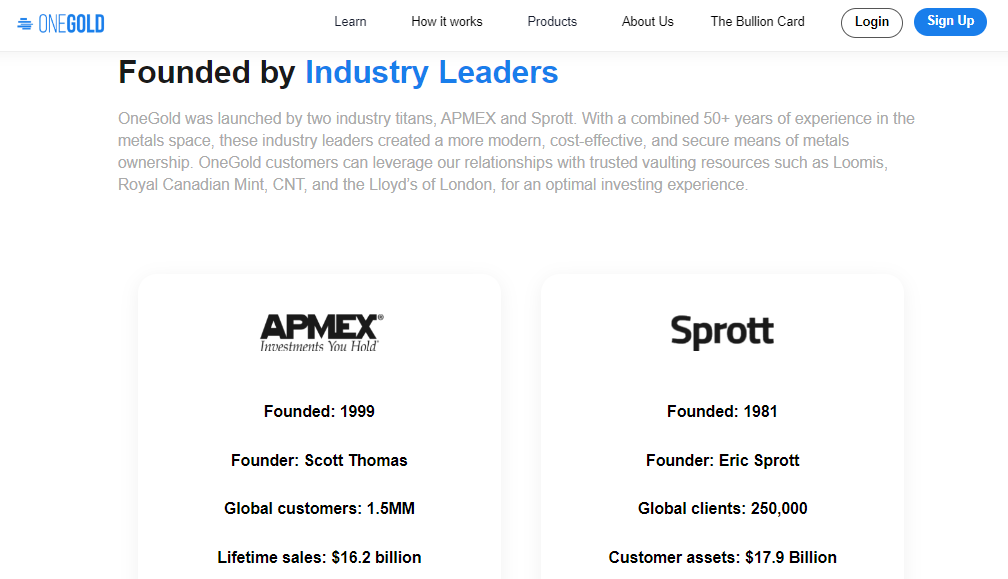

Who Owns Onegold?

Digging deeper into the nature of OneGold, one can discover who owns it. To answer this question in a nutshell: Scott Thomas does.

He is the founder and CEO of Precious Metal Investors Inc., which he started after having worked for over two decades as an investor in precious metals ownership.

Thomas has been actively involved in the mining industry since 1996 and is renowned for his success in bringing new investors to the space through his companies’ innovative offerings and services.

Thomas wanted to create something that would simplify access to gold-backed investments by providing greater liquidity, transparency and security than what was already available on traditional markets.

As such, he founded OneGold with partners Verady and APMEX to provide customers with direct access to digital assets backed by physical gold stored at secure vaults around the world.

With their mission of making purchasing or selling digital gold easy and accessible, they believe that everyone should have equal opportunity to own a piece of history regardless of their financial means.

How Does It Work?

OneGold is an innovative investment platform that provides customers with the opportunity to purchase physical gold and other precious metals. With a simple bank wire, users can take advantage of this unique service offered by OneGold.

Understanding how it works helps investors make informed decisions when considering their options for investing in precious metal.

To get started, customers need to sign up on the OneGold website and provide personal information such as name, address, email ID and phone number. Once registered, they have access to multiple ways to put money into their account including credit card payments or payment via bank wire transfer.

Depending on their financial needs and preferences, customers can choose from different types of investments – either short-term or long-term – when buying gold through Onegold’s secure system. It also allows them to buy fractional amounts of gold which makes purchases more affordable compared to traditional methods of purchasing bullion coins or bars directly from dealers.

Additionally, users may opt for storage services provided by partner vaults where all purchased items are securely stored until redeemed.

The process is straightforward; once funds are received in their accounts customer will be able to browse through a wide range of products available at competitive prices and select specific pieces from there.

They can then place orders using the account balance after confirming details like quantity and price per unit.

Upon completion of the order process customers will receive regular updates concerning delivery status till they finally receive tracking numbers associated with each item shipped out for delivery.

Products and Services

OneGold offers a variety of products and services to its customers. Most notably, they are one of the leading precious metal dealers in the industry, offering everything from gold coins to silver bars.

Additionally, OneGold is also an established real estate firm that provides reliable client service and excellent options for investors looking to diversify their portfolios with hard assets.

These offerings include:

• Precious Metals – Gold, Silver, Platinum & Palladium

• Real Estate – Residential & Commercial Property Investments

• Client Service – Financial Advice & Investment Strategies

The company ensures that all their inventory is up-to-date and properly audited; this attention to detail helps them maintain consistent quality across their entire range of products and services.

With over 10 years of experience in the market, OneGold has become known for its commitment to providing top tier customer care and satisfaction like other companies including Gainesville Coins, ITM, and Cornerstone.

As such, clients can be sure that when dealing with OneGold they will receive only the best materials and advice on how to optimize their investments.

Moving forward into the next section about inventory audit without further ado allows us to explore another aspect of what makes OneGold stand out from other investment firms.

Inventory Audit

Investing in precious metals can be a great way to diversify your portfolio, and Onegold provides customers with the ability to explore different options.

An inventory audit is an important step for anyone who wants to invest wisely and securely.

This process allows individuals to gain insight into their current holdings of products from trusted precious metal dealers so that they can make informed decisions about future investments.

The inventory audit offered by Onegold gives customers a comprehensive look at all purchases through its platform, including storage options as well as physical gold, silver and platinum bullion bars and coins.

Customers have access to real-time information regarding pricing data, market trends and buy/sell activity reports related to their existing holdings in order to better understand their position in the marketplace. Monex offers this as well.

Furthermore, this kind of financial transparency leads to more secure transactions since buyers can view an up-to-date account summary without worrying about hidden fees or other surprises down the line.

With this knowledge base, investors will be able to confidently purchase additional precious metals knowing exactly what they are getting into.

Storage Fees

When discussing the storage fees associated with OneGold, it is important to consider both Lloyd's of London and minimum storage fee.

Lloyd’s of London is a renowned insurance firm that provides secure vaults for gold bullion in addition to other precious metals like silver, platinum and palladium.

These insured vaults give customers peace of mind as their stored items are beyond reach from hackers or criminals. The minimum storage fee requires investors to pay an annual fee which covers costs such as shipping, handling and vaulting expenses.

It should also be noted that certain investments may require additional security measures depending on the size or value of the item being stored. In these cases, extra annual storage fees may have to be paid by customers who opt for this service.

Overall, securing physical gold through OneGold ensures safety as well as convenience; plus with coverage provided under Lloyd’s of London and reasonable Annual Storage Fees, investors can rest assured that their assets are protected at all times.

Transitioning now into the discussion about OneGold mobile app...

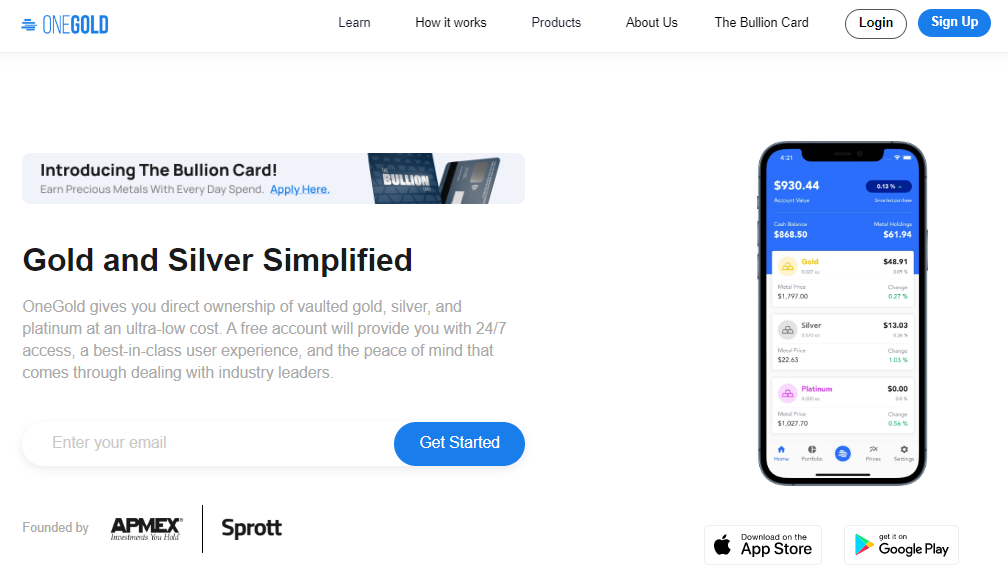

Onegold Mobile App

The OneGold mobile app offers clients a unique, convenient way of managing their gold investments. Through the app, customers can buy and sell gold from any device with an internet connection.

Additionally, transferring funds to or from your bank account is easy - simply choose the amount you wish to transfer and enter in your banking information.

The app also allows users to view product pricing and read client reviews so they can make informed decisions about their purchases.

OneGold's mobile app makes staying on top of your investment portfolio simple by providing real-time updates as well as access to customer support if needed.

With its fast and secure features, it has quickly become one of the most popular ways for investors to manage their investments in precious metals such as gold.

By taking advantage of this technology, customers have greater control over their finances while enjoying the convenience that comes along with it. Moving forward into autoinvest section...

Autoinvest

Onegold's Autoinvest feature is a key component of their online platform. This tool allows customers to easily diversify and invest in precious metal assets through Onegold-affiliated Precious Metals IRAs.

With Autoinvest, users can customize their investment plans with automated contributions that are tailored to each customer's financial goals. The idea behind this feature is to make it easier for customers to build an IRA portfolio without needing to monitor prices or spend long hours researching the markets.

Autoinvest makes investing in gold and other precious metals more accessible than ever before. By setting up recurring purchases, investors can take advantage of fluctuations in the market without having to actively trade in order to take profits or losses.

Customers also benefit from lower fees associated with periodic investments as opposed to one lump sum purchase.

All of these advantages combine to make AutoInvest an attractive option for those looking for reliable ways to grow their retirement funds.

Transitioning seamlessly into the next part about 'redemption', important details such as process steps, minimum and maximum limits, availability and cost are explored further below.

Redemption

Savvy savers seeking to store their precious metal purchases with onegold can secure satisfaction through the redemption process. Redeeming investments is an important feature of Onegold's autoinvest platform, allowing customers to access stored funds effortlessly and without expensive storage fees.

The redemption process at Onegold allows customers to quickly convert their existing gold, silver or platinum holdings into cash.

Customers may also select other options such as transferring their metals from a current IRA account or taking physical possession of certain products.

Despite being able to request changes in asset allocation within a customer’s portfolio, there are no additional costs associated with this service.

Additionally, OneGold provides assistance for those looking to open Precious Metals IRAs accounts and transfer assets from any existing accounts held by another provider.

The team offers guidance throughout the entire process so that customers understand what they need to do and how long it will take them to complete the transaction.

Ultimately, this helps ensure that users receive maximum satisfaction when redeeming their investments on the AutoInvest platform.

Precious Metals IRAs

Investing in precious metals through an IRA can be a wise decision, especially with the volatility of digital assets. Just like storing gold coins under your mattress is not always safe, investing in these valuable commodities without proper guidance may lead to losses as well.

Precious metal IRAs offer investors the chance to diversify their portfolios by leveraging the potential rise of metal prices within a secure vaulted holding.

Precious metal IRAs are tax-advantaged accounts that allow individuals to purchase and hold physical gold or other approved metals such as platinum or silver.

The investment vehicles operate similarly to conventional retirement accounts, but instead of stocks, bonds, and mutual funds; you hold real physical bullion bars, rounds and coins that have been certified for purity and weight.

Additionally, there are no limits on how much money can be invested into these types of accounts as long as it remains within IRS requirements.

With precious metal IRAs you get more control over your investments while still enjoying the benefits associated with traditional retirement plans.

How Do Precious Metal IRAs Work?

Precious metal IRAs are a form of investment that can offer great returns. By investing in physical metals through an IRA, investors have the opportunity to diversify their investments and potentially increase their wealth over time.

In order to understand how precious metal IRAs work, it is important to understand the various aspects of these investments.

Investment platforms typically provide access to different types of stocks, bonds, mutual funds, ETFs and other investments. However, many also offer access to physical metals such as gold, silver, platinum and palladium from a trusted precious metals company.

When purchasing through an IRA platform for retirement purposes, there are certain tax benefits associated with this type of investment which may be beneficial for some investors when compared to more traditional forms of investment products available on the market.

From buying physical metals through an IRA platform to taking advantage of potential tax savings related to this type of retirement planning tool - understanding how precious metal IRAs work will better prepare investors interested in exploring this option further.

Why Invest in Gold?

Investing in gold is an attractive option for many due to its historical price stability and the potential of achieving high returns. Gold has been viewed as a safe-haven asset since ancient times, giving investors an opportunity to hedge against financial uncertainty.

The current gold spot price provides investors with real time updates on the value of their investment. Furthermore, physical gold coins can be purchased at varying prices depending upon the size of coin or bar being bought.

It is important for investors to understand that investing in gold does not guarantee profits; however, it may help protect one’s portfolio from losing money during periods of economic downturn.

Additionally, consistent rises in the price of gold have often outpaced inflation over long-term periods making it a popular choice among conservative investors who wish to reduce risk while still maintaining some upside potential growth.

As such, investing in gold can provide individuals with both security and higher-than-average returns when done right.

Transitioning into this knowledge, a beginner's guide to understanding how best to invest in gold can prove invaluable.

Beginner’s Guide to Gold

Investing in gold has been a timeless tradition. But, what is it that makes gold such an attractive choice for investors? For starters, it is tangible - you can hold the real metal in your hand and admire its beauty.

Gold offers a unique opportunity to gain access to one of the world's oldest investments with minimal risk and maximum reward. In this beginner’s guide to investing in gold, we will explore how:

1) You have the potential to protect yourself from market fluctuations;

2) Investing in gold provides you with more options when diversifying assets;

3) Gold enables you to make smarter choices for your gold investments.

Gold has long been seen as a store of value due to its rarity, portability and low volatility. Unlike stocks or bonds which are subject to economic cycles and changes, buying physical metals like gold allows you to hedge against inflation and other financial risks without having to worry about timing the markets.

Plus, if you choose wisely, there are many ways to benefit from investing in gold including increased liquidity, greater control over your portfolio allocation, tax benefits and investment flexibility.

You should be aware though that even though gold does offer these advantages, the price can still fluctuate dramatically depending on global events or investor sentiment. With all this information in mind key words like real metal ,access to gold ,choice for gold investments could help make informed decisions while investing into Gold .

Thus providing protection against unforeseen market movements while making better decisions when considering different asset allocations.

Reviews

Reviews from customers of OneGold are overwhelmingly positive. Many customers report outstanding satisfaction with the speed and efficiency of their transactions, as well as any customer service inquiries they may have had. In addition to this, many customers also praise the personalized experience they receive when engaging with OneGold representatives.

The level of customer care is repeatedly lauded by users who appreciate the extra effort put in by employees to ensure that all requests are handled quickly and efficiently. Furthermore, reviews often remark on how easy it is to buy gold through the platform, emphasizing its user-friendly interface and intuitive design features.

This contributes significantly towards creating a positive overall impression of OneGold’s services among users.

All these factors contribute towards an impressive track record of customer satisfaction which speaks volumes about OneGold's commitment to providing a quality product and excellent service for its clients.

Conclusion

OneGold is a comprehensive precious metals platform, offering investors the opportunity to invest in gold and other precious metals. Through their products and services, OneGold provides consumers with an easy way to purchase physical bullion online or through an IRA account.

As such, investing in gold can be a great option for those looking to diversify their portfolio and protect themselves against stock market volatility.

However, some may worry that they do not have enough information when it comes to investing in gold. While this concern is understandable, OneGold offers customers several resources including educational articles on beginners guides of how to buy gold as well as inventory audits which help ensure you are getting what you pay for.

Customer reviews offer insight into the experience of other buyers so potential investors can better understand what purchasing from OneGold entails.

All things considered, OneGold stands out among its competitors by providing its clients with access to quality products and services that make investing easier and more secure than ever before.

With its user-friendly features alongside various tools designed specifically for investors new to buying gold, OneGold should be taken seriously by anyone considering adding precious metal investments to their portfolios.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit OneGold below: