When it comes to retirement planning, many of us are looking for ways to secure our future. To do this, we need a plan that is reliable and long-term - enter the TIAA Gold IRA. This type of Individual Retirement Account (IRA) has been around for years but there's more than meets the eye when it comes to these plans!

In this article, we'll explore what makes a TIAA Gold IRA different from other retirement accounts and why they may be a great option for you.

We'll dive into how these IRAs work, their benefits and drawbacks, as well as some tips on getting started with one.

So if you're interested in exploring your options for retirement savings, read on!

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if TIAA made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

History of TIAA

This foundation was named “Teachers Insurance & Annuity Association”, or TIAA. For decades, this organization has provided secure financial planning services designed to help individuals build wealth through long-term investments such as stocks, bonds, mutual funds and gold coins.

Today, they are well known throughout the world and offer a variety of self-directed IRA options with solid investment opportunities.

TIAA has continued to innovate over the years by offering new products and services that meet changing customer needs. They now have an array of long-term investment options available including real estate investments trusts (REITs), annuities, private equity investments, exchange traded funds (ETFs) and even gold IRAs which enable customers to diversify their portfolios by investing in precious metals like gold at prices often below spot market value.

With these various investment choices – plus guidance from experienced professionals – customers can strategically manage their assets based on their individual goals and risk tolerance levels regardless of current gold prices.

Why Put Gold in Your IRA?

Gold is a timeless and sought after asset that can help protect your retirement savings from inflation.

Placing gold into an Individual Retirement Account (IRA) allows investors to enjoy the benefits of investing in physical gold while also taking advantage of tax-deferred growth:

1. Gold has been used as a store of value for centuries, making it an excellent choice for protecting long-term assets against market volatility.

2. Physical gold investments like American Gold Eagle Bullion Coins are not subject to the same wild fluctuations typically seen with stocks or mutual funds.

3. Gold is widely recognized around the world, meaning that you can easily move your gold IRA account without worrying about exchange rates or other fees associated with international transfers.

4. A self-directed individual retirement account gives you more control over your investments, allowing you to diversify your portfolio beyond stocks, bonds, and cash to include precious metals such as gold bullion coins and bars.

Investing in gold through an IRA offers many advantages which makes it one of the most popular ways to save for retirement today.

Allowing you to benefit from both short-term capital gains opportunities and long-term growth potential, placing some of your retirement savings into a gold IRA can be a smart way to ensure financial security during retirement years.

What Is a Gold IRA?

Investors interested in gold investing have a few options. One of the most popular is to put some or all of their retirement investments into a Gold IRA, which stands for Individual Retirement Account.

A Gold IRA provides investors with the opportunity to add actual physical gold bullion and/or other approved precious metals such as silver and platinum, in addition to more traditional investments like mutual funds and stocks.

Gold IRAs can take two forms: custodial accounts held at a bank or brokerage firm, or self-directed individual retirement accounts through an IRS-approved depository company that specializes in buying and holding precious metals for account holders.

The American Gold Eagle Bullion Coin is one of the most common types of coins available within these kinds of accounts. In either form, you will need to open an account first with a special kind of financial institution that deals specifically with Precious Metals IRAs before actually buying any Barrick Gold or other type of gold product from your provider.

A Gold IRA allows individuals to diversify their portfolio by adding physical assets alongside more traditional investment vehicles like mutual funds, bonds, stocks, etc., essentially providing investors with the best possible combination of safety and growth potential across different asset classes.

As economic times change, having exposure to multiple asset classes helps protect against market volatility while optimizing long-term returns when done right.

Incorporating gold into a retirement portfolio offers several unique benefits not found elsewhere - especially tax advantages - making it an attractive option worth considering if you’re looking for ways to maximize your nest egg over time.

Benefits of Gold IRAs

Investors may find that a gold IRA can offer some advantages over other types of retirement accounts.

For example, the bond market has historically been more volatile than gold, meaning that investors with exposure to gold have experienced less risk in their portfolio. Direct ownership of physical precious metals provides greater potential for increases in metal prices compared to investing through ETFs or mutual funds.

The ability of an investor to add and remove investments from their retirement account without incurring taxes or fees makes a self-directed IRA attractive when looking at adding exposure to gold.

With this type of account, investors are able to select specific stocks, bonds, and even precious metals such as gold coins as part of their retirement savings plan. Precious metal investments can be held directly within a retirement account which offers an additional layer of protection against losses due to market volatility or downturns.

Gold IRAs provide investors with many benefits including diversification and potential long-term growth opportunities while still providing stability during times of market uncertainty.

Investors who choose to open a Gold IRA should be aware that they will need approval from the Internal Revenue Service (IRS) before being able to purchase any physical precious metal assets; however, once approved they can take advantage of all the same tax benefits associated with traditional retirement accounts.

As such, it is important for investors considering opening a Gold IRA to understand the regulations around this type of investment vehicle so they can make informed decisions about how best to use it for their own financial goals.

With its numerous benefits and protections against market fluctuations, investing in gold through an individual retirement account is becoming increasingly popular among those seeking security for their hard earned money.

By taking into consideration both short-term and long-term gains offered by these types of accounts, individuals can ensure that their financial future remains secure no matter what economic conditions arise in the years ahead.

Self-Directed IRA Explained

Now that you understand the benefits of Gold IRAs, it’s time to look into what a Self-Directed IRA is and how they work.

A self-directed IRA grants investors unprecedented access to investments outside of traditional stocks or bonds.

This type of investment allows for alternative gold investments such as coins, bullion bars, or even ETFs (Exchange Traded Funds).

A self-directed IRA also offers more control over which funds are invested in and when these funds are withdrawn. It requires a degree of financial sophistication on behalf of the investor since there may be additional fees associated with these alternative investments other than those associated with bond investments.

There can also be rules around how much money can be contributed each year and at what age withdrawals can begin without penalty. Since this type of investing carries extra risk, it's important to have an understanding of not only what your options are but also why you should make certain decisions.

For example, if you're looking for long term growth potential then particular types of gold investments will better suit your needs than others depending on market conditions at the time.

Ultimately, having knowledge about self directed IRAs gives investors greater flexibility and control over their portfolio allowing them to pursue different strategies tailored specifically to their individual goals.

How To Fund Your IRA - Gold IRA Rollover Explained

Getting started with a gold IRA investment is relatively easy, but it's important to understand the processes and rules.

In order to fund your gold IRA rollover, you will need to have an existing retirement account from which you can transfer or rollover funds into the new gold investing vehicle. You can also use cash management services to pull money out of other accounts for funding purposes.

When funding your account through any method, there are certain taxes and fees that may be associated with the transaction.

When making a physical metal purchase as part of your gold IRA investment strategy, it’s essential to consider all potential risks and costs before proceeding.

Gold investments come with many benefits such as portfolio diversification, inflation protection, and long-term growth potential; however, like any asset class, they also carry some risk including market volatility and loss of principal.

Depending on the type of select transactions being completed within the account (for example: bullion coins versus ETFs) additional fees may apply so make sure you research each option carefully prior to buying anything in your portfolio.

Who Should Invest With TIAA?

Investing in a TIAA Gold IRA is an excellent option for many individuals, so it’s no surprise that the question of who should invest with TIAA comes up often. Like any investment portfolio, there are certain factors to consider before deciding if investing with TIAA is right for you.

Not only does TIAA provide access to gold investing through their self-directed IRAs, but also other precious metals such as palladium and silver.

This means investors have the sole discretion over what amounts of gold bullion or coins can be included in their IRA accounts based on their individual financial situation and goals.

Customers can take advantage of features such as automatic deposits, rollover services from previous employers' 401(K) plans, and knowledgeable customer service representatives who are available 24/7.

All these benefits come together to create a well-rounded package that provides customers with everything they need to start building their retirement portfolios without having to worry about making costly blunders along the way.

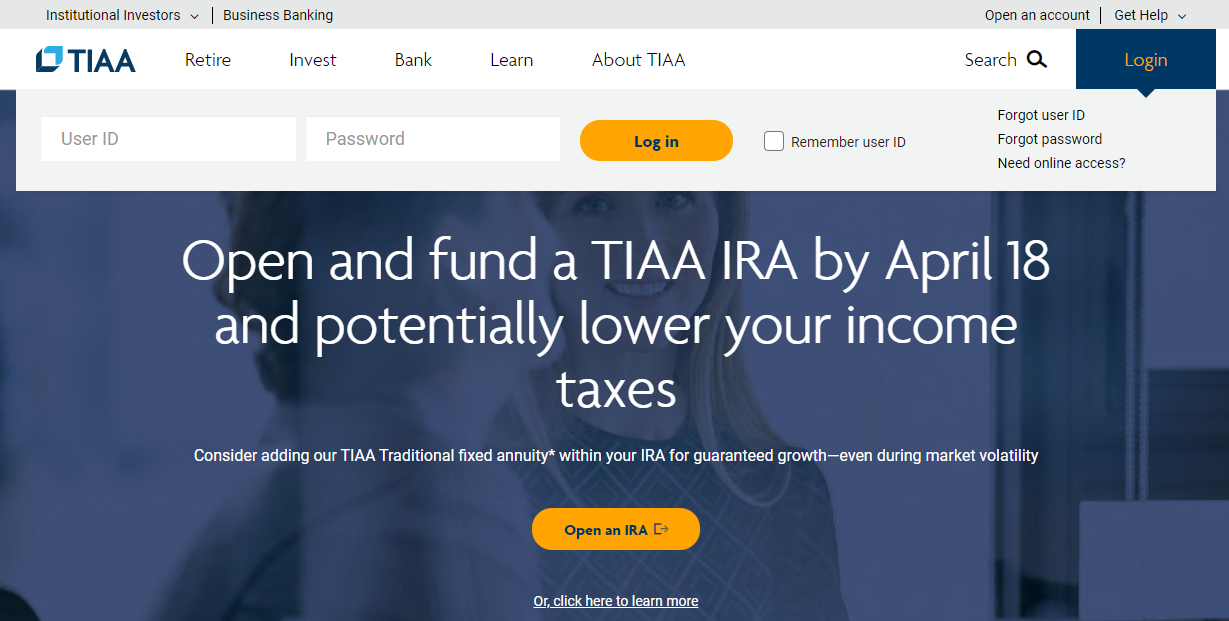

Customer Service at TIAA

TIAA provides a comprehensive customer service platform to help their clients with any questions or concerns they may have.

Clients can access support 24/7 via email, phone and online chat. TIAA also has a team of experts available by appointment to assist customers on an individual basis.

The company offers many services that allow customers to easily manage their accounts and investments in real-time.

Customers are able to view account balances and transactions, make transfers online, set up automatic contributions, and more.

All of these services come without an annual account fee for most Gold IRA plans. All transactions are processed quickly and securely on a transaction basis.

In short, when considering how best to invest your retirement funds with TIAA's options, here is what you can expect:

1) 24/7 customer service

2) Real-time account and investment management tools

3) No annual account fee for most Gold IRA plans 4) Maximum yearly contribution limits set by the IRS

From this perspective it is easy to understand why so many people turn to TIAA for assistance when planning out their future financial security needs - its vast array of products coupled with quality customer service make it a great choice!

Pros and Cons of TIAA

The TIAA Gold IRA is an unallocated metals solution that can be used to make smart investment decisions.

This type of retirement account offers investors a number of benefits, including competitive interest rates and access to sufficient funds for their future needs.

But before investing in a TIAA Gold IRA, it's important to understand the pros and cons associated with this type of retirement account.

One major benefit of a TIAA Gold IRA is its ability to provide investors with increased options when making investment decisions.

Investors can choose from a variety of different investments and portfolios which may offer higher returns than traditional savings accounts or other types of investments.

Gold IRAs are backed by physical bullion which provides added security for long-term savings goals.

Another advantage to these types of retirement accounts is that they offer more flexibility than traditional saving methods such as 401(k)s and pensions.

Investors have the freedom to move money between various assets within the portfolio without incurring any penalties or fees. While these accounts often come with lower degrees of risk compared to other forms of investing, they also tend to be less liquid than stocks and bonds due to their longer holding periods.

Because physical bullion prices can vary significantly over time, it's important for investors to monitor market conditions carefully before making any long-term commitments.

Overall, opening up a TIAA Gold IRA can be beneficial for those looking for an alternative way to save and invest money for retirement purposes.

However, careful consideration should always be given before committing funds toward these types of investments so that you're able to make informed decisions about your financial future.

Conclusion

After examining the history of TIAA and exploring why gold is a smart option for an IRA, it's clear that investing in a Gold IRA with TIAA can be beneficial.

A Gold IRA allows investors to diversify their retirement portfolio while protecting against inflation and market volatility.

The Self-Directed IRA gives individuals greater control over their investments, allowing them to choose from a wide variety of assets including precious metals such as gold and silver.

The ability to fund your account through a rollover makes getting started easy and convenient. It’s also reassuring to know that customer service at TIAA is reliable and friendly if you have any questions or need assistance during the process.

Overall, there are many advantages to investing with TIAA when considering adding gold to your retirement portfolio.

While there may be some drawbacks involved, the potential rewards outweigh these risks by far. Investing in gold can help prepare you financially for the future so don't wait - start planning today!

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit TIAA below: