Pacific Premier Trust is a financial partner offering services for those looking to secure their future. They offer services ranging from retirement planning and trust administration, to estate planning and beyond.

The team at Pacific Premier Trust provides comprehensive solutions tailored to fit individual needs as well as businesses of all sizes. Whether it’s setting up an IRA or designing a complex succession plan, they have the knowledge and experience necessary to ensure success. Their commitment to excellence is unmatched in the industry.

At Pacific Premier Trust, clients receive personalized care every step of the way. From providing detailed advice on investments, trusts, estates and more - no matter what stage of life you're in - they have the expertise needed to help make sure your wealth works for you today and tomorrow.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Pacific Premier made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

Who is Pacific Premier Trust?

Pacific Premier Trust is a growing independent trust company. They specialize in providing self-directed individual retirement accounts (IRAs) backed by an expansive network of custodians and administrators. In just five years, they've grown their asset base to over $2 billion - that’s more than double the amount in 2017!

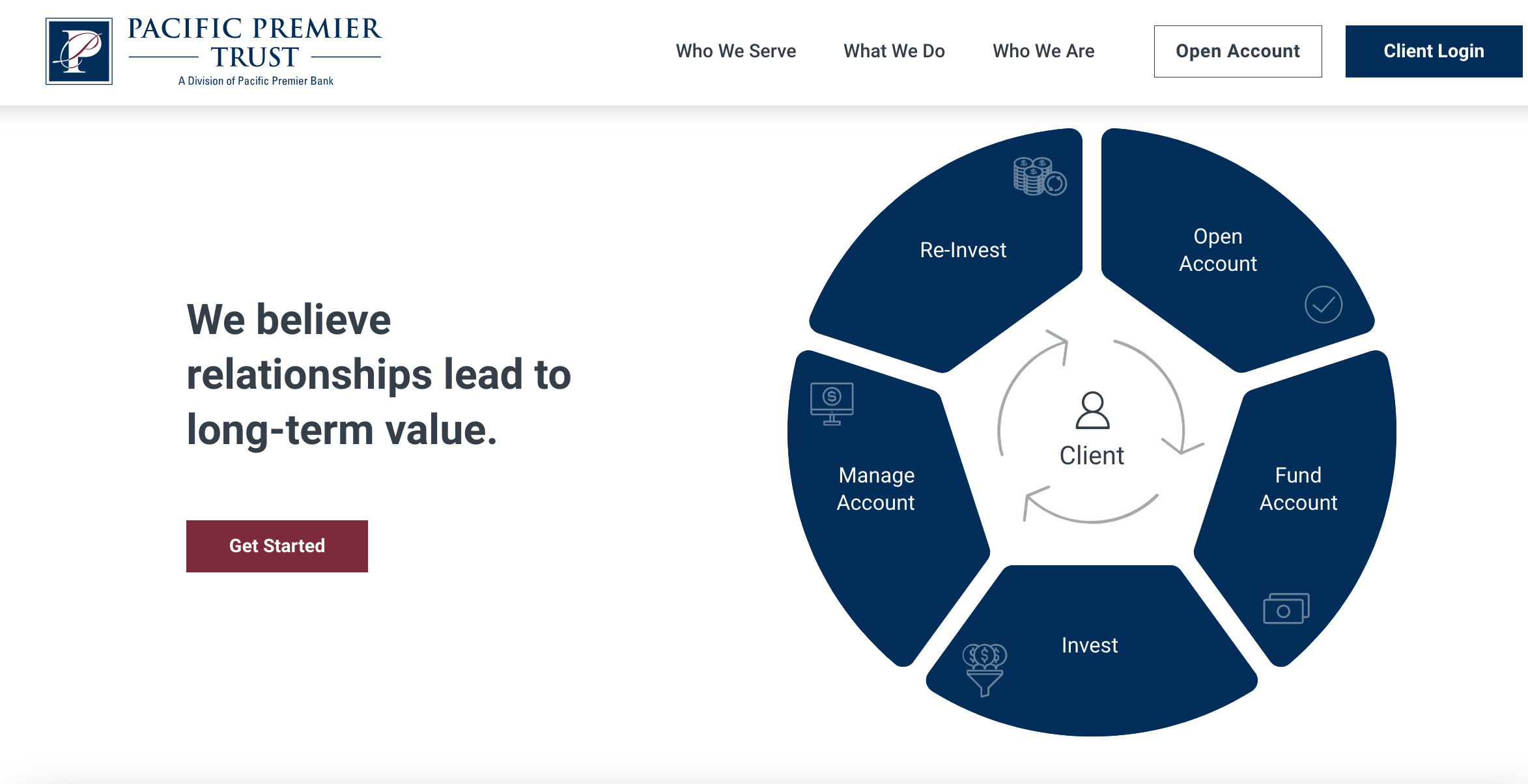

So what makes Pacific Premier Trust so special? It's all about their commitment to customer service and accessibility. Their team of experts are available 24/7 for answers to any questions or help with account management. And with a variety of IRA options, it’s easy to create a custom solution tailored to your retirement goals.

Whether you want to invest in real estate, cryptocurrency, or precious metals, Pacific Premier Trust has got you covered. Plus, they offer low transaction fees and competitive interest rates on many accounts – making them a decent option for setting up a self-directed gold IRA.

IRA Accounts by Pacific Premier Trust

Traditional IRAs

Traditional IRAs are like a pearl in an oyster, tucked away and waiting to be discovered. They offer many benefits that can help you easily save money for retirement in the long run. Here's what they have to offer:

- Tax-deferred savings - Your contributions grow tax free until withdrawal

- Flexibility – You’re able to change your investment choices with ease at any time during the year

- Contributions - You’re allowed to contribute up to $6,000 each year if under 50 years old or up to $7,000 if over 50 years old

- Accessible funds - Funds can be withdrawn without penalty once you reach the age of 59 ½, though taxes will apply when withdrawing from a Traditional IRA account

- Maximum contribution limits – The maximum amount you can contribute may depend on certain factors such as income level

In addition to these benefits, traditional IRAs also give you the opportunity to choose investments with potential growth opportunities while providing protection of principal value against market downturns. So whether you plan on taking advantage of the tax deductions now or later, Pacific Premier Trust offers options for saving towards your retirement goals with traditional IRAs.

Roth IRAs

contributions to a Roth IRA are made with after-tax dollars which means that once it's time to withdraw funds during retirement, all withdrawals – including any earnings - will be tax free. That’s right—no Uncle Sam coming around asking for his cut of your hard earned money. It's like hitting the jackpot!

In addition, there is more flexibility when it comes to withdrawing funds than traditional IRAs. Withdrawals can be taken penalty free for qualified medical expenses or educational costs; plus you don’t have to wait until retirement age before tapping into them. Sounds pretty great, doesn't it?

Roth IRAs also provide greater estate planning opportunities since they do not require minimum distributions at age 69 ½ (as required by Traditional IRAs). This allows investors to pass their account down as an inheritance without having to pay taxes on the gains first. So even after you're gone, your savings can still keep working for your family and loved ones.

Inherited Or Beneficiary IRAs

When dealing with such sensitive matters as inherited wealth, having the right people in your corner can make all the difference. With their friendly and knowledgeable staff on hand every step of the way, they will provide you with advice tailored specifically to meet your needs. All while keeping fees low and providing access to top-tier investments like that of Vanguard's that can help turn those funds into something more substantial over time.

Pacific Premier Trust also offers a range of services designed to give you peace of mind when making decisions about how best to use these funds. From estate planning resources and tax guidance, to personalized account management plans - they have everything covered so you can focus on what really matters: growing your wealth safely and securely for years to come.

Custodial IRAs

Custodial IRAs are a powerful tool for those looking to secure their financial future. They provide an opportunity to make tax-advantaged contributions that can be used later in life. Just like with inherited or beneficiary IRAs, Pacific Premier Trust has the expertise and knowledge necessary to help you get the most out of your custodial IRA:

1) They offer competitive rates on investments

2) Provide access to knowledgeable customer service team so you can always stay up-to-date with your account

3) Offer flexible contribution options

4) And keep costs low while maximizing returns.

Business Retirement Accounts

You see, setting up a business retirement account with them is like having the best of both worlds: all the convenience and ease of their custodial IRAs plus the ability to invest in self-directed account investment options. It's an unbeatable combination.

Pacific Premier Trust takes all the guesswork out of investing for retirement. Their helpful advisors are on call 24/7, ready to answer any questions or give advice when needed. Plus they offer flexible contributions that allow you to choose how much money you want to contribute each month. What more could you ask for?

No matter what stage of life you're at, Pacific Premier Trust has got you covered - and helps ensure that your financial future will be as secure as possible. So don't delay; start planning for your retirement today!

Self-Directed Account Investment Options

When it comes to investing your retirement funds, you have options. Pacific Premier Trust has several self-directed account investment options for you to choose from. Here's a look at some of the best ones:

- 1) Stocks and mutual funds – If you want to stay active in managing your investments, stocks and mutual funds are great choices that allow you to pick specific companies or market sectors.

- 2) Exchange traded funds (ETFs) – These are baskets of securities that give you access to broader markets with one purchase. ETFs can be bought and sold just like regular stocks.

- 3) Real Estate Investment Trusts (REITs) – REITs offer investors exposure to real estate without having to buy property themselves. They’re a way to diversify away from the stock market while still taking advantage of potential appreciation and rental income streams.

- 4) Precious metals – With gold prices on the rise again, there’s never been a better time to take advantage of this valuable asset class by investing in physical gold through an IRA.

Investing wisely is essential when it comes to planning for retirement, so make sure you examine all the different possibilities available before deciding which route works best for you. Whether it’s traditional stocks, ETFS, REITS, or precious metals - Pacific Premier Trust has got something for everyone!

Why Invest Physical Gold in Your IRA?

The allure of gold is undeniable. Not only does it sparkle and shine, but investing in physical gold has been a long-standing tradition for centuries on end. Now more than ever, with the help of Pacific Premier Trust, you can add that glimmer to your self-directed account investment options by investing in physical gold within an IRA.

But why should you invest in physical gold? To begin with, gold offers a level of diversification not seen elsewhere in the market; this helps protect against losses when other investments plunge due to economic downturns or global events. Additionally, many investors are attracted to its tangible nature – while stocks may be volatile and susceptible to market forces outside one’s control, holding physical gold gives individuals peace of mind knowing they have something real and valuable.

Plus, having access to funds housed in an IRA allows for tax benefits that could save investors precious money come tax time like deductions from contributions as well as deferring taxes on profits until withdrawals have been made from the account. With so much at stake financially speaking, adding some golden luster to your financial portfolio through Pacific Premier Trust might be just what you

Conclusion

Overall, investing with Pacific Premier Trust offers a variety of options for different types of retirement accounts. From traditional IRAs to business retirement accounts, they offer investment solutions that can help you reach your financial goals. Investing in physical gold is an excellent way to diversify your portfolio and protect your assets.

Whether you’re looking to save for the future or plan ahead for unexpected events, Pacific Premier Trust makes it easy and secure.

The juxtaposition between safety and security versus growth opportunities creates an ideal scenario when considering investments. The ability to have both protection and potential profits keeps investors from having to choose one over the other.

Knowing that their money is protected while being able to grow at the same time gives peace of mind as well as confidence in making the right decisions about where their hard-earned cash goes.

Pacific Premier Trust allows people to invest in something tangible like gold - something that has been around since ancient times - while also benefiting from all the modern amenities such as online banking, mobile apps, and more. By utilizing these tools combined with an attractive return on investment opportunity, Pacific Premier Trust helps make sure that everyone's retirement plans are on track!

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Pacific Premier Trust below: