Are you looking to invest your hard-earned money? Are you considering the Prudential Gold IRA as an option?

If so, it’s important to understand exactly what this investment entails and whether or not it is a good fit for you.

In this article, we will explore the ins and outs of investing in a Prudential Gold IRA, from its potential benefits to possible drawbacks. We will also take a look at some alternative investment options that may be more suitable for certain individuals.

By the end of this piece, readers should have a better idea of whether or not investing in a Prudential Gold IRA is right for them. Let's dive in!

The concept of retirement planning has been around since ancient times with Roman senators first setting up pension funds for their citizens thousands of years ago.

Nowadays, modern retirees face different challenges when it comes to making sure they are financially secure during their golden years. Investing in gold has become increasingly popular over recent decades due to its perceived reliability amid economic uncertainty and market volatility.

The Prudential Gold IRA offers individuals the chance to diversify their investments by taking advantage of these assets while avoiding the risks associated with traditional stock markets. So how does one go about investing in such an account?

When opening a Prudential Gold IRA, investors must decide which type of gold they would like to purchase – coins, bars or bullion – as well as how much gold they want to buy per transaction.

It is wise for prospective buyers to do research on current gold prices before committing any funds; however once purchased all purchases are insured by the Federal Deposit Insurance Corporation (FDIC).

After deciding which asset class fits best into their financial portfolio, investors can then choose between various payment methods such as cash deposits or wire transfers.

Investors need consider which custodian bank they wish use manage their account; luckily there are many reputable institutions available today offering competitive rates and flexible terms when investing in precious metals through their services.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Prudential made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

About Prudential

Prudential has been a leader in the financial services industry.

With over 140 years of experience and expertise under its belt, the company provides investors with a wide range of investment options, including self-directed gold IRAs.

A Prudential Gold IRA allows those looking to diversify their portfolio with exposure to gold to do so without having to buy physical gold bars or coins. The account can be managed online as part of an existing retirement plan or independently as a stand-alone option.

Prudential offers access to experienced advisors who will help guide individual investor's decisions when it comes to investing in precious metals like gold for their retirement savings.

Account holders are able to customize their investments based on risk tolerance and goals, allowing them maximum control over how much they allocate towards certain assets within their portfolios.

Prudential also offers additional features such as tax minimization strategies that could potentially save money come tax season.

All told, Prudential is well equipped to serve as a reliable resource for those interested in adding some extra security into their retirement savings by investing in gold through a self directed IRA.

Why Place Gold in Your IRA?

Investing in gold can be a great way to diversify your retirement portfolio.

A Prudential Gold IRA is an individual retirement account that allows you to invest in physical gold and other precious metals, such as silver and platinum. This type of investment offers many advantages over traditional investments like mutual funds or stocks.

Gold has historically been one of the most stable investments available, even during times of economic uncertainty. The price of gold typically rises when stock prices drop, providing investors with a hedge against market volatility.

Gold's lack of correlation with other asset classes makes it ideal for risk management strategies within a well-diversified portfolio.

For these reasons, investing in a Prudential Gold IRA may provide significant protection from market downturns as well as potential upside should markets rise again.

With a Prudential Gold IRA, you have access to all forms of physical gold—from coins and bars to jewelry and bullion—as well as the ability to choose between various types of gold stocks and ETFs (Exchange Traded Funds).

You also get free storage at depository facilities around the country so that your physical assets are safe and secure. Investing in physical gold can give you peace of mind knowing that your money is backed by something tangible instead of just paper currency or digital numbers on a screen.

Plus, there is no need to worry about fluctuating gold prices since they are already included in the cost of your purchase!

With all these benefits combined, investing in a Prudential Gold IRA can be an excellent option for those looking to diversify their portfolios and protect their hard-earned savings from inflationary pressures.

What Are Gold IRAs?

Having discussed why you should place gold in your IRA, it is important to understand exactly what a Gold IRA is.

A Gold IRA is an Individual Retirement Account that allows investors to store physical precious metals such as gold, silver coins and bars, platinum, palladium, and even certain types of rare coins or collectibles within the account.

This type of self-directed IRA gives investors more control over their retirement portfolio by allowing them to invest in assets other than traditional stocks and bonds.

Gold IRAs are also known as Precious Metals IRAs because they offer individuals the opportunity to add physical gold, silver, platinum and palladium bullion, coins or ETFs into their retirement accounts.

Investors may also choose from different types of metal investments including Exchange Traded Funds (ETFs) like GLD which tracks spot prices for gold, as well as individual mining stocks and mutual funds focused on precious metal investments.

For those looking to diversify their portfolios with something tangible beyond paper money or stock options, investing in one or several gold ETFs can be a smart move.

Not only do these products provide protection against inflation but they also allow you to access your wealth quickly if necessary since many gold IRAs are liquidated easily and can be converted into cash fairly quickly compared with traditional investment vehicles.

When researching potential investments it’s important to remember that not all precious metals are created equal; some have higher liquidity while others may contain trace amounts of additional elements—like copper and nickel—that could affect its value over time.

As such it’s important to consider any fees associated with buying physical silver or buying physical gold before making any decisions about where best to allocate your hard earned savings for retirement planning purposes.

What Is a Self-Directed IRA?

Many people are looking for reliable ways to invest and save for retirement. One of the most popular options is a self-directed IRA, which allows individuals to take control of their own finances—without relying on a financial advisor or other outside parties.

But what exactly does this mean?

A self-directed Individual Retirement Account (IRA) offers investors more autonomy than traditional IRAs. With a self-directed IRA, you can make investments in various asset classes such as real estate, commodities, private placements and even certain types of stocks and ETF trades--all without needing approval from any third party.

This type of investment vehicle gives its owners greater freedom when making decisions about their retirement funds while also giving them access to potentially lucrative investments that may not be available through standard accounts.

The following are five key benefits associated with owning a self-directed IRA:

- Potential Tax Advantages: Self-directed IRAs offer tax advantages similar to those found in other retirement savings plans like 401(k)s and Roth IRAs. Depending on your individual situation, these potential tax breaks could help you save money over time.

- Flexible Investment Options: A self-directed IRA gives you more flexibility when it comes to where you put your money; allowing you to diversify your portfolio beyond typical stock market investments by investing in alternative assets such as precious metals or real estate.

- Control Over Your Investments: When you open a self-directed IRA, all decision making lies solely with you—not with an external manager who might have different goals than yourself. You decide how much risk to take and the length of time before withdrawing funds—giving you full control over your retirement future.

- Access To Unique Opportunities: By having access to nonstandard investments like cryptocurrency or foreign currency markets, investors can explore opportunities they wouldn't otherwise have access to within conventional retirement vehicles like 401(K)s or mutual funds.

- Easy Liquidity: Unlike some other long term investments, self directed IRAs allow easy liquidity should there ever be an emergency need for cash – something that isn’t always possible with many traditional forms of investment due to high fees or long waiting periods required before withdrawals can be made.

In short, choosing a self-directed IRA provides individuals with both flexibility and control over their financial futures - two things that everyone needs when planning for retirement.

From the potential tax savings offered by these accounts to increased accessibility unique opportunities for growth – opening up a Self Directed IRA could prove beneficial for anyone looking for innovative ways to manage their personal finances and achieve financial success later in life

How To Open a Gold IRA

Opening a gold IRA is fairly straightforward. It begins with selecting an investment company that specializes in offering gold IRAs, such as SPDR Gold Trust (GLD). After researching the various options and finding one that works for you, contact them to open an account.

The process won't take long—it usually only takes around 10 minutes or so.

Before investing in a gold IRA, it’s important to understand what type of assets are eligible for inclusion. Generally speaking, most types of investments can be included in an IRA.

These include stocks and mutual funds from major companies like Apple and Microsoft; exchange-traded funds (ETFs) based on commodities such as oil and natural gas; real estate investments trusts (REITs); foreign securities; certificates of deposit (CDs); bonds issued by the federal government or corporations; precious metals such as gold, silver, platinum or palladium bullion coins; and other alternative assets such as cryptocurrency.

Depending on your provider's requirements, typically no more than 20% of all statutory assets within any given retirement portfolio may consist of physical gold holdings.

That said however, many investors consider adding even smaller amounts – say 5%-10% -of their overall savings into gold-based instruments as means of diversifying wealth over time.

Gold IRAs offer plenty of advantages compared to other forms of investments including tax benefits and protection against inflationary forces which often erode the purchasing power of traditional currencies like the U.S dollar over time.

Because it is widely accepted throughout the world, owning physical gold allows individuals to easily transfer wealth across international borders without having to rely solely upon currency exchanges or banking systems which have unique risks associated with them depending on where you live.

Benefits of Investing in Physical Gold

With physical gold as a retirement asset, investors have the potential to reap a variety of benefits.

Generally speaking, it is important to note that many IRA custodians do not offer direct investments in gold and silver bullion and coins due to their inability to store them safely and securely.

Prudential’s full-service retirement business helps facilitate these types of transactions through four stages for those interested in investing in physical assets: Evaluation, Establishment, Funding, and Preservation.

Physical gold can help hedge against inflation over time by enabling an investor's purchasing power to remain intact or even increase during periods of economic uncertainty.

Certain tax advantages come with owning physical gold within a self-directed IRA such as avoiding capital gains taxes on profits earned from selling precious metals held long enough to meet IRS requirements; however, there are restrictions when withdrawing funds early which could result in severe penalties.

Many investors turn towards gold IRAs because they are viewed as a valuable portfolio diversifier and provide reliable returns under almost any market conditions.

In comparison with stocks and bonds, physical gold has historically outperformed both categories by providing consistent appreciation while avoiding the volatility associated with paper currency markets.

How to Perform a 401k Rollover to a Gold IRA

The process of moving your retirement savings from a 401k to a gold IRA is like navigating a winding road.

You must be aware of the various rules and regulations that govern retirement plans in order to make sure you handle the transition correctly, or else face hefty penalties.

To begin, seek the assistance of an experienced financial advisor who can help guide you through the steps required for setting up your individual retirement account (IRA). They will need information about your current 401k plan such as contribution limits and any rollover assets.

Next, complete all paperwork necessary for transferring funds from your existing 401k into your new gold IRA.

This includes a transfer authorization form provided by both custodians which authorizes the movement of money between accounts.

Be sure to review all documents carefully before signing anything and confirm that nothing has been left out.

Once completed, submit copies of everything to each custodian along with any other additional documentation they may require.

Your financial advisor should also remain involved throughout this entire process and ensure that it runs smoothly.

Background of Prudential

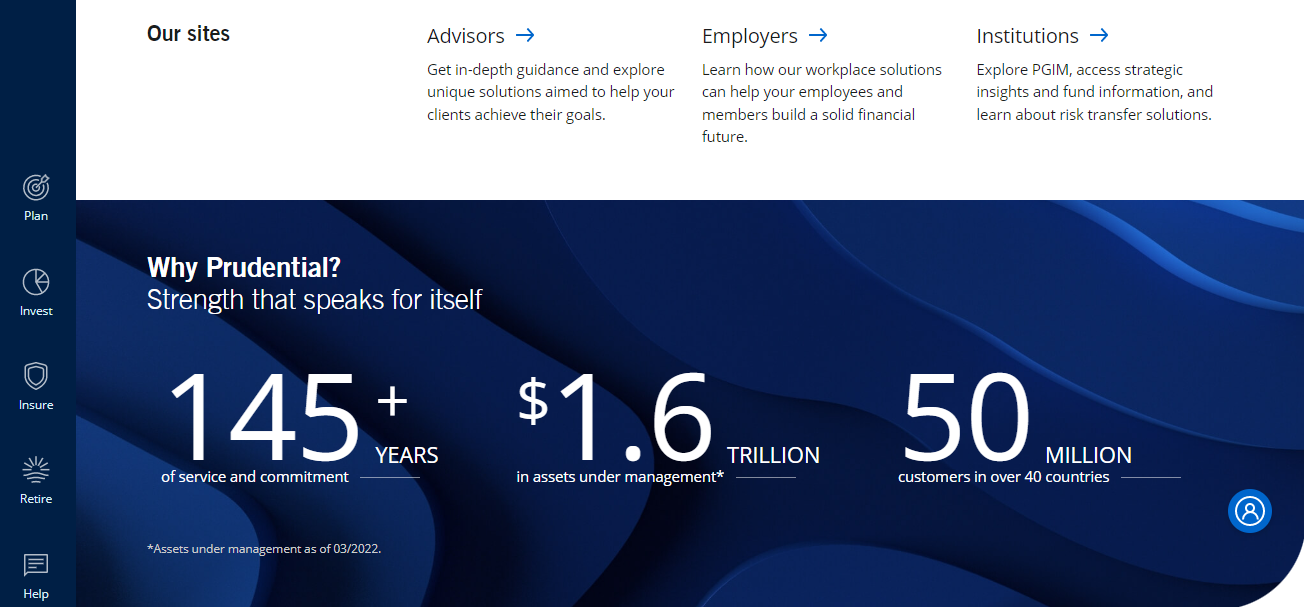

Prudential Financial is a financial services powerhouse with over 140 years of experience in providing sound investment advice and retirement portfolio management.

Prudential has become one of the most widely recognized names in global finance, offering solutions to individuals, companies, institutions and governments across the world.

Prudential's main focus is on helping people prepare for retirement through employer plans that meet minimum employee coverage requirements as well as individual annuities, life insurance products and investments.

Prudential also offers comprehensive asset protection solutions such as long-term care insurance and disability income policies to help customers protect their finances against unexpected events.

Through its network of experienced advisors, Prudential provides personalized advice tailored to each client’s unique needs and goals.

With strong customer service support and an extensive suite of financial products, Prudential is well positioned to provide quality guidance throughout every stage of life.

In addition to its wealth management offerings, Prudential also provides services related to banking, debt consolidation loans and estate planning.

The company’s goal is to offer clients holistic guidance for all aspects of personal finance so they can live confidently knowing that their money is being managed responsibly.

As part of this commitment, Prudential supports initiatives aimed at creating greater economic mobility for families around the globe by investing in education funds and microfinance organizations that serve low-income communities.

By doing so, it hopes to make a meaningful impact on those who need it most while helping them build brighter futures for themselves and their loved ones.

With decades of knowledge behind it, Prudential continues to be a leader in the financial industry today – delivering innovative products backed by expert advice that empowers customers to shape secure futures for themselves and generations after them.

Prudential Services

Investing in a Prudential Gold IRA is often seen as a wise choice due to the wide range of retirement plan options available through this provider.

Prudential Retirement provides an employer sponsored retirement plan, which can be customized based on individual needs and goals.

This type of plan allows employers to provide their employees with competitive benefits packages while building long-term wealth for themselves. Social Security benefits may also be included in the mix when investing in a Prudential Gold IRA.

Minimum distributions are required by law at age 70 ½; however, these can vary depending on whether or not you choose a traditional or Roth IRA option.

Traditional IRAs offer tax breaks now but generally require higher taxes later; whereas, Roth IRAs allow investors to pay taxes upfront so that withdrawals become tax free after meeting certain requirements.

With either option, prudential gold IRAs offer more flexibility than other types of investments and can help you maximize your income during retirement years.

It's important to research all the different aspects before making any decisions about how much money you should invest and what kind of account best suits your financial situation.

Conclusion

Prudential's gold IRA is a good investment for those looking to diversify their retirement portfolio. It provides investors with the potential to benefit from both short-term and long-term gains in the precious metal market.

With a self-directed IRA, you can also open a Gold IRA, which allows you to have more control over your investments and reap higher returns than other traditional IRAs.

Investing in physical gold offers many benefits such as its liquid nature, financial security, and stability against inflation.

If you decide to perform a 401k rollover into a Gold IRA, it's important to understand the process beforehand so that your funds are managed properly.

Overall, Prudential's Gold IRA is an attractive option for those looking for greater diversity of assets in their retirement portfolios.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Prudential below: