Are you looking for an alternative to traditional investments?

Investing in a gold IRA could be the perfect way to diversify your portfolio, and Sprott Physical Gold is one of the top providers when it comes to investing in precious metals.

This review will explore all aspects of this type of investment from its advantages to its drawbacks so that readers can make an informed decision about whether or not investing with Sprott Physical Gold is right for them.

The value of gold has been on the rise since 2000, making it an attractive option for those wanting to secure their financial future.

With a Sprott Physical Gold account, investors have access to bullion bars and coins at competitive prices that are safely stored by a third-party depository.

Read on to find out what makes this company stand out among other gold IRA companies as well as how easy it is to open an account and get started with investing today.

When choosing between different gold IRA custodians, there are many factors that need to be considered such as fees, customer service, storage options, and more.

In this review we’ll take a comprehensive look at everything related to Sprott Physical Gold so investors can feel confident in their decisions about where they choose to invest their money.

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Sprott made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

Sprott Company Background

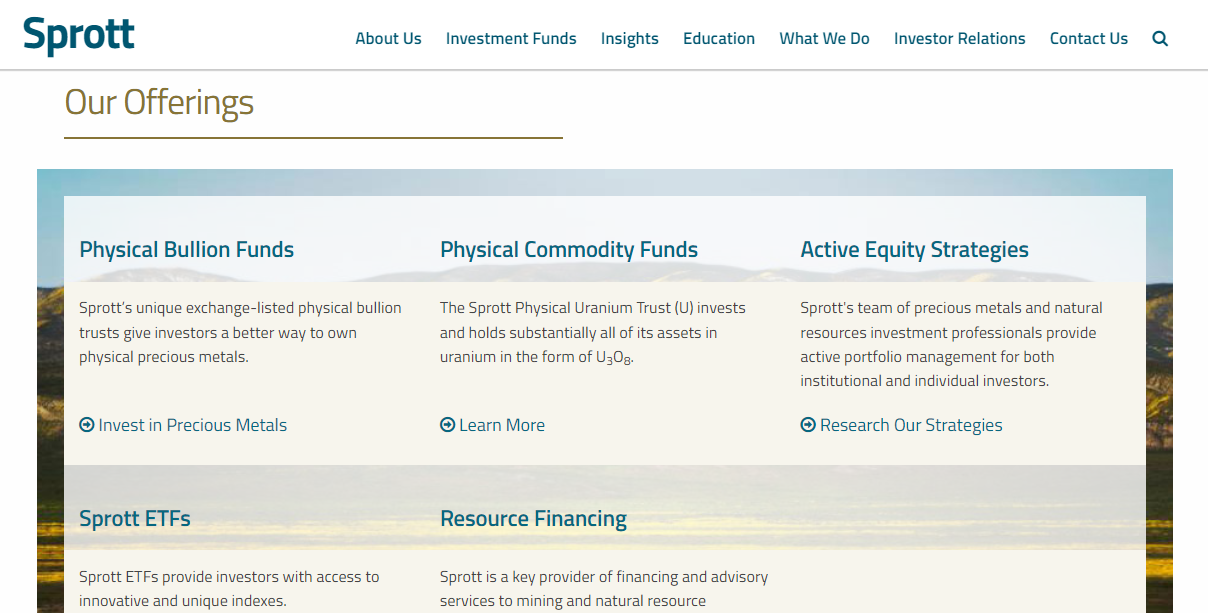

Established in 1981, Sprott Inc. is a well-renowned asset management firm founded by Eric Sprott that specializes in providing physical gold investments to its customers.

Without any doubt, they have been successful with their offerings and have made a name for themselves within the industry.

The company's flagship product is called the “Sprott Physical Gold Trust” which offers investors an opportunity to own bullion gold coins from the Royal Canadian Mint without having to worry about storage or other associated costs.

Their aim is to provide secure and reliable service through facilitating access to physical precious metals such as silver bars and gold, thus enabling their clients to make sound investment decisions on behalf of them.

With decades of experience, they are considered one of the most trusted names when it comes to investing in gold and other Precious Metals IRAs.

What Is a Gold IRA?

A gold IRA is an Individual Retirement Account (IRA) that allows you to invest in physical bars or coins of gold.

With a gold IRA, one can diversify their retirement portfolio and hedge against inflation. The process for investing in a Gold IRA is similar to that of any other type of Traditional or Roth IRA though there are some additional steps required such as finding an approved depository and opening an account with them.

It's important to note that all the investments must be held in the name of your self-directed IRA custodian, who will manage the funds on behalf of the individual.

Gold IRAs offer investors many advantages such as potential tax benefits, liquidity and portability.

Precious metals like gold have long been sought after by investors due to their historical stability and security from market volatility.

Investing in a gold-backed IRA gives individuals access to these safe-haven assets while benefitting from the same tax treatment given to traditional IRAs.

Reasons To Invest in a Gold-Backed IRA

According to the World Gold Council, gold prices have risen an average of 6.5% annually over a 20-year period.

This means that investing in gold through a Gold IRA could be beneficial for those who are looking to diversify their retirement portfolio and hedge against inflation.

A Gold-backed IRA is similar to a traditional IRA but instead of stocks or bonds, it holds physical precious metals such as gold coins or bullion bars.

Investors may choose from different types of investments when setting up their own individual Retirement Account (IRA).

While there are many benefits to having a well-diversified portfolio with both paper assets and physical commodities, some investors prefer the added security that comes with holding tangible assets like gold Coins, Bullions, and other Precious Metals.

When choosing between buying gold coins or Physical Bullion Bars for your Gold IRA account, it's important to understand how each one works and what its advantages are.

Gold Coins offer greater liquidity than physical bullion bars as they can more easily be sold on the open market without any additional fees associated with melting down larger quantities of metal into smaller sizes.

Certain rarer coins may even increase in value beyond spot price depending on rarity and numismatic value.

On the other hand, Physical Bullion Bars often come at significantly lower premiums than coins due to their higher weight and easier storage capabilities; making them ideal for long term wealth preservation strategies.

Each approach has its own merits so it is important for potential investors to assess which investment option and strategy best meets their financial goals before deciding which type of asset should form part of their portfolio.

Gold Coins or Gold Bullion?

As the old adage goes, “a penny saved is a penny earned.”

When it comes to investing in gold for retirement, there are two main options: gold coins or gold bullion.

Gold Bullion refers to large bars of pure gold held as an investment flow; whereas, gold coins are smaller denominations that are minted and collected. Both have their advantages when included in your portfolio:

•Gold Bullion offers investors a way to purchase physical gold at low premiums above its spot price. With such savings, you can allocate more funds into other investments while still diversifying with precious metals.

•Gold Coins provide investors with collectible value due to numismatic factors like rarity and age. They offer portability since they come in much smaller sizes compared to large bullion bars which require storage and security measures.

•Another advantage of both Gold Bullion and Gold Coins is that most dealers will accept them for payment when buying additional items from their shop – something not many other forms of investments can do!

When deciding between these two types of gold investments, consider what's important to you.

Do you want to buy larger quantities of lower-cost products? Or would prefer collecting rarer pieces with potential numismatic value?

Keep in mind that no matter which option you choose, adding either form of gold adds diversity and stability to any retirement portfolio.

Where Are the Precious Metals Inside a Gold IRA Stored?

People invests in a Sprott physical gold IRA to diversify retirement portfolio. With an investment like this, it's essential to understand where the precious metals will be stored.

Gold IRAs are investments that allow individuals to hold physical gold and other metals as part of their retirement savings.

Precious metal investments must be held in secure storage facilities outside of the investor's home or possession.

When investing in a gold IRA, custodians provide investors with access to IRS-approved storage facilities for their precious metals investments.

These highly secure vaulting locations are used by financial institutions all around the world for storing valuable goods such as jewelry and artwork.

The government regulates these storage facilities to ensure maximum security and safety for the funds inside them.

Storage fees vary depending on the type of account you have and what kind of assets you're storing.

It is important to remember that your personal information will always remain confidential when dealing with these storage facilities; only your custodian has access to your account information.

With proper education about which coins are IRS approved, investors can successfully store their physical gold with confidence using a Sprott Physical Gold IRA process.

Which Coins Are IRS-Approved for a Gold IRA?

When it comes to investing in gold through a Gold IRA, the Internal Revenue Service (IRS) only allows certain coins to be held within this type of account.

The IRS-approved coins include American Eagle and Buffalo gold bullion coins, Canadian Maple Leaf coins, Austrian Philharmonic coins, and South African Krugerrand coins.

These are all considered precious metals investments that can help diversify your portfolio for retirement purposes.

In addition to these approved gold coins, there are also other options such as Exchange Traded Funds (ETFs) or stocks backed by physical gold.

ETFs consist of baskets of securities representing an index fund which track a particular sector or industry.

These funds have very low management fees compared to mutual funds and allow investors to gain exposure into the gold market without actually owning any physical metal directly.

Investing in gold stocks is another option available; however, individual stock prices may fluctuate more than actual gold prices due to their higher volatility levels making them riskier investments overall.

TIP: When considering what type of investment products you should use when setting up a Gold IRA Rollover, make sure you do your research first on each option mentioned above - from gold bars, gold ETFs (even Precious Metals ETFs) and gold stocks to American Gold Eagles – so that you’re well-informed before diving into the world of precious metal IRAs.

What Exactly Is a Gold IRA Rollover?

Investing in gold is a popular choice for many people, and the idea of setting up a Gold IRA Rollover may sound appealing.

But what exactly does it mean? Here we explore this unique investment opportunity, delving into how mutual funds, gold prices, and other gold products are involved.

A Gold IRA Rollover is an Individual Retirement Account that allows investors to hold physical gold as part of their retirement portfolio.

The account can be funded with investments from 401(k)s, traditional IRAs or employer sponsored plans which then allow individuals to purchase various types of metals including coins, bars, rounds and more.

As the price of gold fluctuates on the open market so too do these holdings; allowing investors to benefit financially if they choose wisely.

When investing in a Gold IRA there are no annual fees or costs associated with holding onto your assets — making it an attractive option compared to more volatile investments such as mutual funds.

This type of asset protection also makes it easier for retirees to preserve the value of their savings while taking advantage of rising gold prices during times where inflation has outpaced returns otherwise expected from stock markets.

Do You Have To Use a Gold Investment Company?

Investing in gold can be a lucrative and rewarding venture.

But, making the most of such an investment requires more than simply buying up any old shiny metal; you need to partner with a reputable gold investment firm.

Whether it’s through physical assets in gold like coins or bars, ETFs (Exchange Traded Funds) tracking precious metals, or investments into gold mining companies – having the right organization on your side is essential for success.

So, when looking at options like Sprott Physical Gold IRA Review, do you have to use a specific type of gold investment company?

The answer is yes and no. While there are certain firms that may specialize in certain areas of investing within the gold industry - like mutual funds versus stocks - many other organizations offer comprehensive services aimed at helping customers explore all their options.

Ultimately though, it's important to understand your own financial objectives before choosing a provider who will help you reach them.

Conclusion

Investing in a gold-backed IRA can be an excellent way to diversify one’s portfolio and protect their retirement savings from inflation.

Gold has historically been seen as a safe haven asset, meaning its value tends to remain relatively stable over time despite short-term market fluctuations.

It is important for investors considering this option to understand the different types of coins or bullion that may be used as well as how they are stored and which companies offer assistance with setting up such accounts.

There are certain requirements when it comes to doing gold IRA rollovers which must also be taken into account by potential investors.

All these factors should be carefully considered before making any decisions regarding investing in precious metals within an IRA.

The advantages offered by a gold-backed IRA have long made it popular among those looking for secure investments during uncertain times.

By providing protection against inflation and diversifying one’s portfolio, gold IRAs can help ensure that individuals have sufficient funds available upon reaching retirement age.

Understanding the ins and outs of such accounts will give people added peace of mind knowing that their money is being handled properly and safely invested in accordance with IRS guidelines.

Overall, investing in a gold-backed IRA is a great way to take advantage of the many benefits associated with holding physical precious metal assets while ensuring compliance with all legal regulations pertaining to such investments.

With proper research and planning, individuals can obtain financial security for themselves both now and in the future.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Sprott below: