Pacific Premier Trust is a financial institution that specializes in providing custodial services for self-directed IRA accounts. The company was founded in 2004 and has since grown to become one of the leading providers of alternative asset custody solutions.

Pacific Premier Trust offers a wide range of investment options, including real estate, private equity, precious metals, and more.

As a custodian, Pacific Premier Trust does not provide investment advice or recommendations.

Instead, it acts as an intermediary between investors and their chosen investments. The company's role is to ensure compliance with IRS regulations and maintain accurate records of all transactions within the account.

In this article, we will review Pacific Premier Trust's offerings and explore the benefits of investing in a self-directed IRA account with them.

We will also examine the fees associated with using their services and compare them to other similar providers in the industry.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Pacific Premier Trust made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

About Pacific Premier Trust

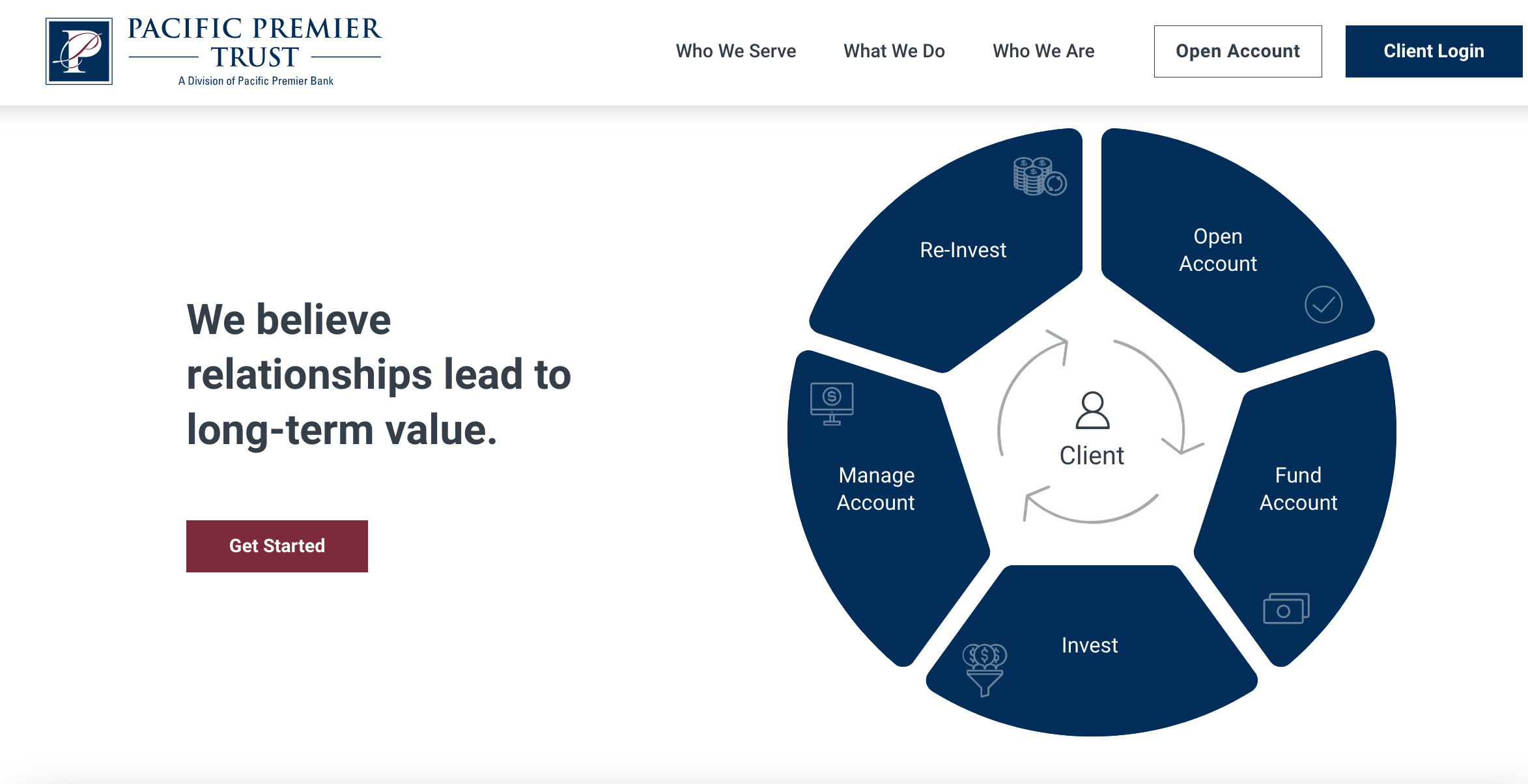

Pacific Premier Trust is a financial institution that specializes in providing investment options and financial services to potential account holders for retirement planning.

They offer assistance in opening and managing self-directed and conventional retirement accounts while providing guidance on common and alternative investments, along with an explanation of the differences between each type of account.

The company's staff assists clients with account management and wealth management, making it easier for them to make informed decisions about their finances.

The Pacific Premier Trust website lists two people in leadership positions, Tamara Wendoll as the EVP, Chief Operating Officer, and William G. Eustis as the SVP, Head of Sales and Strategic Partnerships.

As of 9/30/2022, Pacific Premier Trust has $17 billion in assets under custody from 43,903 client accounts holding 40,345 unique assets. With such a large client base and variety of assets under custody, Pacific Premier Trust has established itself as a reliable provider of financial services.

Pacific Premier Trust offers comprehensive financial services to those seeking assistance with managing their retirement accounts.

Their staff provides guidance on investment options while offering explanations about each type of account available to help clients make informed decisions about their finances.

With experienced leadership at the helm and billions in assets under custody from thousands of clients worldwide, Pacific Premier Trust is undoubtedly one of the leading providers in its field.

Who do They Serve?

Individuals looking to diversify their retirement portfolios with alternative assets can benefit from the tax-advantaged IRA accounts offered by a well-regulated independent custodian with over 30 years of experience in alternative asset custody.

Pacific Premier Trust caters to individual investors who want to follow their investment strategy when buying investments for their retirement savings.

The company offers a platform that makes it easy for clients to invest in alternative assets using tax-advantaged IRA accounts.

Small business owners and financial planners can also benefit from Pacific Premier Trust's services.

The company provides quarterly statements that display account positions and transaction activity, making it easier for small business owners and financial planners to manage their clients' investments.

A dedicated Relationship Manager is available to help meet clients' expectations of transparency.

Pacific Premier Trust also serves professional service providers such as CPAs, lawyers, and real estate agents who advise clients on alternative investments using IRA funds.

The company helps these professionals increase their knowledge of self-directed IRAs so they can better support customers who want to invest in alternative assets.

With its broad range of investment options, Pacific Premier Trust is an excellent choice for anyone looking to diversify their retirement portfolio with alternative assets while benefiting from the tax advantages of an IRA account.

Pacific Premier Trust IRA Accounts

Pacific Premier Trust offers a variety of IRA accounts that cater to the different needs of investors.

These include Traditional, Roth, Inherited or Beneficiary IRAs, Custodial IRAs and Business Retirement Accounts.

Traditional and Roth IRAs are popular options for individuals looking to save for retirement with tax advantages while Inherited or Beneficiary IRAs provide options for those inheriting an IRA from a deceased loved one.

Custodial IRAs are available for minors while Business Retirement Accounts can be established by employers for their employees.

Traditional IRA

A popular retirement account choice is the Traditional IRA due to its flexibility and lack of minimum contribution requirements or income restrictions.

Contributions made to this type of account are tax deductible on state and federal taxes, making it an attractive option for those who want to reduce their current taxable income.

Individuals who want to postpone paying taxes until they can withdraw the money without a penalty at 59 ½ years of age can benefit from a Traditional IRA.

There are certain limitations that come with this type of account. Here are some key points to consider:

- Tax benefits: As mentioned earlier, contributions made to Traditional IRAs are tax-deductible, which reduces current taxable income.

- Contribution limits: There is a maximum contribution limit set by the IRS each year for Traditional IRAs.

- Required distributions: Owners of Traditional IRAs must make minimum withdrawals when they turn 72 years old.

- Early withdrawal penalties: Withdrawing funds from a Traditional IRA before age 59 ½ may result in early withdrawal penalties.

While there are some limitations associated with Traditional IRAs, their flexibility and tax benefits make them an attractive option for many people planning for retirement.

Roth IRA

The Roth IRA is a retirement account option that offers several advantages to its holders. One of the most significant benefits is that withdrawals are penalty-free and tax-free once the holder reaches the age of 59 ½.

This feature provides a 'tax-free harvest' metaphorically speaking, for individuals who anticipate being in a higher tax bracket when they retire.

Contributions can be made with after-tax income, meaning that there are no taxes on qualified distributions.

There are contribution limits for Roth IRA holders based on their income level.

Early withdrawal penalties apply if funds are withdrawn before reaching age 59 ½ or if the account has not been open for at least five years.

Converting from a traditional IRA to a Roth IRA may result in additional taxes owed due to the differences in tax implications between the two types of accounts.

While there are some limitations and potential tax implications associated with a Roth IRA, it remains an attractive option for those looking to maximize their retirement savings while minimizing their future tax burden.

Inherited or Beneficiary IRAs

Inherited or beneficiary IRAs provide an opportunity for individuals to receive retirement accounts from the original account holder, but there are limitations on contributions and tax implications that must be considered.

When the new owner inherits an IRA, they have two options: a lump-sum distribution or to stretch out distributions over their lifetime. If they choose to stretch out distributions, they must take required minimum distributions (RMDs) based on their life expectancy.

One important aspect of inherited or beneficiary IRAs is the tax implications. In most cases, these accounts are subject to income tax, which means that the withdrawals will impact the individual's taxable income.

If the original account holder had not taken all of their RMDs before passing away, then those distributions must be taken by the new owner in addition to their own RMDs.

There is a strategy known as 'Stretch IRA' where beneficiaries can minimize tax liability by taking only the required distribution each year over their lifetime instead of taking a lump sum distribution and paying taxes on it all at once.

Understanding inherited and beneficiary IRAs' rules and regulations is crucial when planning for retirement and managing assets after inheriting them from someone else.

Custodial IRAs

Establishing a Custodial IRA for a child can be a savvy savings strategy for parents or guardians.

This type of IRA allows the child to start investing in their future at an early age and potentially benefit from the power of compound interest.

Here are three key benefits of Custodial IRAs:

- Investing Benefits: A Custodial IRA offers various investment options, including stocks, bonds, mutual funds, and ETFs. The earlier the child starts investing, the longer their money has time to grow.

- Rules & Regulations: The parent or guardian is responsible for managing the account until the child reaches adulthood. Once they reach 18 or 21 (depending on state laws), ownership of the account transfers to them.

- Tax Implications: Contributions made to a Traditional Custodial IRA may be tax-deductible up to certain limits while withdrawals during retirement will be taxed as income. In contrast, contributions made to a Roth Custodial IRA are not tax-deductible, but qualified withdrawals (after age 59 ½) are tax-free.

Choosing the best custodian for your Custodial IRA is essential as it impacts investment options and fees associated with maintaining the account.

It's crucial to research potential custodians' reputation, fees charged, customer service quality before selecting one that meets your needs and aligns with your financial goals.

Business Retirement Accounts

One effective way for businesses to support their employees' retirement savings is by offering business retirement accounts. Business retirement planning is an essential aspect of financial management, and it helps employers attract and retain talented employees.

By providing employer-sponsored plans like SEP or SIMPLE IRAs, businesses can offer their staff a range of retirement savings options while enjoying significant tax benefits.

Retirement plan setup can be complicated, but Pacific Premier Trust offers flexible solutions that cater to different needs. Small firms with less than 100 employees can establish a SIMPLE IRA for their staff with low setup and maintenance costs.

The employer can make contributions on behalf of their employees, and these contributions are tax-deductible.

On the other hand, SEP IRAs allow only the employer to fund the account while enabling employees to determine investment choices within trustee-set limits.

In both cases, Pacific Premier Trust ensures that your business's retirement plan meets regulatory requirements while empowering your employees to achieve their long-term financial goals.

Self-Directed Account Investment Options

Investors can diversify their retirement portfolio beyond traditional stocks and bonds by investing in alternative assets such as private equity, real estate, promissory notes, cryptocurrency, precious metals, and more through a Pacific Premier Trust self-directed IRA.

The advantage of investing in these alternative investments is that they offer tax benefits to the investors.

Private equity refers to having an ownership stake in businesses that are not listed on a stock exchange and are generally made available through a private placement.

Real estate is another popular investment option for self-directed IRA owners. They can invest in residential properties, commercial properties, and raw land for long-term appreciation or rental income.

Self-directed IRAs also allow investors to invest in promissory notes such as trust deeds and mortgages which have potential for positive cash flow and above-average rates.

Investors can receive favorable tax treatment if they keep debt obligations in an IRA.

Pacific Premier Trust offers alternative asset classes for investors seeking to diversify their portfolios. Self-directed IRA owners can invest in precious metals such as gold, silver, platinum or palladium.

Cryptocurrency is another emerging asset class that some investors consider adding to their portfolio.

It is important to note that these investments must comply with the IRS guidelines and Pacific Premier Trust's operational requirements and restrictions before making any investment decisions.

Pacific Premier Trust provides a variety of investment options for those looking to diversify their retirement portfolios beyond traditional stocks and bonds while enjoying the tax benefits offered by self-directed IRAs.

Why Invest Physical Gold in Your IRA?

Investing in physical gold through an IRA provides a reliable and secure asset that retains its value and even increases over time, making it a popular choice for those looking to protect their financial future amidst economic uncertainty.

Gold investing is one of the most effective ways of mitigating market volatility and protecting your retirement savings from inflation.

By diversifying your portfolio with gold, you can add a layer of stability to your long-term investment strategy.

There are several reasons why investing in physical gold is a smart move for retirement planning.

- Unlike paper assets such as stocks or bonds, gold has intrinsic value that cannot be eroded by market fluctuations or inflation.

- Owning physical gold gives investors more control over their investments than other types of assets held within an IRA.

- Gold has historically performed well during times of crisis or economic downturns, making it an excellent hedge against systemic risks.

Incorporating physical gold into your IRA can also help diversify your portfolio and reduce overall risk exposure.

A diversified portfolio is less vulnerable to short-term market fluctuations and provides greater potential for long-term growth.

Adding precious metals to your retirement account can provide protection against geopolitical risks such as war or political instability that could negatively impact other types of assets in your portfolio.

Incorporating physical gold into an IRA offers numerous benefits for those looking to safeguard their financial future throughout all kinds of economic climates.

Fees

The fee structure of Pacific Premier Trust's IRA accounts varies depending on the type of investments and services required. The company charges a one-time fee for account establishment, which includes transferring cash to their account and contacting the custodian to start receiving funds.

Account administration and maintenance fees cover accessing client service representatives, quarterly transaction activities, and annual tax reporting.

Transactional charges apply for purchases, liquidations, partial transfers, and overnight mailings.

When compared to other custodians in the market, Pacific Premier Trust's fees are generally competitive.

It is important to note that fees may vary widely depending on the type of investment held within an IRA account. Thus it is crucial for investors to review their specific situation carefully before selecting a custodian.

Pacific Premier Trust maintains transparency with its fee structure by providing clear explanations of each charge on its website.

The company also offers options for reducing fees through self-directed investing or consolidating multiple accounts under one umbrella account.

Investors should consider these options when reviewing their overall retirement savings strategy and selecting a custodian that aligns with their goals.

Conclusion

Pacific Premier Trust is an IRA custodian that provides self-directed investment options for individuals looking to diversify their retirement portfolios.

They specialize in alternative investments such as precious metals, real estate, and private equity.

Pacific Premier Trust's fees are reasonable compared to other IRA custodians in the market, making it a popular choice among investors.

Their Self-Directed IRA account allows investors to invest in physical gold, which can serve as a hedge against inflation and currency devaluation.

With Pacific Premier Trust's online platform, investors can easily track their investments and make informed decisions based on market trends.

Pacific Premier Trust offers a variety of investment options for individuals who want more control over their retirement portfolio.

Their specialization in alternative investments is particularly appealing for those looking to diversify beyond traditional stocks and bonds. While there are fees associated with their services, they are reasonable compared to other IRA custodians in the market.

Investing in physical gold through Pacific Premier Trust is worth considering if you're concerned about protecting your assets from inflation or currency fluctuations.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Pacific Premier Trust below: