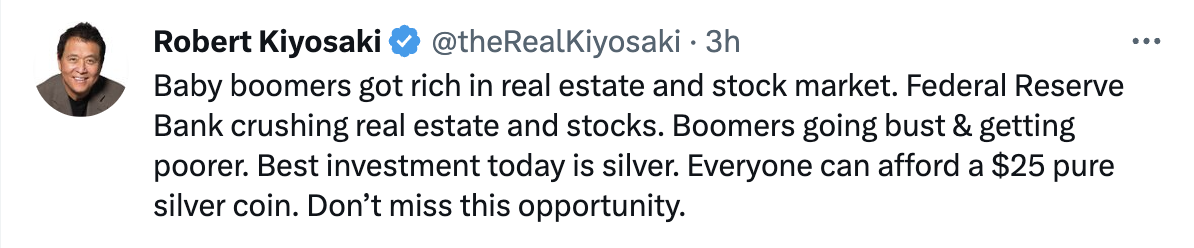

I try and stay away from social media as much as possible, but tonight I was on Twitter and I read this tweet from Robert Kiyosaki from "Rich Dad Poor Dad."

So immediately started thinking about writing this post to benefit my readers.

Investing is a powerful way to make your money work for you. With the right strategies and knowledge, you can maximize your returns while minimizing risk. But what is the best investment today? Many experts agree that silver could be one of the most rewarding investments available in 2023.

In this article, we will discuss why investing in silver may be an effective strategy to grow your wealth over time. We'll look at some key factors including its historic performance as well as any potential risks associated with it. Finally, I'll provide actionable advice on how to get started investing in silver if you're new to the market or looking for ways to diversify your portfolio.

So whether you are an experienced investor or just starting out, read on to learn why many believe that silver could be one of the best investments today!

Disclosure: Some of the links in this article are from sponsors. The list below is an honest review gathered from thorough research, experience, and consumer-based feedback.

#1 Choice for Buying Silver

Get Their Free Info Kit Below

Baby Boomers Got Rich In Real Estate And Stocks

Real estate and stocks have been two of the most lucrative investments for baby boomers. They're a generation that has seen great success in these areas, becoming wealthy as they made wise decisions along the way. Investing in either one can be a smart move, depending on your individual financial goals.

When it comes to real estate investing, there are many options available to those looking to get involved – from flipping houses to long-term renting or leasing. With stock investment, you could look into both traditional methods such as blue chip companies or riskier trades like penny stocks.

No matter which avenue you choose, make sure you do your due diligence by researching potential investments thoroughly before taking any big risks with your money. It's important to remember that while past performance may provide an indication of what might happen in the future, no one can guarantee success when it comes to investing.

Federal Reserve Bank Crushing Real Estate And Stocks

The Federal Reserve Bank has long been a major influence on the stock and real estate markets. In recent years, their decisions have had an even greater impact than ever before.

It's no surprise that with rates at historic lows, investors are turning away from these traditional investments to seek out other options.

This shift in investor thinking is being driven by the Fed’s actions: they are making it near impossible for potential buyers of stocks and real estate to get financing or make profits due to low interest rates. As a result, many people who otherwise would be considering investing in either of these asset classes are now looking elsewhere.

Silver may well be one of those alternatives worth exploring today. Its price has more than doubled since 2020 and is currently around $25 per ounce; significantly higher than its average over the last decade. With silver’s impressive performance as compared to other assets during this pandemic-induced recession, it could be one investment option worth considering right now.

Boomers Going Bust & Getting Poorer

Boomers are facing a tough time financially. Many of them have seen their retirement savings dwindle and their real estate investments take a hit due to the Federal Reserve Bank's economy-crushing policies. Now, they're poorer than ever before.

Boomers are facing a tough time financially. Many of them have seen their retirement savings dwindle and their real estate investments take a hit due to the Federal Reserve Bank's economy-crushing policies. Now, they're poorer than ever before.

Retirees who counted on Social Security or pensions as part of their income sources may be struggling to make ends meet, with prices rising faster than wages. Those who invested in stocks pre-pandemic could see those profits turn into losses if the market doesn't recover soon enough from its downturn.

The combination of low returns on investment and an uncertain future means that boomers will likely remain poor for some time yet. With no clear resolution in sight, it's crucial that this generation looks ahead—carefully analyzing potential investments and weighing each option carefully before taking any kind of risk with their hard-earned money.

Don't Miss This Opportunity!

As our population ages and more people are faced with financial instability, it's important to consider new opportunities for investment. Don't miss this chance - silver could be the best oopportunity of your lifetime.

Silver has seen consistent growth over time, outperforming many other assets in recent years. It’s a reliable long-term investment that can withstand market volatility much better than stocks or bonds. Its value isn’t tied to any particular currency, so you don’t have to worry about inflation eroding your profits.

The current economic climate means now is a great time to invest in silver. With low costs of entry and high potential returns, adding silver as part of your portfolio diversification strategy could help you see significant gains over the coming years. Investing in silver provides protection against uncertainty while also providing solid returns on top of whatever investments you already have.

It pays to explore all available options when it comes to investing - especially at times like these when boomer households are going bust and getting poorer. Silver is worth considering Act now before the opportunity passes by!

You can get a Complimentary Silver Investing Guide from the top gold investing company we recommend by clicking the button above.

If you'd like a thorough review of the top 5 list, click here:

>>>Click HERE to Read Our List of the Silver Investment Companies in 2023.<<<

Or, visit American Hartford Gold below:

In Conclusion

Silver is the best investment today. It is a safe haven asset that has been historically reliable during economic downturns and it provides an opportunity to increase your wealth in uncertain times.

Silver will help you protect your assets from further losses due to market volatility and give you a chance to make more money when other investments fail.

Don't miss this opportunity - make the smart choice and start investing in silver now!