Equity Trust Company provides a wide range of investment options to its customers. It has been around since 1974 and provides individuals with an opportunity to invest their money in various markets, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investments trusts (REITs) and more.

Equity Trust Company prides itself on offering competitive pricing and excellent customer service.

In this review we will explore the different features of Equity Trust Company that make it unique among other financial services firms.

Equity Trust Company offers investors the ability to create customized portfolios tailored to meet individual needs.

With access to over 8 million products from multiple asset classes, clients have the freedom to choose how they want to manage their wealth.

For those looking for additional guidance, Equity Trust also provides portfolio management services which can help them achieve long-term goals faster by having experts construct a diversified portfolio designed specifically for their situation.

Finally, Equity Trust’s online platform makes managing your investments easy and convenient with tools like personalized alerts and market analysis so that clients are always up-to-date on what's happening in the markets.

We'll cover these features in more detail throughout our review of Equity Trust Company so you can decide if it meets your investing needs or not!

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

Before we get started with this review:

We understand that choosing a company to invest with is an extremely important financial choice; good news for you, we have done all the research and digging in this field for years.

That being said, through our rigorous review process, we have compiled a list of our 5 top gold investment companies for 2022.

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Check if Equity Trust Company made our top 5 list in 2023!

Or...

Get a FREE Gold Investing Kit from our #1 recommendation by clicking below:

Introduction

Equity trust companies are part of the financial landscape, claiming to provide a safe harbor for investors searching for secure investment opportunities.

Private equity trusts offers personalized services to maximize returns on investments.

As such, it is important to review these firms in order to ensure that they can meet your needs and expectations.

The assessment of any equity trust company requires consideration of a variety of factors related to their products and services.

It is prudent to consider matters such as customer service, fees, portfolio performance and quality, technology offerings, educational resources available, security measures taken by the firm, and whether or not the organization has achieved professional accreditations.

With this information at hand, customers can make informed decisions about which equity trust best fits their individual needs.

Taking into account all these considerations will help you decide if an equity trust company meets your requirements when looking for sound advice amid turbulent markets and uncertain economic times.

Moving forward now let's take a look at what kind of Equity Trust Products and Services are out there.

Equity Trust Products and Services

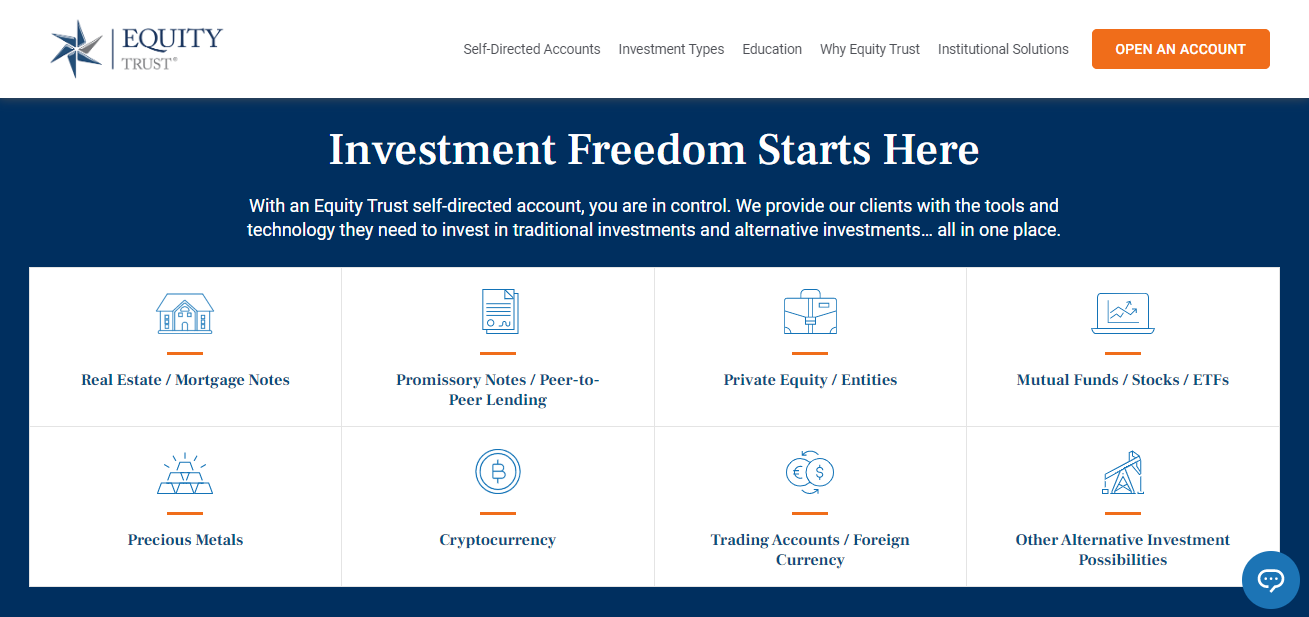

Equity Trust products and services are designed to help customers with financial investments. They offer a variety of tools for those who want to take control of their savings, retirement planning, or estate planning goals like other companies on the market such as American Bullion, LCR Coin, and MME.

Equity Trust's customer service is top-notch; they provide assistance from certified financial advisors to guide customers through the sometimes overwhelming process of investing.

Here are just some reasons why Equity Trust stands out:

• Custodial Services - Customers have access to custodial account setup and maintenance as well as strategic insights into how to grow their wealth over time.

• Financial Advisors – Professional advice and guidance is available when needed so that investors can make informed decisions about their finances.

• Online Platforms – Allowing customers easy access to manage their accounts in real-time without having to visit an office location.

• Investment Portfolios – Options include stocks, bonds, ETFs (Exchange Traded Funds), mutual funds, annuities, etc., tailored specifically for individual needs.

• Retirement Planning – Providing resources and support for traditional IRA’s (Individual Retirement Accounts) such as 401K plans, Roth IRAs and more.

These features offered by Equity Trust demonstrate its commitment to helping clients reach their personal finance goals with ease and confidence.

From comprehensive online platforms where you can view your portfolio anytime anywhere to knowledgeable financial advisors providing solid investment advice, this company has thoughtfully crafted a suite of services that allow customers peace of mind in managing their money.

The next step is looking at traditional IRA options which allows investors additional tax advantages on retirement contributions.

Traditional IRA

The traditional IRA is a tried and true way of investing for retirement. It's like an old friend that never lets you down, offering investors security and stability in their financial portfolios.

Traditional IRAs have been around since the mid-1970s, providing numerous tax advantages to those who choose to invest with them.

They are great vehicles for long-term investments such as stocks, bonds, mutual funds, real estate investment trusts (REITs) and other traditional investments.

Even though they require annual contributions in order to maintain the account’s status, these accounts offer attractive incentives such as deducting contributions from income taxes or allowing penalty free early withdrawals under certain circumstances.

Additionally, many people use them to purchase tax liens which can provide better returns than some other types of traditional investments.

Overall, traditional IRAs are reliable options when it comes to saving for retirement; however there are alternatives such as Roth IRAs that may provide even more benefits depending on individual needs and financial goals.

With different variations available for lots of different situations, understanding how each type of IRA fits into your overall finances is key in making sure you get the most out of your hard earned money.

Roth IRA

A Roth IRA is a type of retirement savings account that allows individuals to save money tax-free. It differs from a Traditional IRA in the way it's taxed; contributions are made with after-tax dollars, and earnings are withdrawn without taxation.

This makes them attractive for people who expect their income level to increase as they age or anticipate higher taxes in the future.

The amount one can contribute annually to a Roth IRA is limited by both federal regulations and individual income levels.

Automated processes make it easy for investors to manage investments within the limits set forth by the government.

Roth IRAs also provide flexibility when withdrawing funds due to special circumstances such as disability or educational expenses.

Additionally, there’s no required minimum distribution so you don’t have to withdraw funds at any particular age like traditional accounts require.

As long as these rules are followed, all distributions from a Roth IRA will be free from federal taxes, including capital gains earned on investments over time. With careful planning and proper management, investing in a Roth IRA can help ensure financial security during retirement years.

Transitioning into this next section about Health Savings Accounts (HSAs), we will explore how those fit into overall investment strategies...

Health Savings Account

Health Savings Accounts (HSAs) are one of the most popular tax-advantaged investment accounts available.

They offer substantial financial benefits, allowing individuals to invest in a tax-free account with significant advantages over other types of savings instruments.

HSAs provide excellent financial planning tools when used correctly and can help you save for retirement or unexpected medical expenses.

HSAs work by providing an annual contribution limit that allows individuals to contribute pre-tax dollars into their own health savings account. The money deposited into the HSA is not taxed until it is withdrawn, meaning that investors have more control over how they use the funds for their future needs.

Additionally, HSAs allow for growth on any gains within the account without being subject to taxes as long as the withdrawal is related to qualified medical expenses.

This makes HSAs attractive investments since there’s no need to worry about capital gains taxes if withdrawals are made for eligible medical treatments.

Transitioning from Health Savings Accounts, Coverdell Education Savings Accounts are another type of tax-advantaged investment tool which may be suitable for younger people preparing for college costs.

Coverdell Education Savings Account

The Coverdell Education Savings Account is a popular choice for parents looking to store up educational resources. If you are wondering whether this particular account has what it takes, then the answer might surprise you!

For starters, there's no storage fees associated with setting one of these accounts up - an absolute godsend when you consider how costly some other savings options can be.

On top of that, the tools and services available through a Coverdell ESA make for invaluable educational support.

From tax-free distributions to generous contribution limits, investing in a Coverdell ESA could be a smart move if you're planning ahead for your child's education.

It requires patience and perseverance but with the right approach and knowledge base at your disposal, it won't take long to build up enough funds to provide ample learning opportunities down the road.

And while gold may not have much relevance here, having access to reliable financial advice from experienced professionals certainly does!

Why Put Gold in Your IRA?

Gold has become an increasingly popular asset to add to retirement portfolios, with over $35 billion in gold held by American households.

Adding physical gold and other precious metals to a self-directed IRA can provide many benefits for retirement investors. When considering why put gold in your IRA, there are several reasons that make it attractive for retirees.

One of the primary advantages of adding physical gold to IRAs is its ability to act as a hedge against inflation. This is different than just buying physical gold outside of an IRA with companies like Goldsilver.com and Silver Gold Bull.

As markets fluctuate and currency values decline, having a portion of one's portfolio allocated towards physical gold provides protection from market volatility. Gold prices tend to increase during periods of economic downturns or when inflation rises, allowing investors to diversify their portfolios away from traditional stocks and bonds.

Additionally, most gold IRA firms offer annual storage fees which keep costs low compared to other investments such as mutual funds.

This makes them convenient options for people who want access to physical assets but do not have the resources or time to store them on their own.

How Is Equity Trust Regulated?

Equity Trust is a financial services company that provides custodial services for retirement accounts. It is regulated by the Internal Revenue Service (IRS) and must undergo an annual renewal process to maintain its status as an approved custodia.

As such, customers can rest assured that their investments are safe with this respected firm.

The IRS inspects and reviews Equity Trust's procedures every year in order to safeguard customer funds and make sure they comply with all applicable laws and regulations.

In addition, Equity Trust has implemented strict internal controls over customer assets, including the use of advanced cybersecurity measures, which further protect investors from potential fraud or manipulation of their data.

With these safeguards in place, customers can be confident that their money is secure when using Equity Trust for their IRA account needs.

Equity Trust takes its role as an IRS-approved custodian very seriously and makes sure it meets all necessary requirements on an ongoing basis so that customers can have peace of mind about where they place their investments.

Moving forward, we will explore how to open an IRA account with Equity Trust and review some of the features available through them.

How To Open an IRA With Equity Trust

Equipped with the right knowledge and resources, individuals can invest through this Gold IRA firm.

Equity Trust offers a variety of types of investment accounts including traditional IRAs, Roth IRAs, Simplified Employee Pension (SEP) plans, Coverdell Education Savings Accounts (ESAs), Health Saving Accounts (HSAs), trust accounts, custodial accounts, self directed 401(k)s and others.

All these accounts are IRS approved custodia offering investors access to alternative investments such as real estate or cryptos while still getting the tax benefits associated with retirement savings vehicles.

Investors don’t have to worry about setting up their own account since Equity Trust provides turnkey solutions for their customers which includes assistance in making sure all necessary paperwork is properly filled out so that they meet all requirements set by the Internal Revenue Service.

With Equity Trust providing competitively priced fees and experienced customer service representatives on hand to help guide customers' decisions, people looking for an easy way to diversify their retirement portfolios should consider investing through them if they wish to take advantage of alternative investment options.

What Are Alternative Investment Options?

Alternative investments can provide many benefits to an investor's portfolio. Take the case of John, a retiree who wanted to diversify his retirement savings and add more stability to his financial future.

He decided to explore alternative investment options with Equity Trust Company in order to gain greater returns on his investments than he was getting from traditional stocks and bonds.

Investors have several choices when it comes to alternative investments - including real estate, private equity, venture capital, hedge funds, and commodities such as gold or oil - that may help increase their return on investment (ROI).

By diversifying into these types of assets, investors can reduce risk while still optimizing gains. It is important for any investor to research all available alternatives before committing money and ensure they are comfortable with the associated risks involved.

The types of prohibited transactions that could potentially occur within an IRA vary depending upon its custodian or trustee.

For example, at Equity Trust Company certain activities such as self-dealing, illegal acts, and borrowing are not allowed under Internal Revenue Service regulations; however there may be other restrictions imposed by the account administrator or custodian itself.

It's essential for any investor considering an IRA account with Equity Trust Company understand these limitations prior to investing in order to avoid potential issues down the line.

What Are Prohibited Transactions in an IRA?

Investors searching for alternative investment options may be surprised to learn that there are certain transactions prohibited in an IRA.

For the savvy investor, understanding which activities and investments are not allowed by the IRS can help them avoid costly transaction fees or even worse, running afoul of their custodian.

The first prohibited transaction is engaging a non-IRS approved custodian; investors must ensure they use an approved custodian such as Equity Trust Company to handle their retirement accounts.

Some other common prohibitions include:

• Self-dealing - An IRA owner cannot purchase assets from themselves or sell assets to themselves through their account

• Lending money - Investors cannot lend money or extend credit to their IRA account, nor should they accept loans or extensions of credit from it

• Transfers between IRAs – A transfer between two different IRAs owned by the same individual could potentially cause major tax issues for both accounts

With these forbidden transactions in mind, investors can make sure all their decisions within the scope of their retirement plan remain compliant with IRS regulations while minimizing any potential costs due to fees.

It's important to choose wisely when selecting a custodian who understands these restrictions and will work diligently on your behalf towards building up your nest egg.

Why Investors Choose Equity Trust

Investors are increasingly turning to Equity Trust for their individual investments. This is due to the company’s focus on providing investors with a wide range of investment options, as well as flexibility in selecting and managing those investments.

By offering this level of service, Equity Trust has become an attractive choice for many individuals looking to grow their wealth through reliable investing strategies.

Equity Trust also offers individual investors access to advanced financial planning tools that allow them to create tailored portfolios that meet their specific needs.

Additionally, the company's online platform makes it easy for customers to track and manage all of their investments from one convenient location.

With these advantages combined, Equity Trust provides investors with the resources they need to make informed decisions about where and how to invest their money.

By giving its clients unparalleled investment selection and management control over their finances, Equity Trust stands out among other providers in the industry.

Its commitment to customer satisfaction ensures that each investor receives the best possible advice when making important decisions about their financial future.

Equity Trust Staff

The staff at Equity Trust are the backbone of the company. They provide support and guidance to investors, setting up reliable partnerships with investment firms.

Each team member is an expert in their field who works hard to ensure a positive experience for all customers.

It's like the gears of a machine, working together seamlessly to create something greater than the sum of its parts.

Employee events are regular occurrences that celebrate success and bring staff closer together as they share stories and experiences from their investments.

Employees also have access to industry-leading resources to help them stay informed on current trends, regulations, and other pertinent information related to investing.

With such knowledgeable people providing top-notch service, Equity Trust continues to be one of the leaders in trust services today.

Investors can rest assured knowing their financial future is in capable hands when partnering with this exceptional group of professionals.

Equity Trust Reviews

Picking the perfect partner for financial planning can be a perplexing proposition. People pour over portfolios, peruse performance records and probe pricing plans to pick the right equity trust company.

Reviews of Equity Trust Company are plentiful; they paint an impressive picture of a provider with excellent execution and extensive experience.

From institutional investors to individual customers, Equity Trust has earned a sterling reputation as one who puts clients first.

It's no surprise that their customer service representatives have become renowned for being attentive and accessible.

A look at their track record reveals why so many value Equity Trust: they offer outstanding products backed by top-notch services, allowing them to create satisfied customers time after time.

From opening accounts quickly and efficiently to providing up-to-date reports on portfolio performance, Equity Trust offers modern solutions tailored to fit each individual's needs.

Equity Trust provides strong evidence that it is capable of delivering reliable results when it comes to helping people manage their finances responsibly.

With its long history of success in the industry, this trusted institution will continue to provide personalized assistance for years into the future.

IRA Withdrawal Rules

IRA withdrawal rules are important for those looking to utilize their retirement savings. It’s essential that people understand the regulations and procedures when it comes to accessing funds in an Individual Retirement Account (IRA).

Mutual funds, stocks and other assets for retirement can be used towards these transactions, but knowing the guidelines is key.

Here are four points regarding IRA withdrawals:

1) Generally speaking, individuals must reach age 59 ½ before they can start making distributions from their accounts without incurring a penalty.

2) Withdrawals prior to this age may incur both taxes and penalties depending on the type of account held.

3) There are certain exceptions based on specific circumstances such as disability or death; however, consulting with a financial advisor is recommended if you need clarification on any rule or exception.

4) An individual’s total yearly contributions should also be taken into consideration when withdrawing money – exceeding the amount allowed could lead to hefty fines.

It's clear then why having knowledge about IRA withdrawal rules is critical when planning your future finances.

Knowing these regulations will help ensure that one makes wise decisions regarding their retirement savings and ultimately achieve financial security later in life.

Conclusion

Equity Trust Company is an ideal choice for those looking to diversify their retirement portfolio. With a variety of products and services available, such as Traditional IRAs, Roth IRAs, and Health Savings Accounts, investors have the opportunity to maximize their savings potential.

The company also offers access to knowledgeable staff who can provide guidance on any of Equity Trust's offerings.

This makes it easy for customers to trust in the service that they are receiving from the firm.

And with over 500,000 accounts opened since 1999, it’s clear that many people find equity trust appealing.

An interesting statistic: 93% of surveyed customers reported being satisfied or very satisfied with Equity Trust's services.

It is no surprise why so many investors choose Equity Trust when building their financial futures.

You can get a Complimentary Gold Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Best Gold IRA Companies in 2023.<<<

Or, visit Equity Trust Company below: